Get the free illinois new hire reporting form

Show details

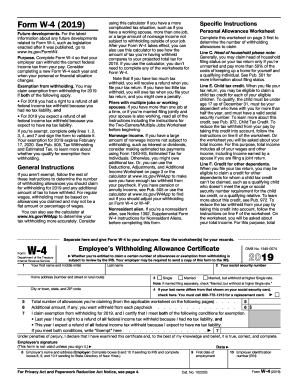

State of Illinois Department of Employment Security New Hire Reporting Form Employers must report each new hire within 20 days. Please print or type Assistance: 1 800 327-HIRE (4473) EMPLOYER NAME

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your illinois new hire reporting form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your illinois new hire reporting form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing illinois new hire reporting online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit illinois new hire reporting form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

How to fill out illinois new hire reporting

How to fill out Illinois new hire reporting:

01

Obtain the necessary forms: Visit the Illinois Department of Employment Security website and download the New Hire Reporting Form. You can also request a physical copy by contacting the department directly.

02

Gather the required information: Collect the employee's full name, social security number, address, date of birth, and date of hire. Ensure that the information is accurate and up-to-date.

03

Complete the form: Fill out the New Hire Reporting Form with the employee's information. Double-check for any errors or missing details before submitting.

04

Submit the form: There are three options to submit the completed form. You can either mail it to the Illinois Department of Employment Security, fax it, or submit it online through their secure website.

05

Retain a copy for your records: Make sure to keep a copy of the completed form for your own records. This will come in handy for any future reporting or verification purposes.

Who needs Illinois new hire reporting?

01

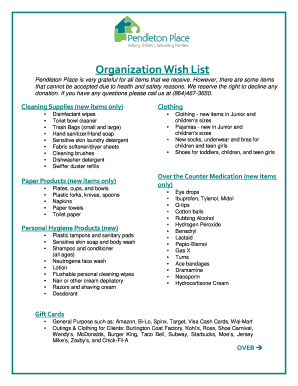

Employers in Illinois: All employers in the state of Illinois are required to file new hire reports for each newly hired employee.

02

Multiple employers: If the employee is employed by more than one company, each employer must individually report the newly hired employee.

03

Independent contractors: If an individual is an independent contractor, the hiring company is not required to report them as a new hire. However, it is still essential to accurately classify their employment status.

Fill illinois new hire reporting online : Try Risk Free

People Also Ask about illinois new hire reporting

What is an example of a new hire packet?

What to do when hiring a new employee in Illinois?

How do I fill out a new hire packet?

How do I fill out a new hire paperwork?

What forms does a new employee need to fill out in Illinois?

What should be included in new hire paperwork?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

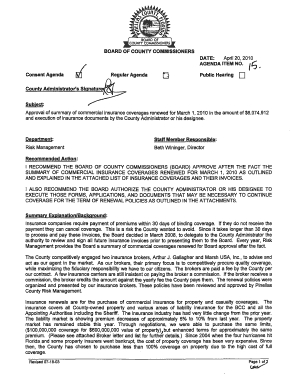

What is illinois new hire reporting?

Illinois New Hire Reporting is a program that requires employers to report information about newly hired employees to the Illinois Department of Employment Security (IDES). The program is designed to help state agencies locate parents who owe child support and collect the necessary payments.

Employers in Illinois are required by law to report certain information about newly hired employees within 20 days of the employee's start date. This information includes the employee's name, social security number, address, and date of hire. The report can be submitted electronically or by mail.

The reported information is then cross-matched with child support records maintained by the Illinois State Disbursement Unit (SDU) to identify individuals who owe child support. If a match is found, the relevant child support enforcement agency can take appropriate action to collect and enforce child support orders.

The purpose of Illinois New Hire Reporting is to aid in the enforcement of child support obligations and ensure that parents fulfill their financial responsibilities towards their children.

Who is required to file illinois new hire reporting?

Employers in the state of Illinois are required to file Illinois New Hire reports.

How to fill out illinois new hire reporting?

To fill out the Illinois New Hire Reporting form, follow these steps:

1. Obtain the Illinois New Hire Reporting Form, commonly known as the IL-W-4N, from the Illinois Department of Employment Security (IDES) website or request a physical copy from IDES.

2. Provide your business information in the designated fields at the top of the form. This includes your business name, mailing address, federal employer identification number (FEIN), and the quarter and year of the report.

3. Fill in the employee information section. For each newly hired employee, provide their full name, social security number, hire date, and address.

4. Include additional information, such as the employee's state date (if different from the hire date), the employee's most recent employment separation date (if applicable), and their gross wages earned for the reporting quarter.

5. Determine the reporting period. Illinois requires employers to report new hires on a quarterly basis. The reporting periods typically follow the calendar year, with quarters ending on March 31st, June 30th, September 30th, and December 31st.

6. Once completed, make copies of the form for your records.

7. Submit the IL-W-4N form to IDES as instructed by the department. You can typically submit it electronically through IDES' reporting system or mail a physical copy to the designated address provided on the form or on the IDES website.

Note: The instructions and process for completing the Illinois New Hire Reporting form may change over time, so it's always recommended to refer to the official IDES website or contact IDES directly for the most up-to-date information and instructions.

What is the purpose of illinois new hire reporting?

The purpose of Illinois new hire reporting is to assist the state in enforcing child support obligations. Employers are required by law to report new employees to the Illinois Department of Employment Security (IDES) within 20 days of the employee's hire or rehire date. This information is then cross-matched with child support records to ensure that parents who owe child support payments fulfill their obligations. The reporting helps IDES to locate noncustodial parents, establish paternity, establish or enforce child support orders, and detect fraudulent claims for unemployment benefits.

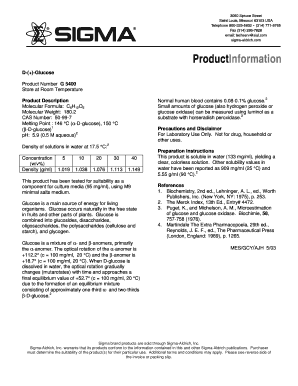

What information must be reported on illinois new hire reporting?

When reporting a new hire in Illinois, the following information must be included:

1. Employer Information:

- Federal Employer Identification Number (FEIN) or State Employer Identification Number (SEIN)

- Employer name

- Employer address and phone number

2. Employee Information:

- Employee's full name

- Employee's address

- Social Security Number (SSN)

- Date of hire

- Whether the employee is a full-time or part-time worker

It is important to note that some additional optional data fields may be available, such as the Employee Identification Number (EIN), which is assigned by the employer.

When is the deadline to file illinois new hire reporting in 2023?

As of my knowledge cutoff in October 2021, the specific deadline for filing Illinois new hire reports in 2023 has not been announced yet. It is recommended to consult the Illinois Department of Employment Security (IDES) or visit their official website for the most up-to-date and accurate information regarding deadlines for Illinois new hire reporting in 2023.

What is the penalty for the late filing of illinois new hire reporting?

The penalty for late filing of Illinois new hire reporting is $15 for each report not filed or filed late.

How do I make edits in illinois new hire reporting without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your illinois new hire reporting form, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out illinois new hire form using my mobile device?

Use the pdfFiller mobile app to complete and sign illinois new hire on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Can I edit il new hire reporting on an Android device?

You can make any changes to PDF files, such as il new hire form, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your illinois new hire reporting online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Illinois New Hire Form is not the form you're looking for?Search for another form here.

Keywords relevant to illinois hire reporting form

Related to illinois new reporting

If you believe that this page should be taken down, please follow our DMCA take down process

here

.