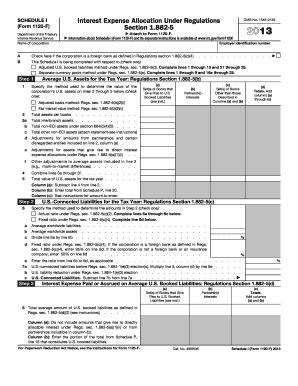

Get the free W-2, W-2P and/or K-1 Forms 1099 Forms for all

Show details

W2, W2P and/or K1 Forms1099 Forms for all incomes & DOB for dependentsPrior Year Tax ReturnMedical / Health Insurance Expenses and/or PremiumsCharitable ContributionsMortgage Interest Statemented

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your w-2 w-2p andor k-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your w-2 w-2p andor k-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing w-2 w-2p andor k-1 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit w-2 w-2p andor k-1. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

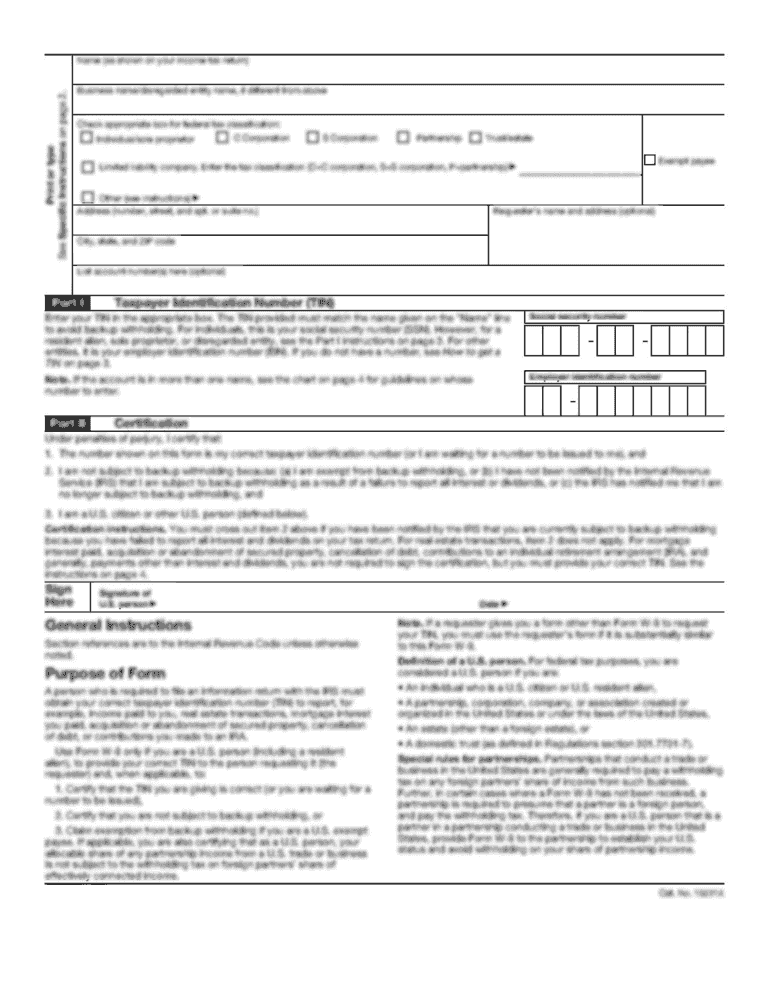

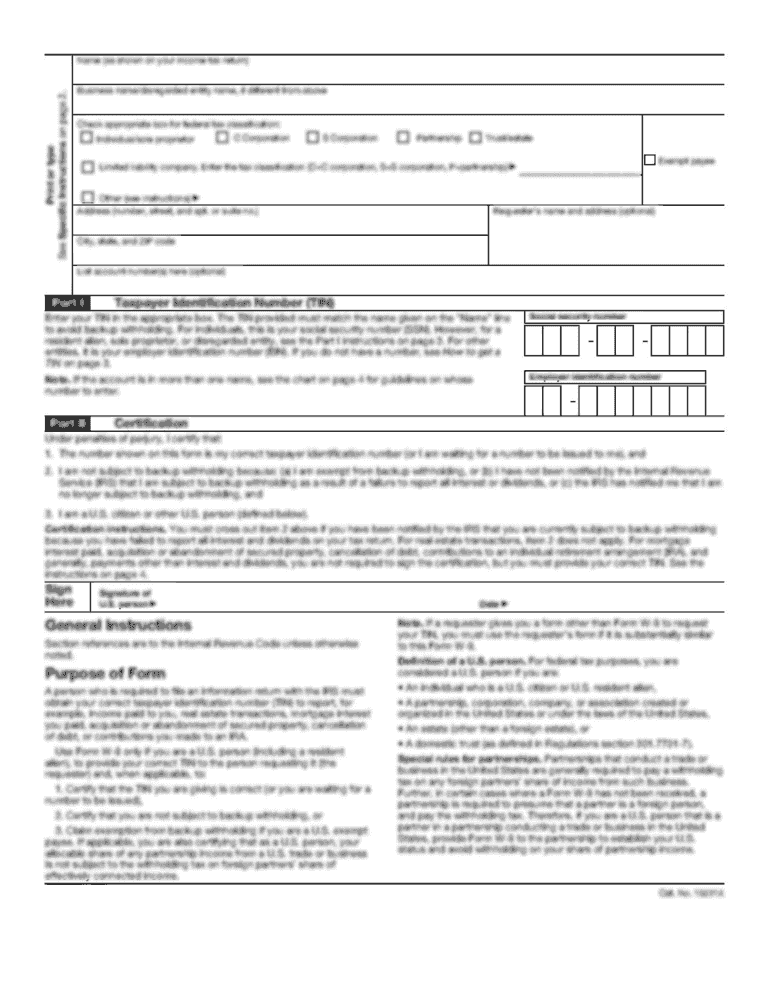

How to fill out w-2 w-2p andor k-1

How to fill out w-2 w-2p andor k-1

01

To fill out a W-2 form, follow these steps:

02

Obtain the necessary forms for a W-2, W-2P, or K-1 depending on your situation.

03

Fill in your personal information, including your name, address, and social security number.

04

Enter your employer's information, including their name, address, and employer identification number.

05

Report your wages, tips, and other compensation in the appropriate boxes. Make sure to accurately calculate and report these amounts.

06

Fill out any additional sections or schedules depending on your specific situation, such as reporting pension income or certain types of dividends.

07

Double-check all the information you have entered to ensure accuracy.

08

Sign and date the form before submitting it to the appropriate tax authorities.

09

To fill out a W-2P form, follow the same steps as above, but be sure to report only pension and annuity income.

10

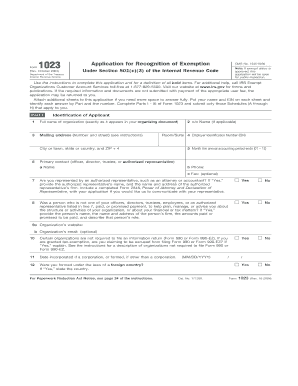

To fill out a K-1 form, follow these steps:

11

Obtain the necessary forms for a K-1 based on your ownership in a partnership or S corporation.

12

Fill in your personal information, including your name, address, and social security number.

13

Enter your partnership or S corporation's information, including their name, address, and employer identification number.

14

Report your share of income, deductions, credits, and other items as specified in the K-1 form instructions.

15

Fill out any additional sections or schedules depending on your specific situation, such as reporting foreign taxes paid or certain types of income.

16

Double-check all the information you have entered to ensure accuracy.

17

Sign and date the form before submitting it to the appropriate tax authorities.

Who needs w-2 w-2p andor k-1?

01

W-2 forms are needed by employees who receive wages, tips, or other forms of compensation from their employers.

02

W-2P forms are needed by individuals who receive pension or annuity income.

03

K-1 forms are needed by individuals who have ownership in a partnership or S corporation and need to report their share of income, deductions, credits, and other items.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get w-2 w-2p andor k-1?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific w-2 w-2p andor k-1 and other forms. Find the template you want and tweak it with powerful editing tools.

How do I edit w-2 w-2p andor k-1 online?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your w-2 w-2p andor k-1 to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I edit w-2 w-2p andor k-1 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your w-2 w-2p andor k-1, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your w-2 w-2p andor k-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.