Get the free 2012 Canadian Non-Resident Questionnaire. Application for IRS Individual Taxpayer Id...

Show details

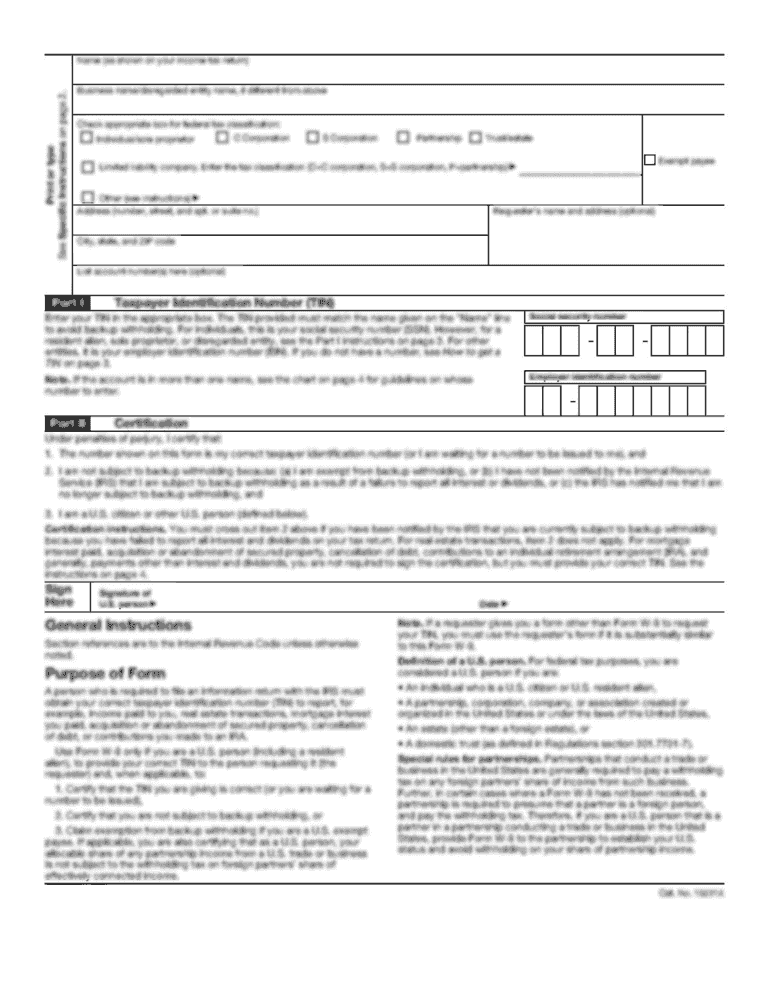

CANADIAN PERSONAL TAX RETURN QUESTIONNAIRE FOR A NON-RESIDENT OF CANADA 2013 Name Marital Status Spouse Name Single Engaged Married Separated Common-law Divorced Widowed as of December 31 Date of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2012 canadian non-resident questionnaire form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 canadian non-resident questionnaire form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2012 canadian non-resident questionnaire online

To use the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2012 canadian non-resident questionnaire. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

How to fill out 2012 canadian non-resident questionnaire

Point by point instructions on how to fill out the 2012 Canadian non-resident questionnaire:

01

Obtain the questionnaire: The 2012 Canadian non-resident questionnaire can typically be obtained from the Canada Revenue Agency (CRA) website or by contacting the CRA directly.

02

Gather necessary documents: Before filling out the questionnaire, gather all relevant documents such as your passport, tax documents from both Canada and your home country, and any other supporting documents that may be required.

03

Understand residency status: Determine whether you are considered a non-resident of Canada for tax purposes. This may depend on factors such as the length and purpose of your stay in Canada.

04

Fill out personal information: Start by providing your full legal name, contact information, and social insurance number (SIN) if applicable.

05

Answer residency-related questions: The questionnaire will likely ask about your residency status for the tax year in question. You may need to provide details about your length of stay in Canada, primary residence, and any ties you have to the country.

06

Report sources of income: Provide information about any income you earned during your time in Canada, including employment income, rental income, investment income, and any other sources of income.

07

Claim available deductions and credits: You may be eligible for certain deductions or tax credits as a non-resident. Be sure to review the instructions provided with the questionnaire to determine if you qualify for any tax benefits.

08

Calculate tax liability: Depending on your income and residency status, you may be required to calculate and report your tax liability in Canada. Review the instructions provided with the questionnaire or seek professional tax advice if needed.

09

Submit the questionnaire: Once you have completed filling out the questionnaire, review your answers for accuracy and completeness. Sign and date the form as required and submit it to the CRA by the specified deadline, either by mail or online through their website.

Who needs the 2012 Canadian non-resident questionnaire?

01

Individuals who were non-residents of Canada for tax purposes during the 2012 tax year.

02

Non-residents who earned income in Canada or had certain ties to the country during that period.

03

Individuals who are required to report their income and tax liability to the Canada Revenue Agency as non-residents for the 2012 tax year.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

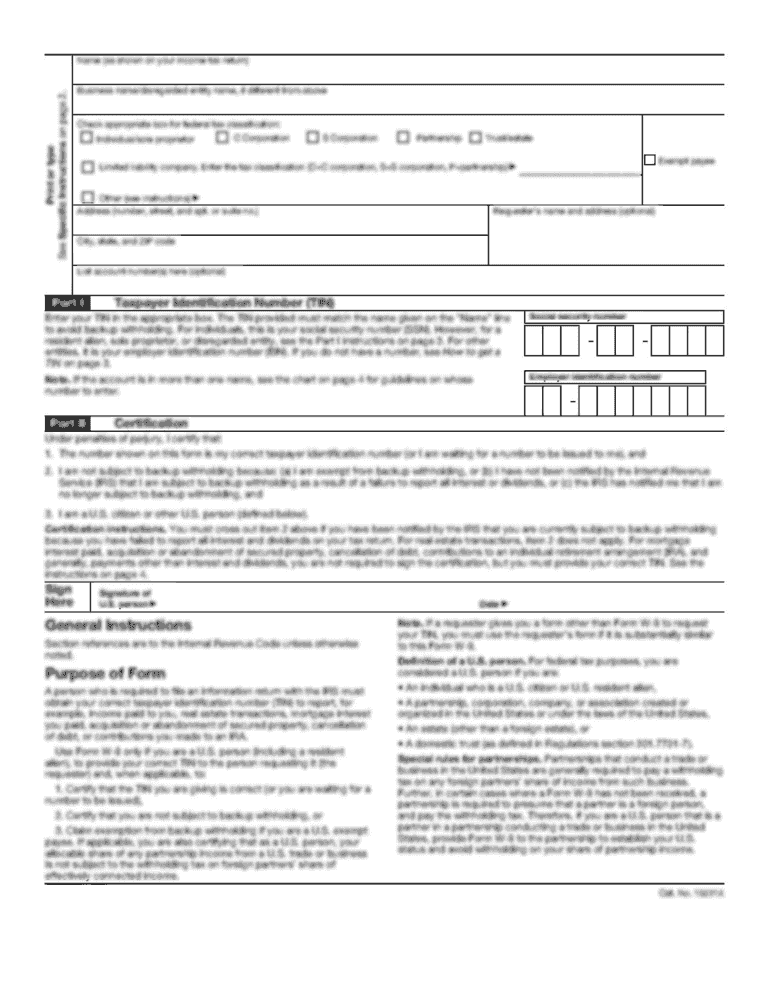

What is canadian non-resident questionnaire application?

The Canadian non-resident questionnaire application is a form that non-residents of Canada must fill out to determine their tax obligations in Canada.

Who is required to file canadian non-resident questionnaire application?

Non-residents of Canada who earn income in Canada or have assets in Canada are required to file the Canadian non-resident questionnaire application.

How to fill out canadian non-resident questionnaire application?

The Canadian non-resident questionnaire application can be filled out online or in paper form. Non-residents must provide information about their income, assets, and residency status.

What is the purpose of canadian non-resident questionnaire application?

The purpose of the Canadian non-resident questionnaire application is to determine the tax obligations of non-residents in Canada and ensure compliance with Canadian tax laws.

What information must be reported on canadian non-resident questionnaire application?

Non-residents must report their income earned in Canada, assets located in Canada, and their residency status on the Canadian non-resident questionnaire application.

When is the deadline to file canadian non-resident questionnaire application in 2023?

The deadline to file the Canadian non-resident questionnaire application in 2023 is April 30, 2023.

What is the penalty for the late filing of canadian non-resident questionnaire application?

The penalty for late filing of the Canadian non-resident questionnaire application is a monetary fine imposed by the Canadian tax authorities.

How can I edit 2012 canadian non-resident questionnaire from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2012 canadian non-resident questionnaire. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I make edits in 2012 canadian non-resident questionnaire without leaving Chrome?

2012 canadian non-resident questionnaire can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I sign the 2012 canadian non-resident questionnaire electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your 2012 canadian non-resident questionnaire in minutes.

Fill out your 2012 canadian non-resident questionnaire online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.