This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the granter is an individual and the grantee is a corporation. Granter conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Granter, if any, which are reserved by Granter.

Get the free nm deed individual corporation form

Show details

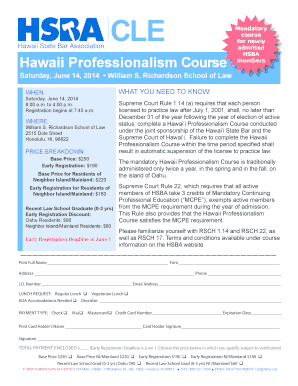

This document prepared by (and after recording return to): Name: Firm/Company: Address: Address 2: City, State, Zip: Phone:)))))))))) --------Above This Line Reserved For Official Use Only-------------

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your nm deed individual corporation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nm deed individual corporation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nm deed individual corporation online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit curry county new mexico required deed forms. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out nm deed individual corporation

How to fill out NM deed individual corporation:

01

Determine the type of deed needed for the specific property transfer. In this case, it would be an individual corporation deed.

02

Gather all necessary information and documents for the deed, including the legal description of the property, the name and contact information of the individual corporation, and any supporting documentation required by the state.

03

Consult with a real estate attorney or legal professional to ensure compliance with New Mexico state laws and regulations regarding individual corporation deeds.

04

Complete the deed form by accurately entering all required information. This may include the name of the individual corporation as the grantor or grantee, the legal description of the property being transferred, and any additional terms or conditions relevant to the transfer.

05

Sign the completed deed in the presence of a notary public, who will verify and authenticate the signatures.

06

Record the deed with the appropriate county recorder's office in New Mexico. This step ensures the legal transfer of ownership and provides a public record of the transaction.

Who needs NM deed individual corporation?

01

Individuals or entities planning to transfer ownership of a property to a corporation.

02

Corporations or businesses wishing to acquire properties in their name rather than an individual's name.

03

Real estate investors or developers who frequently conduct property transfers involving corporations.

It is important to consult with a legal professional or real estate expert to ensure the correct completion of the NM deed individual corporation and to understand any specific legal requirements or implications.

Fill form : Try Risk Free

People Also Ask about nm deed individual corporation

What are the disadvantages of a transfer on death deed?

What is a quit claim deed in New Mexico?

How do I file a deed in New Mexico?

How do I avoid probate in New Mexico?

Does New Mexico have a transfer on death deed?

What is required on a deed in New Mexico?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file nm deed individual corporation?

Individuals and corporations may both be required to file a deed in New Mexico. However, the specific filing requirements depend on the circumstances. Here are some scenarios:

Individuals: If an individual purchases or sells real estate in New Mexico, they are generally responsible for filing a deed to transfer the ownership of the property. The individual may file the deed personally or hire a lawyer or title company to handle the filing on their behalf.

Corporations: If a corporation purchases or sells real estate in New Mexico, the company must typically file a deed to transfer the property. In such cases, the deed is usually executed by an authorized officer or representative of the corporation, and the filing may be handled by the corporation's legal or administrative department.

It's important to note that the specific filing requirements and procedures may vary based on the county in New Mexico where the property is located. It's advisable to consult with a legal professional or the county clerk's office for precise instructions related to filing a deed in a particular situation.

How to fill out nm deed individual corporation?

To fill out a New Mexico Deed for an individual corporation, you will need to follow these steps:

1. Obtain the correct form: Find the appropriate New Mexico deed form for an individual corporation. This form can typically be obtained from the county recorder's office or downloaded from their website.

2. Start with the heading: At the top of the form, fill in the name of the county where the property is situated. Then, mention the name of the deed, such as "Individual Corporation Deed."

3. Enter the grantor information: The grantor is the individual or corporation conveying the property. Enter the full legal name of the corporation as the grantor and provide the principal address.

4. Enter the grantee information: The grantee is the individual or entity receiving the property. Fill out the full legal name of the individual or corporation as the grantee and provide their address.

5. Describe the property: Provide an accurate description of the property being transferred. This should include the physical address, legal description, and any other identifying details.

6. Include any special provisions: If there are any specific provisions or conditions that need to be included in the deed, add them in this section. This can include restrictions, easements, or any other relevant information.

7. Signatures and notarization: The grantor(s) must sign the deed in the presence of a notary public. Be sure to include the printed or typed name of the signatory below the signature line. The notary will also need to sign and affix their official seal.

8. Filing the deed: Once the deed is completed and notarized, make copies for both the grantor and grantee. File the original document with the county recorder's office, along with any filing fees required. The county recorder will assign a book and page number to the recorded deed, which serves as proof of its official record.

It is important to note that laws and requirements may vary by county, so it is advisable to consult with a legal professional or the county recorder's office for any additional guidance specific to your situation.

What information must be reported on nm deed individual corporation?

When creating a deed for an individual or a corporation in New Mexico, the following information must be reported:

For an Individual:

1. The full legal name of the individual, including any middle names or initials.

2. The individual's current residential address.

3. The individual's marital status, including whether they are married, single, or divorced.

4. If married, the individual's spouse's full legal name.

5. The individual's social security number or taxpayer identification number.

6. Any previous names the individual may have used.

7. Any relevant identification numbers (e.g., driver's license number).

For a Corporation:

1. The full legal name of the corporation.

2. The corporation's principal place of business address.

3. The state or country of incorporation.

4. The corporation's federal employer identification number (EIN).

5. The full legal name and title of the person signing on behalf of the corporation.

6. If applicable, a copy of the corporation's Articles of Incorporation or Certificate of Formation.

It is important to note that this information may vary slightly depending on the specific circumstances and requirements of each transaction. It is always recommended to consult with a legal professional or a title company for the most accurate and up-to-date information.

What is the penalty for the late filing of nm deed individual corporation?

The penalty for the late filing of a New Mexico deed by an individual or corporation can vary depending on the specific circumstances and the governing laws. It is advisable to consult with a legal professional or the appropriate authority in New Mexico for specific information regarding penalties or late fees associated with filing a deed.

How can I send nm deed individual corporation to be eSigned by others?

To distribute your curry county new mexico required deed forms, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit fillable quit deed nm in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your nm deed individual corp, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I create an eSignature for the quit claim deed new mexico in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your nm deed individual corp form and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your nm deed individual corporation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fillable Quit Deed Nm is not the form you're looking for?Search for another form here.

Keywords relevant to nm quitclaim individual corp form

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.