Get the free fatca declaration form union bank of india

Show details

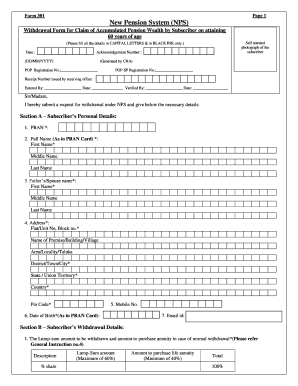

Must ID:FATCAPARTA 1961 285BA AnnexureAdditional mandatory details required under section 285BA of IT Act 1961 // / ? ()Tennis your Country of Birth/Nationality/Tax Residency

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your fatca declaration form union form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fatca declaration form union form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fatca declaration form union bank of india online

Follow the steps below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit additional mandatory details required under section 285ba of it act 1961 form pdf. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out fatca declaration form union

How to fill out FATCA declaration form union:

01

Start by carefully reading the instructions provided with the form. This will help you understand the purpose and requirements of the form.

02

Gather all the necessary information and documentation required to fill out the form. This may include your personal details, such as name, address, and taxpayer identification number.

03

Fill in the relevant sections of the form accurately and completely. Provide the requested information, such as your financial account details, income sources, and the relevant taxable years.

04

Pay attention to any additional requirements or special instructions mentioned in the form. This may include attaching supporting documents or providing explanations for certain entries.

05

Review your filled-out form to ensure all the information provided is correct and consistent. Mistakes or inaccuracies can delay the processing of the form or result in penalties.

06

Sign and date the completed form as required. Make sure to follow any instructions regarding authorized signatures or additional documentation, such as power of attorney or legal representation.

Who needs FATCA declaration form union:

01

Any individual or entity that meets the criteria specified under the Foreign Account Tax Compliance Act (FATCA) regulations may need to fill out the FATCA declaration form union.

02

This may apply to U.S. citizens, U.S. tax residents, U.S. entities or foreign entities with U.S. connections, or individuals or entities holding financial accounts outside the United States.

03

The FATCA declaration form union helps the Internal Revenue Service (IRS) identify and deter tax evasion by U.S. taxpayers using offshore accounts. Therefore, those falling under the scope of FATCA regulations are required to provide the necessary information and comply with reporting obligations.

Note: It is advisable to consult with a tax professional or seek guidance from the IRS or relevant authorities to ensure that you correctly understand and fulfill your FATCA obligations.

Fill additional mandatory details required under section 285ba of it act 1961 form : Try Risk Free

People Also Ask about fatca declaration form union bank of india

How do I submit a FATCA declaration form?

What is self declaration form in Union Bank of India?

How to fill out a FATCA form?

Is FATCA declaration mandatory in india?

Where can I find my FATCA?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is fatca declaration form union?

The FATCA Declaration Form Union is a form created by the European Commission to help facilitate the exchange of information between EU Member States and the United States regarding the Foreign Account Tax Compliance Act (FATCA). The form is used to provide information on financial accounts held by U.S. persons outside of the United States, and to assist other jurisdictions in complying with their FATCA obligations.

What is the purpose of fatca declaration form union?

The Foreign Account Tax Compliance Act (FATCA) declaration form is a document used by a financial institution to identify US citizens and tax residents who have financial accounts with the institution. This form is used to help comply with FATCA regulations, which require financial institutions to report information about financial accounts held by US taxpayers or foreign entities financially linked to US taxpayers to the US Internal Revenue Service.

When is the deadline to file fatca declaration form union in 2023?

The deadline to file FATCA declaration form in the United States for the 2023 tax year is April 15, 2024.

Who is required to file fatca declaration form union?

There is no specific "Fatca declaration form union" that has been mentioned or is commonly known. FATCA (Foreign Account Tax Compliance Act) is a United States federal law that requires individuals and entities, including certain financial institutions, to report their U.S. accounts and investments held outside of the United States to the Internal Revenue Service (IRS). The specific requirements for filing FATCA declarations depend on the individual's or entity's status, financial situation, and relevant jurisdictional regulations. It is best to consult with a tax professional or the IRS for accurate and up-to-date information regarding FATCA reporting obligations.

How to fill out fatca declaration form union?

To fill out the FATCA (Foreign Account Tax Compliance Act) declaration form for Union, follow these steps:

1. Obtain the form: Request the FATCA declaration form from Union. It may be available on their website or you can contact their customer service for assistance.

2. Personal Information: Begin by providing your personal information such as your full name, address, country of citizenship, and Tax Identification Number (TIN). Provide accurate and complete details to ensure compliance.

3. Account information: List the account(s) that you hold with Union. Include the type of account (e.g., savings, checking), account number, and any other relevant details they require.

4. Tax information: Declare whether you are a U.S. person for tax purposes. Answer the questions related to your U.S. citizenship or residency status honestly. If you are not a U.S. person, state your country of tax residence.

5. Self-certification: Sign and date the form to certify that the information provided is true and accurate to the best of your knowledge. Keep a copy of the completed form for your records.

6. Submit the form: Once completed, submit the filled-out FATCA declaration form to Union as per their instructions. They may ask for a physical copy or provide an online submission option.

Note: The exact format and requirements of the FATCA declaration form can vary between financial institutions. It is always advisable to refer to Union's specific instructions or seek guidance from their customer service if you have any doubts or questions while completing the form.

What information must be reported on fatca declaration form union?

The information that must be reported on a FATCA declaration form includes:

1. Personal Information: This includes the name, address, social security number (or equivalent), and date of birth of the individual making the declaration.

2. Tax Identification Number (TIN): The individual's taxpayer identification number must be provided.

3. Foreign Accounts: Details of any foreign financial accounts held by the individual, including the name and address of the financial institution, account number, and the maximum value of the account during the reporting year.

4. Income: The individual must report any income earned from foreign sources, such as dividends, interest, or rental income.

5. Foreign Assets: Information about any other foreign assets held by the individual, such as real estate, stocks, or bonds.

6. Signature: The individual must sign and date the declaration form, certifying that the information provided is complete and accurate.

It is important to note that the specific requirements for a FATCA declaration form may vary between different jurisdictions, so individuals should consult the relevant tax authorities or financial institutions for the specific form and requirements applicable to their situation.

How can I modify fatca declaration form union bank of india without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your additional mandatory details required under section 285ba of it act 1961 form pdf into a dynamic fillable form that you can manage and eSign from anywhere.

Where do I find mandatory form?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the additional mandatory details required under section 285ba of it act 1961 form pdf in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out mandatory form using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign additional mandatory details required under section 285ba of it act 1961 form and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Fill out your fatca declaration form union online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mandatory Form is not the form you're looking for?Search for another form here.

Keywords relevant to mandatory form

Related to mandatory form download

If you believe that this page should be taken down, please follow our DMCA take down process

here

.