Get the free LOST POLICY AFFIDAVIT - BENEFICIARY - Maximum Corporation

Show details

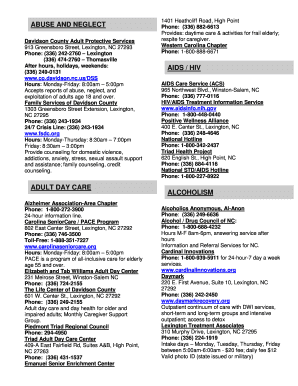

LOST POLICY AFFIDAVIT BENEFICIARY Return to: PO BOX 833879 RICHARDSON TX 75083-3879 ? ? ? ? Champions Life Insurance Company Central Security Life Insurance Company Western American Life Insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your lost policy affidavit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lost policy affidavit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing lost policy affidavit online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit lost policy affidavit. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out lost policy affidavit

How to fill out a lost policy affidavit:

01

Gather all necessary information: Start by collecting all relevant details about the lost policy, such as the policyholder's name, policy number, insurance company, and any other relevant information. This information will be needed to accurately complete the affidavit.

02

Obtain the lost policy affidavit form: Contact the insurance company or visit their website to obtain the official lost policy affidavit form. This form may also be available from regulatory agencies or insurance industry organizations.

03

Read the instructions carefully: Before filling out the form, carefully read through the instructions provided. Understand the purpose of the affidavit and any specific requirements or guidelines outlined.

04

Personal information: Begin by providing your personal information as the person filling out the affidavit. Include your full name, address, contact information, and any other details requested.

05

Policy details: In the section dedicated to policy details, provide information such as the policyholder's name, policy number, type of insurance policy, and the issuing insurance company. If any of this information is unknown or uncertain, note it accordingly.

06

Coverage details: Describe the coverage details of the lost policy, such as the types and amounts of coverage provided. Be as specific as possible to ensure accuracy.

07

Circumstances of loss: Explain the circumstances surrounding the loss of the policy. Include details such as when and where the policy was last seen, any possible reasons for the loss, and any efforts made to locate it.

08

Signature and notarization: Sign and date the affidavit, certifying that the information provided is true and accurate to the best of your knowledge. Some lost policy affidavit forms may require notarization, so ensure this step is completed if necessary.

Who needs a lost policy affidavit?

01

Beneficiaries: In the event of the policyholder's death, beneficiaries may need to file a lost policy affidavit to claim their entitlements. This ensures that they can receive the benefits outlined in the lost policy.

02

Policyholders: If the policyholder has lost their original policy document but wishes to make changes or submit a claim, they may need to complete a lost policy affidavit as a substitute for the original document.

03

Insurance companies: Lost policy affidavits are often required by insurance companies to verify the loss of a policy and process any subsequent requests or claims. It serves as proof that the policyholder or beneficiary legitimately lost the policy and requires assistance.

In summary, filling out a lost policy affidavit involves gathering relevant information, obtaining the official form, carefully reading the instructions, providing personal and policy details, explaining the circumstances of loss, and signing and notarizing the document. Various individuals, including beneficiaries, policyholders, and insurance companies, may need a lost policy affidavit to initiate or process claims or make changes to the policy.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is lost policy affidavit?

A lost policy affidavit is a legal document that is filed to declare that a policy document or insurance policy has been lost or misplaced.

Who is required to file lost policy affidavit?

The policyholder or the beneficiary of the insurance policy is required to file the lost policy affidavit.

How to fill out lost policy affidavit?

To fill out a lost policy affidavit, one must provide details such as policy number, name of insurance company, date of issuance, and reason for the loss of the policy document.

What is the purpose of lost policy affidavit?

The purpose of a lost policy affidavit is to officially declare the loss of an insurance policy document and request for a duplicate copy.

What information must be reported on lost policy affidavit?

The information that must be reported on a lost policy affidavit includes policy details, reason for loss, and contact information of the policyholder or beneficiary.

When is the deadline to file lost policy affidavit in 2023?

The deadline to file a lost policy affidavit in 2023 is typically within a reasonable time after the loss of the policy document.

What is the penalty for the late filing of lost policy affidavit?

The penalty for the late filing of a lost policy affidavit may include delays in processing a duplicate copy of the policy document or potential complications in claims processing.

Can I sign the lost policy affidavit electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your lost policy affidavit in seconds.

How do I fill out the lost policy affidavit form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign lost policy affidavit and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Can I edit lost policy affidavit on an iOS device?

Use the pdfFiller mobile app to create, edit, and share lost policy affidavit from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your lost policy affidavit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.