Get the free CPA Exemption - Town of Wellesley - wellesleyma

Show details

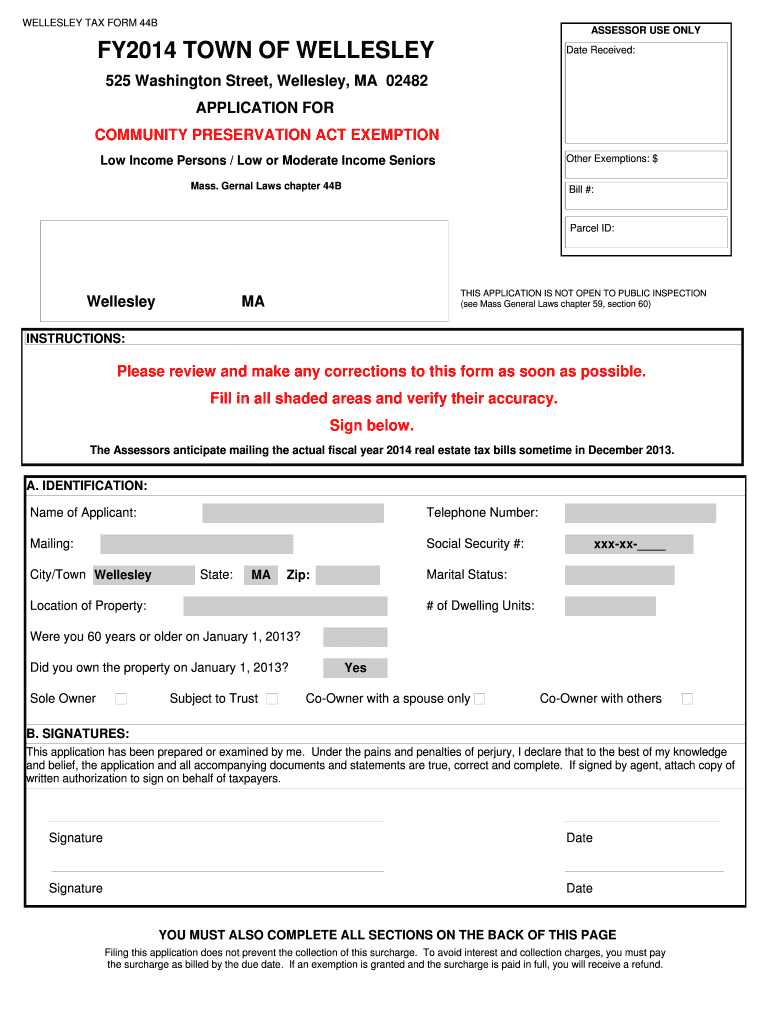

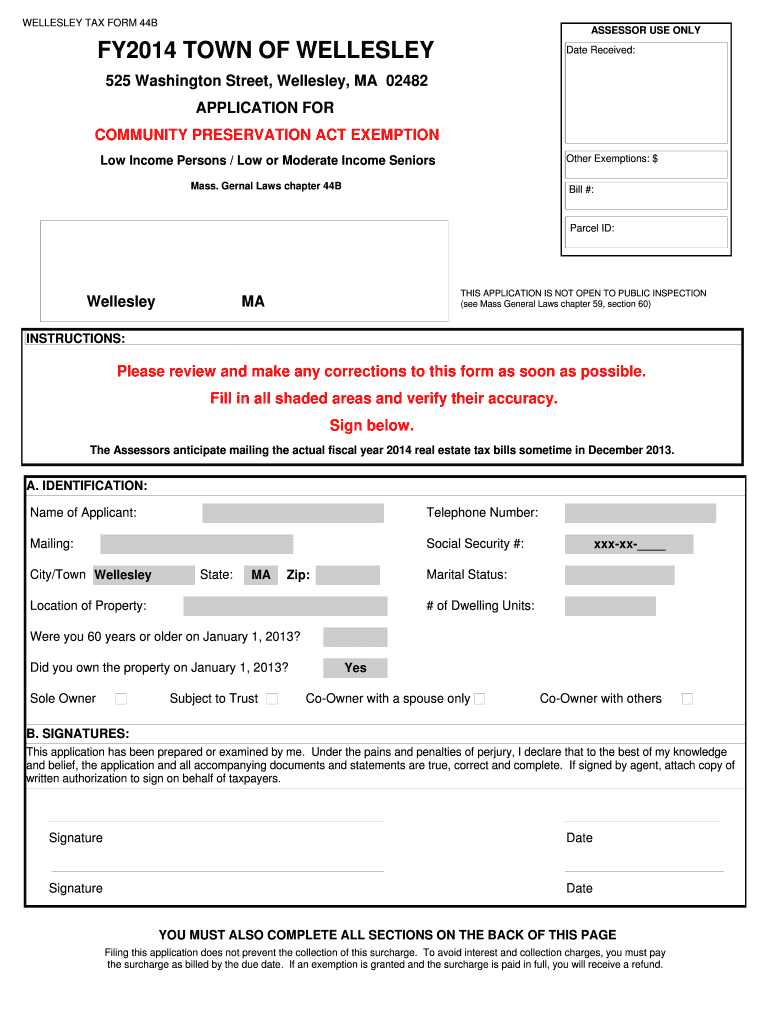

WELLESLEY TAX FORM 44B ASSESSOR USE ONLY FY2014 TOWN OF WELLESLEY Date Received: 525 Washington Street, Wellesley, MA 02482 APPLICATION FOR COMMUNITY PRESERVATION ACT EXEMPTION Other Exemptions: $

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpa exemption - town

Edit your cpa exemption - town form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpa exemption - town form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cpa exemption - town online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit cpa exemption - town. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpa exemption - town

How to fill out CPA exemption - town:

01

Start by gathering all the necessary documents. These may include identification proof, residency proof, and any other relevant documents as required by the town.

02

Research the specific requirements and guidelines for the CPA exemption in your town. Each town may have slightly different requirements, so it is important to be familiar with the specific rules.

03

Complete the CPA exemption form accurately and legibly. Provide all the requested information and make sure to double-check for any errors or missing information.

04

If required, include any supporting documentation that may be necessary to prove your eligibility for the CPA exemption. This could include income statements, tax returns, or any other relevant documents.

05

Review the completed form and supporting documents to ensure everything is in order. Make sure all necessary signatures are included and that the form is filled out completely.

06

Submit the completed CPA exemption form to the appropriate town office or department. Follow any specific instructions provided for submitting the form, such as mailing it or hand-delivering it.

07

Keep a copy of the completed form and any supporting documentation for your records. It is always a good idea to maintain a record of any forms submitted to the town for future reference.

Who needs CPA exemption - town?

01

Individuals who meet the eligibility criteria and want to be exempted from a certain aspect of the Certified Public Accountant (CPA) requirements in their town may need the CPA exemption.

02

Business owners or professionals who do not meet the traditional CPA requirements but still want to engage in certain financial or accounting practices in their town may also need to apply for the CPA exemption.

03

People who have extensive experience or knowledge in accounting or finance but may not have the formal education or certification required for a standard CPA designation may also be interested in obtaining the CPA exemption in their town.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the cpa exemption - town in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your cpa exemption - town in minutes.

Can I create an electronic signature for signing my cpa exemption - town in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your cpa exemption - town right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

Can I edit cpa exemption - town on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share cpa exemption - town on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is cpa exemption - town?

CPA exemption - town is a form that allows certain eligible taxpayers to apply for an exemption from the Community Preservation Act (CPA) surcharge on their property taxes.

Who is required to file cpa exemption - town?

Homeowners who meet specific criteria, such as income limits or being over a certain age, are required to file for the CPA exemption - town.

How to fill out cpa exemption - town?

To fill out the CPA exemption - town form, taxpayers must provide information about their property, income, and any other relevant details as requested on the form.

What is the purpose of cpa exemption - town?

The purpose of the CPA exemption - town is to provide financial relief to eligible taxpayers who may be burdened by the CPA surcharge on their property taxes.

What information must be reported on cpa exemption - town?

Taxpayers must report information such as their income, property value, and any other criteria specified by the local government in order to determine eligibility for the CPA exemption - town.

Fill out your cpa exemption - town online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpa Exemption - Town is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.