Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is g7 quarterly return for?

The G7 Quarterly Return typically refers to the financial performance of the G7 countries. G7 stands for the Group of Seven, which consists of the seven largest advanced economies in the world – Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States.

The G7 Quarterly Return may depict the economic indicators such as GDP growth, unemployment rate, inflation, trade balance, and other relevant factors that reflect the economic health of these countries on a quarterly basis. It allows policymakers and analysts to assess the progress or challenges faced by these nations and provides insights into global economic trends and outlook.

Who is required to file g7 quarterly return for?

The G7 quarterly return is typically filed by businesses operating in India who are registered under the Goods and Services Tax (GST) system. These businesses are required to file this return to provide details of their outward supplies, inward supplies, and any applicable tax liabilities for a specific quarter.

How to fill out g7 quarterly return for?

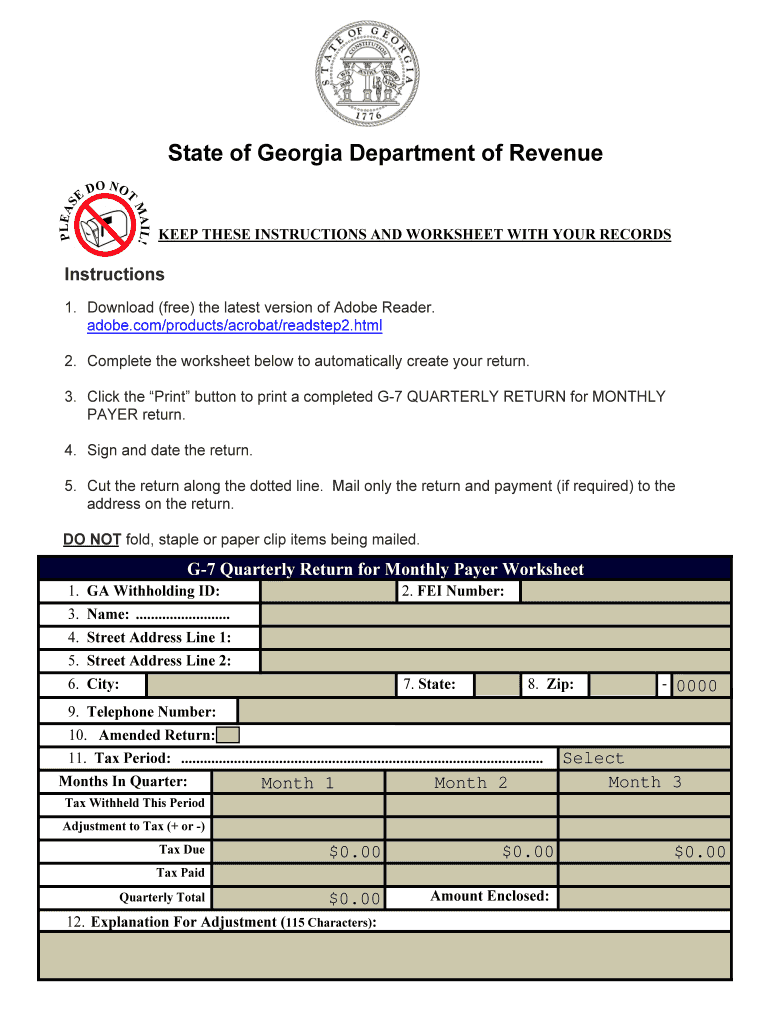

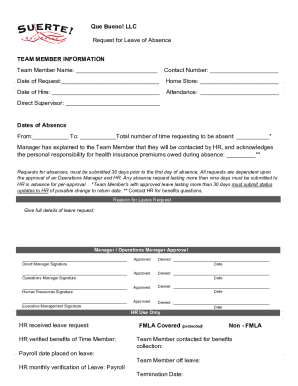

The G7 Quarterly Return form is used by businesses to report their sales and use tax liability for a specific period. Here are the steps to fill out the form:

1. Obtain the G7 Quarterly Return form: You can typically download the form from your state's Department of Revenue website or request a physical copy if available.

2. Enter your business information: Fill in the required fields at the top of the form, such as your business name, address, tax identification number, and the period covered by the return.

3. Report gross sales: Calculate your total gross sales for the quarter and enter the amount on line 1 of the form. Include all taxable and non-taxable sales made during this period.

4. Deduct exempt sales: If you made any exempt sales during the quarter, deduct the total amount from your gross sales and report the result on line 2 of the form.

5. Calculate taxable sales: Subtract the exempt sales from the gross sales, and enter the taxable sales amount on line 3 of the form.

6. Apply the tax rate: Multiply the taxable sales by the applicable tax rate for your jurisdiction, and report the resulting sales tax liability on line 4 of the form.

7. Report credits and prepayments: If you have any credits or prepayments that reduce your tax liability, enter the amounts on line 5 of the form.

8. Calculate the final liability: Subtract the credits and prepayments from the sales tax liability calculated in the previous step, and report the final liability on line 6.

9. Provide additional information: Some jurisdictions may require additional information to be reported on the G7 Quarterly Return form, such as details about out-of-state purchases or exemptions. If applicable, complete these sections accordingly.

10. Sign and submit the form: Review the entire form to ensure accuracy, sign it, and submit it to the appropriate tax authority by the specified due date. Make sure to keep a copy for your records.

Note: The specific instructions and requirements for filling out the G7 Quarterly Return form may vary by state, so it's important to refer to the official instructions provided with the form or consult with a tax professional to ensure compliance with your jurisdiction's regulations.

What is the purpose of g7 quarterly return for?

The G7 quarterly return is a report that provides information on the economic performance and financial status of a company or organization. It is typically used for internal purposes, such as tracking and evaluating the company's financial and operational progress over a specific quarter. The purpose of this report is to monitor key financial metrics, assess profitability, identify areas of improvement, and make informed decisions based on the data provided. It also helps in meeting legal and regulatory requirements, enabling transparency and accountability within the organization.

What information must be reported on g7 quarterly return for?

The G7 quarterly return form, also known as the G7/QR, is used by businesses to report their sales, purchases, and tax information on a quarterly basis. The specific information that must be reported on the G7 quarterly return form may vary based on the tax jurisdiction, but generally includes the following:

1. Business information: The name, address, and contact details of the business.

2. Tax identification number: The tax identification number or registration number of the business.

3. Reporting period: The specific quarter for which the return is being filed.

4. Sales information: The total sales made during the quarter, including taxable and non-taxable sales.

5. Taxable purchases: The total value of purchases made during the quarter that are subject to sales tax.

6. Exempt purchases: The total value of purchases made during the quarter that are exempt from sales tax.

7. Tax collected: The sales tax collected on taxable sales made during the quarter.

8. Tax paid on purchases: The sales tax paid on taxable purchases made during the quarter.

9. Adjustments: Any adjustments or corrections to sales or purchases for previous reporting periods.

10. Other information: Additional information or explanations that may be required by the tax authority.

It is important to note that the specific reporting requirements may vary depending on the tax jurisdiction and the nature of the business. Therefore, businesses are advised to consult with their tax advisors or refer to relevant tax regulations to ensure accurate reporting on the G7 quarterly return form.

When is the deadline to file g7 quarterly return for in 2023?

The deadline to file the G7 quarterly return for 2023 would depend on the specific jurisdiction or country in question. The G7 refers to a group of seven major advanced economies, including the United States, Canada, United Kingdom, Germany, France, Italy, and Japan. Each country or jurisdiction may have different rules and regulations regarding their tax filing deadlines. Therefore, it is recommended to check with the tax authority of the specific country in order to determine the exact deadline for filing the G7 quarterly return for 2023.

How can I edit g7 quarterly return for ga from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your ga g7 forn form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I execute georgia g7 form online?

With pdfFiller, you may easily complete and sign form g 7 online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an eSignature for the georgia form g 7 in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your georgie dor form g 7 quarterly 2018 directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.