Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

CRP forms refer to the Conservation Reserve Program forms. The Conservation Reserve Program (CRP) is a voluntary program administered by the United States Department of Agriculture (USDA) Farm Service Agency (FSA). The program aims to reduce soil erosion, protect water quality, and enhance wildlife habitat by converting environmentally sensitive agricultural land into long-term vegetative cover.

CRP forms are used by landowners and operators to apply for participation in the program. These forms collect information about the land and the proposed conservation practices that will be implemented. The forms also include contracts and agreements that outline the terms and conditions of participation, such as the length of the contract, payment rates, and conservation requirements.

Overall, CRP forms serve as the official documentation to initiate and maintain participation in the Conservation Reserve Program.

Who is required to file crp forms for?

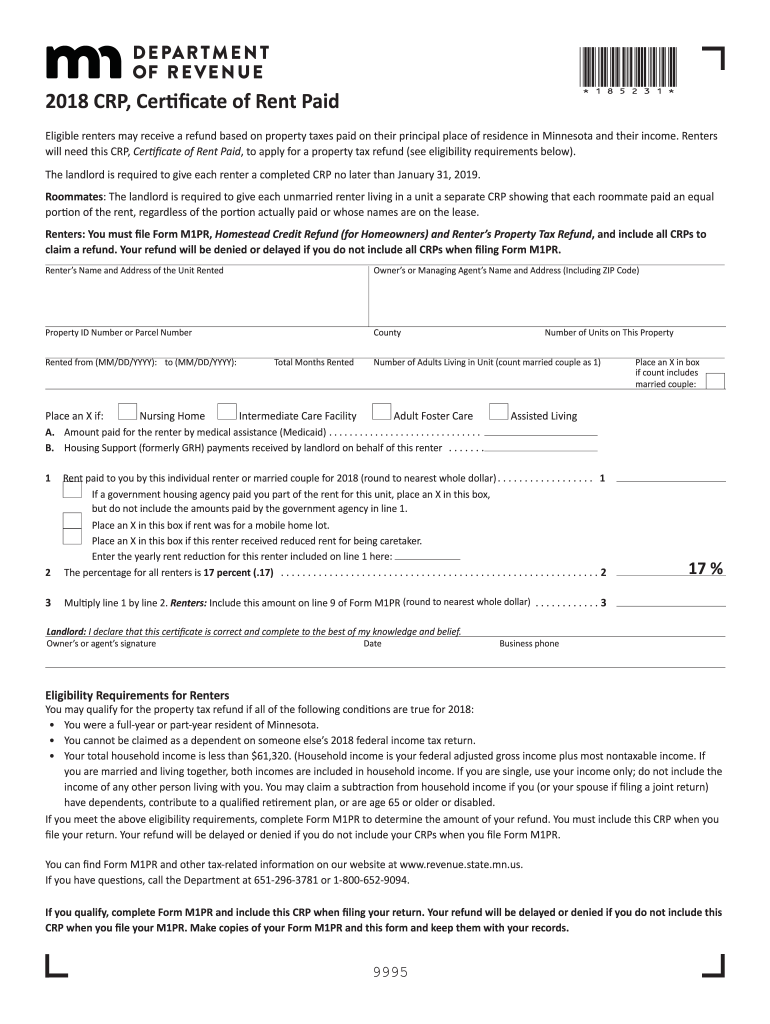

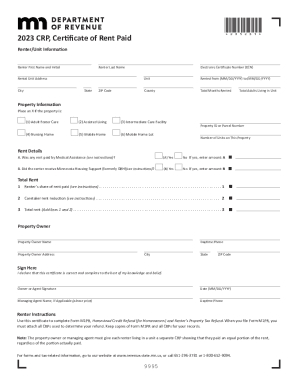

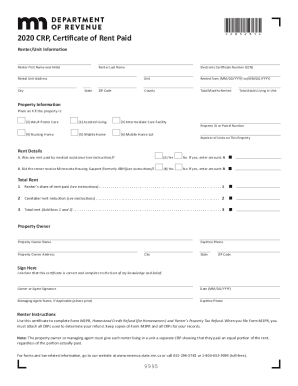

CRP (Certificate of Rent Paid) forms are typically filed by renters or tenants, not landlords or property owners. In the United States, the requirement to file CRP forms may vary by state or locality, but it is commonly required for individuals who pay rent and claim rent-related tax benefits or credits on their income tax returns. The form provides information on the amount of rent paid in a calendar year, which is needed for tax purposes.

How to fill out crp forms for?

To fill out CRP (Conservation Reserve Program) forms, follow these steps:

1. Obtain the necessary forms: Visit the official website of the United States Department of Agriculture (USDA) or contact your local USDA Farm Service Agency (FSA) office to obtain the CRP forms. Make sure to get the latest version of the form.

2. Read the instructions: Carefully read through the provided instructions accompanying the forms. Familiarize yourself with the requirements and guidelines for completing the forms correctly.

3. Gather the required information: Collect all the necessary information needed for completing the CRP forms. This may include personal details, such as name, address, social security number, and contact information.

4. Complete the application form: Begin filling out the application form by providing the requested information. This will typically include details about the land being enrolled in CRP, such as acreage, legal description, and different land uses.

5. Follow the guidelines for conservation practices: Certain conservation practices may be required as part of the CRP enrollment. Ensure that you accurately provide information related to these practices, such as the type of cover crop or vegetation seeding, and other conservation enhancements.

6. Provide supporting documents: Depending on the specific CRP program and enrollment options, you may be required to provide additional documentation. This can include soils maps, aerial photos, or land management plans. Make sure to attach all required documents to the application form.

7. Submit the completed forms: Once you have completed the forms and gathered all the necessary documents, review everything carefully to avoid errors or omissions. Sign and date the forms where required. Submit the completed forms to the designated USDA-FSA office. You may be asked to keep a copy for your records.

Remember that the CRP forms and application process may vary depending on the specific program and region. Therefore, always refer to the provided instructions and consult with the USDA-FSA office, if needed, for clarification or assistance in filling out the forms accurately.

What is the purpose of crp forms for?

The purpose of CRP (Conservation Reserve Program) forms is to gather relevant information for landowners and farmers who are participating in the CRP program. CRP is a voluntary federal program in the United States that provides financial incentives to landowners to remove environmentally sensitive land from agricultural production and convert it to conservation practices. This program aims to improve water quality, prevent soil erosion, and enhance wildlife habitat. The CRP forms help document the landowner's enrollment, eligibility, land specifics, and their conservation plans, allowing the government to administer the program effectively and ensure compliance.

What information must be reported on crp forms for?

CRP (Conservation Reserve Program) forms are used to report various details regarding agricultural land enrolled in the program. The specific information that must be reported on CRP forms includes:

1. Landowner Information: This includes the name, address, and contact details of the landowner who has enrolled the land in the CRP program.

2. Farm and Tract Information: The forms require the identification of the farm and tract numbers, which help in specifically identifying the enrolled land.

3. Total Acres: The total number of acres enrolled in the CRP program must be reported accurately on the forms.

4. CRP Contract Information: Details of the specific CRP contract associated with the enrolled land, including the contract number, terms, and expiration date, should be reported.

5. Conservation Practices: The forms require reporting on the specific conservation practices implemented on the enrolled land, such as grass planting, tree planting, wetland restoration, etc.

6. Compliance Information: Any changes in land use, cropping patterns, or conservation measures undertaken on the enrolled land must be reported, ensuring compliance with CRP guidelines.

7. Payment Details: The forms also include sections for reporting the payment information, including the amount received for enrollment, annual rental payments, and any other relevant financial details.

It is important to note that specific information required on CRP forms may vary based on the program's regulations, types of conservation practices used, and reporting requirements in different regions or countries. Therefore, farmers and landowners are advised to consult program guidelines and local authorities to ensure accurate reporting on CRP forms.

What is the penalty for the late filing of crp forms for?

The penalty for the late filing of CRP (Certified Residential Property) forms may vary depending on the jurisdiction. In some places, a penalty fee may be imposed for each day of non-compliance until the form is submitted. This fee can accumulate over time and potentially increase the total penalty amount. However, specific penalties and consequences can be found in local laws, regulations, or governing bodies that oversee CRP form filing. It is advisable to consult the relevant authorities or legal resources to determine the precise penalties for late filing in a particular area.

Can I edit crp forms for 2018 on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign 2018 minnesota certificate of rent paid form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How can I fill out mn crp 2018 on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your crp form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

How do I complete mn renters rebate 2018 form on an Android device?

On Android, use the pdfFiller mobile app to finish your 2018 crp form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.