CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1) 2018 free printable template

Show details

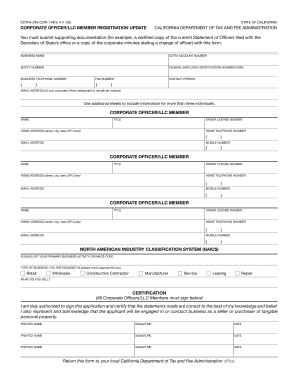

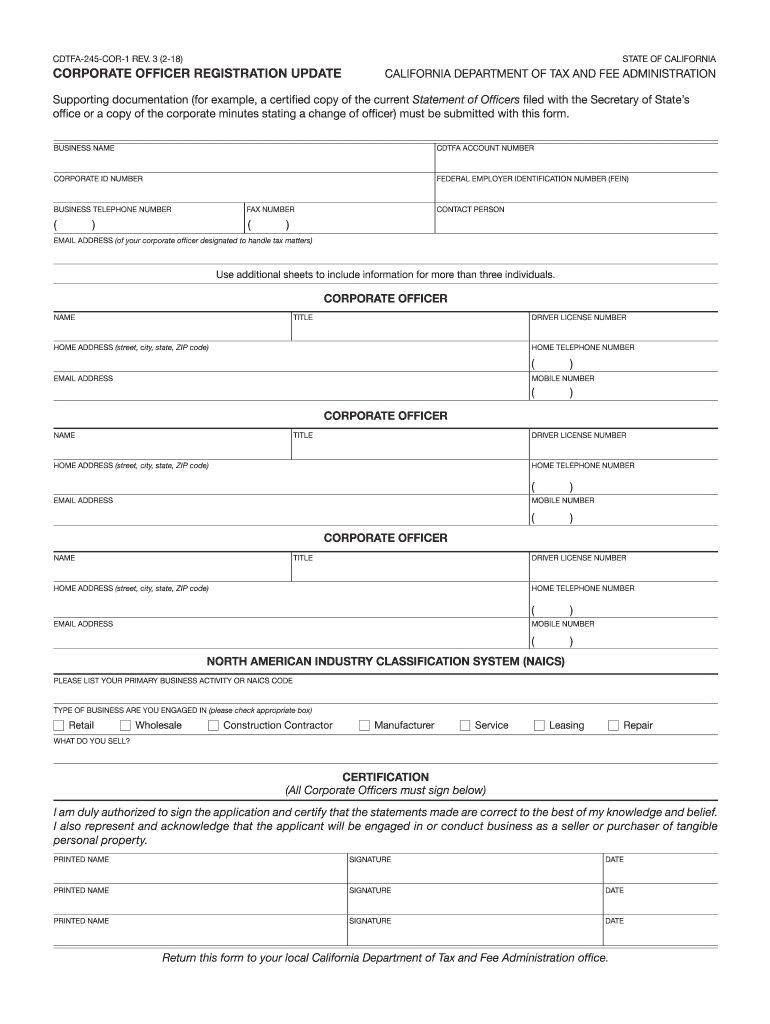

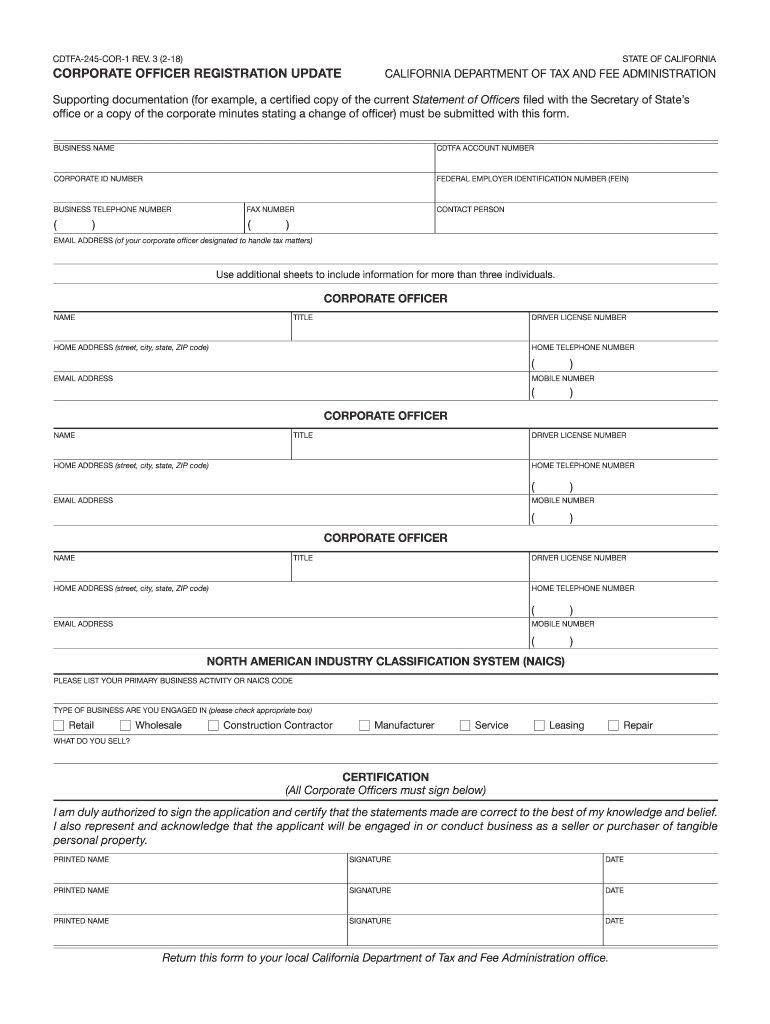

CDTFA245COR1 REV. 3 (218)STATE OF CALIFORNIACORPORATE OFFICER REGISTRATION UPDATECALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATIONSupporting documentation (for example, a certified copy of the current

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-245-COR-1 Formerly BOE-245-COR-1

Edit your CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-245-COR-1 Formerly BOE-245-COR-1. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-245-COR-1 Formerly BOE-245-COR-1

How to fill out CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)

01

Obtain the CA CDTFA-245-COR-1 form from the official California Department of Tax and Fee Administration (CDTFA) website.

02

Fill out your business information at the top of the form, including your name, address, and account number.

03

Provide the date of the claim for refund or credit and indicate whether this is an original claim or a refiled claim.

04

Identify the specific tax type you are claiming a refund or credit for.

05

Detail the reason for the refund or credit claim in the designated section.

06

Attach any supporting documents that substantiate your claim, such as invoices or proof of payment.

07

Review the completed form for accuracy and ensure all sections are filled out completely.

08

Sign and date the form certifying that the information provided is true and correct.

09

Submit the completed form to the appropriate CDTFA address indicated on the form.

Who needs CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

01

Any business or individual that has overpaid taxes or fees to the California Department of Tax and Fee Administration may need to fill out the CA CDTFA-245-COR-1 form to request a refund or credit.

02

Businesses that experience an error in reporting sales or use tax can also use this form to correct the overpayment.

03

Taxpayers who have been erroneously assessed or paid certain fees may utilize this form to seek reimbursement.

Fill

form

: Try Risk Free

People Also Ask about

What is CDTFA payment fee?

Pay Directly from Your Bank Account There is no fee to use this service. To make a payment online, visit CDTFA's Online Services Login Page. You can find more information in our Online Payments – Frequently Asked Questions.

Can CDTFA garnish wages?

A levy or garnishment is the taking of property to satisfy a liability. CDTFA has the authority to levy/garnish your property (such as bank accounts, wages, real estate, and accounts receivable) if you do not pay Page 15 11 the amount due or make arrangements to settle your debt.

What is the finality penalty for CDTFA?

If you received a Notice of Determination (billing), but failed to pay the amount due by the due date, you will generally be assessed a 10 percent “finality” penalty. Under certain circumstances, we may waive the 10 percent “finality” penalty.

What is the statute of limitations for CDTFA?

At any time within three years after any tax or any amount of tax required to be collected becomes due and payable and at any time within three years after the delinquency of any tax or any amount of tax required to be collected, or within the period during which a lien is in force as the result of the recording of an

What is a CDTFA tax clearance?

A use tax clearance is a document issued by CDTFA stating that you qualify for a specific exemption and that you may register your vehicle or vessel without payment of use tax. DMV can process many nontaxable transfers without requiring that you obtain a use tax clearance from CDTFA.

Does California have a sales tax exemption certificate?

If you are selling to a customer who has an exempt status, you must collect a California Sales Tax Exemption certificate and keep it on file. If you are audited, you will be expected to produce this as proof that you sold an exempt item.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 online?

Filling out and eSigning CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 right away.

How do I edit CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 on an Android device?

With the pdfFiller mobile app for Android, you may make modifications to PDF files such as CA CDTFA-245-COR-1 Formerly BOE-245-COR-1. Documents may be edited, signed, and sent directly from your mobile device. Install the app and you'll be able to manage your documents from anywhere.

What is CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1) is a form used by the California Department of Tax and Fee Administration (CDTFA) to report claims for a refund of sales and use tax.

Who is required to file CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

Businesses and individuals who have overpaid sales or use tax and wish to claim a refund are required to file CA CDTFA-245-COR-1.

How to fill out CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

To fill out CA CDTFA-245-COR-1, provide your contact information, detailed transaction data related to the overpayment, and any supporting documentation that justifies the refund request.

What is the purpose of CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

The purpose of the CA CDTFA-245-COR-1 is to officially document and process requests for refunds of sales and use tax from the CDTFA.

What information must be reported on CA CDTFA-245-COR-1 (Formerly BOE-245-COR-1)?

The information that must be reported includes the taxpayer's identification details, the amount of overpayment, the reason for the refund, and relevant transaction details.

Fill out your CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-245-COR-1 Formerly BOE-245-COR-1 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.