Get the free Paycheck mail out form - EWU Access Home - Eastern Washington ... - access ewu

Show details

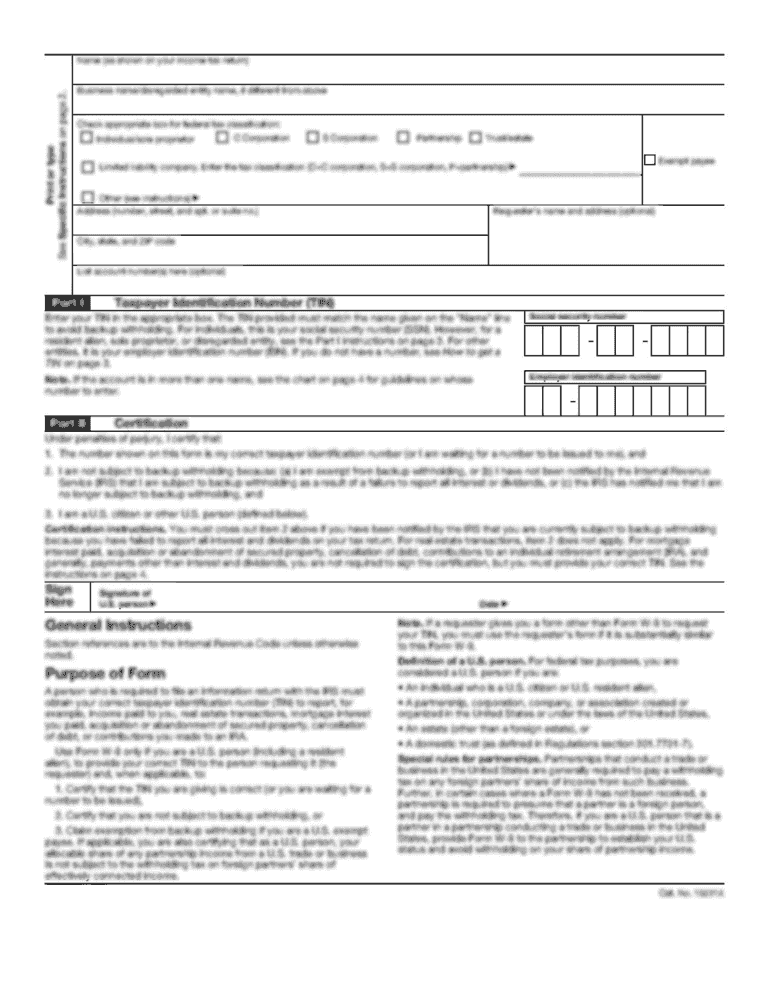

PAYCHECK MAIL OUT FORM. Eastern Washington University. Office of Controller Payroll. 319 Show alter Halls. Cheney WA 99004-2445. FAX: (509) 359-6869.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your paycheck mail out form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your paycheck mail out form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing paycheck mail out form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit paycheck mail out form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out paycheck mail out form

How to fill out a paycheck mail out form:

01

Begin by entering the date on the top right corner of the form.

02

Provide the name of the company or organization issuing the paycheck in the designated space.

03

Fill in the name of the employee who will be receiving the paycheck.

04

Enter the employee's address, including the street, city, state, and zip code.

05

Make sure to accurately input the employee's social security number or employee ID number.

06

Specify the payment period for which this paycheck is being issued, such as the dates of the pay period.

07

Indicate the employee's hourly wage or salary for the given period, and specify whether it is before or after tax deductions.

08

In the deductions section, list any applicable deductions, such as taxes, healthcare contributions, or retirement savings.

09

Calculate the net pay by subtracting the total deductions from the gross pay.

10

Double-check all the information provided and ensure its accuracy.

11

If necessary, obtain the employee's signature on the form, confirming receipt of the paycheck.

12

Keep a copy of the paycheck mail out form for your records.

Who needs a paycheck mail out form:

01

Companies or organizations that employ individuals and pay them in the form of physical paychecks.

02

Employers who want to ensure confidentiality and privacy of employee payment information.

03

Businesses that may not have the capability to directly deposit employee salaries into their bank accounts.

04

Employers who want to have a physical record of paychecks distributed to their employees.

05

Organizations that have remote or off-site employees who may not be able to access their salaries electronically.

06

Companies that prefer a paper-based system for issuing and documenting employee payments.

07

Employers who want to maintain control over the distribution of paychecks and ensure they reach the intended recipients.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

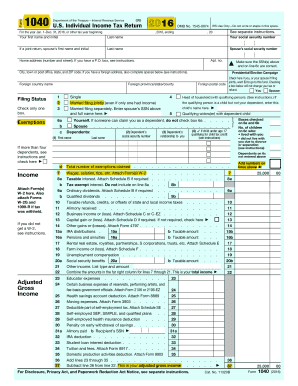

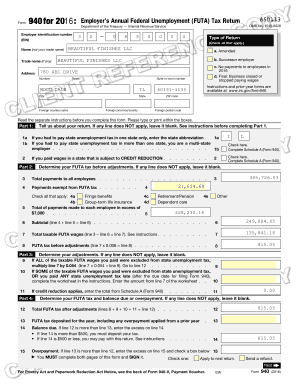

What is paycheck mail out form?

Paycheck mail out form is a form used to report information about an employee's wages and taxes withheld by their employer.

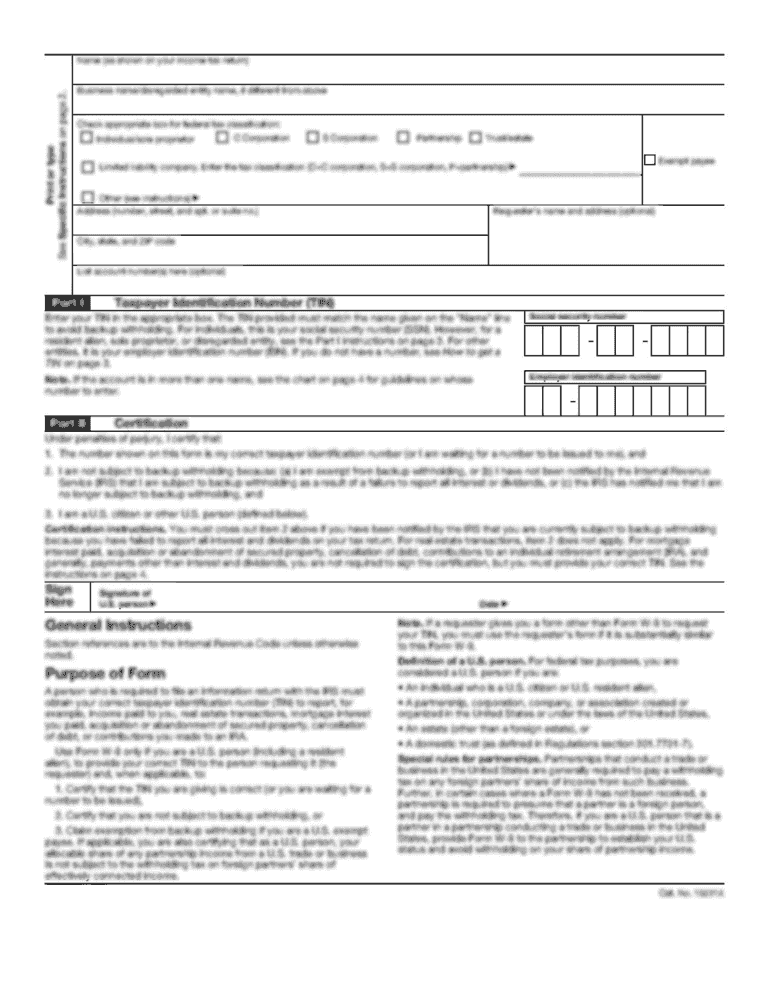

Who is required to file paycheck mail out form?

Employers are required to file paycheck mail out forms for each employee they have paid wages to.

How to fill out paycheck mail out form?

To fill out paycheck mail out form, employers need to provide information such as employee's name, social security number, wages earned, and taxes withheld.

What is the purpose of paycheck mail out form?

The purpose of paycheck mail out form is to report wage and tax information to both employees and the IRS.

What information must be reported on paycheck mail out form?

Information such as employee's name, social security number, wages earned, and taxes withheld must be reported on the paycheck mail out form.

When is the deadline to file paycheck mail out form in 2023?

The deadline to file paycheck mail out form in 2023 is typically January 31st.

What is the penalty for the late filing of paycheck mail out form?

The penalty for late filing of paycheck mail out form can vary, but typically includes fines and interest on unpaid taxes.

Can I create an electronic signature for the paycheck mail out form in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your paycheck mail out form in seconds.

How do I fill out paycheck mail out form using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign paycheck mail out form and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit paycheck mail out form on an Android device?

You can edit, sign, and distribute paycheck mail out form on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your paycheck mail out form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.