Get the free 2014 Connecticut CPA Firm Permit to Practice Renewal Form - CT.gov

Show details

2014 Connecticut CPA Firm Permit to Practice Renewal Form For Board Office use only! Complete and return both pages of this form no later than December 31, 2013 (2013 permit expires 12/31/2013. Firm

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2014 connecticut cpa firm form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2014 connecticut cpa firm form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2014 connecticut cpa firm online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2014 connecticut cpa firm. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out 2014 connecticut cpa firm

How to fill out 2014 Connecticut CPA firm:

01

Gather all relevant financial documents: Start by collecting all the necessary financial documents, including income statements, balance sheets, and tax returns for the 2014 period. These documents will be crucial for accurately filling out the necessary forms.

02

Understand the filing requirements: Familiarize yourself with the specific filing requirements for a CPA firm in Connecticut for the year 2014. It is essential to understand the specific forms, deadlines, and any additional documentation needed for proper compliance.

03

Complete the necessary forms: Based on the information obtained from the financial documents, fill out the appropriate forms required for the 2014 Connecticut CPA firm. Some common forms may include income tax returns, financial statements, and disclosures.

04

Ensure accuracy and compliance: Double-check all the information provided in the forms to ensure accuracy. It is crucial to comply with all the relevant laws and regulations applicable to CPA firms in Connecticut for the year 2014.

05

Review and submit: Once you have completed the necessary forms and ensured their accuracy, review them thoroughly. Make sure that all required information is provided and any supporting documents are attached. Finally, submit the filled-out forms to the appropriate authorities within the designated timeframe.

Who needs 2014 Connecticut CPA firm:

01

Small businesses: Small business owners who require financial statements, tax return preparation, and other accounting services typically need the assistance of a CPA firm in Connecticut. These services are vital for maintaining accurate financial records and complying with tax regulations.

02

Individuals with complex financial situations: Individuals with intricate financial situations, such as multiple sources of income, investments, or rental properties, may benefit from the expertise of a CPA firm. These professionals can assist in maximizing deductions, minimizing tax liabilities, and ensuring compliance with state and federal tax laws.

03

Non-profit organizations: Non-profit organizations operating in Connecticut often require specialized accounting services to maintain accurate financial records and comply with reporting requirements. A CPA firm can assist in conducting audits, preparing financial statements, and ensuring compliance with applicable tax regulations.

04

Professionals in regulated industries: Professionals operating in regulated industries, such as law firms, medical practices, or engineering firms, may require the services of a CPA firm to handle their financial and accounting needs. In addition to tax return preparation, these professionals may require assistance with payroll management, financial planning, and compliance with industry-specific regulations.

Overall, anyone seeking professional assistance with financial and accounting matters in the year 2014 in Connecticut, particularly related to tax compliance, financial statements, and regulatory requirements, can benefit from the services of a CPA firm.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

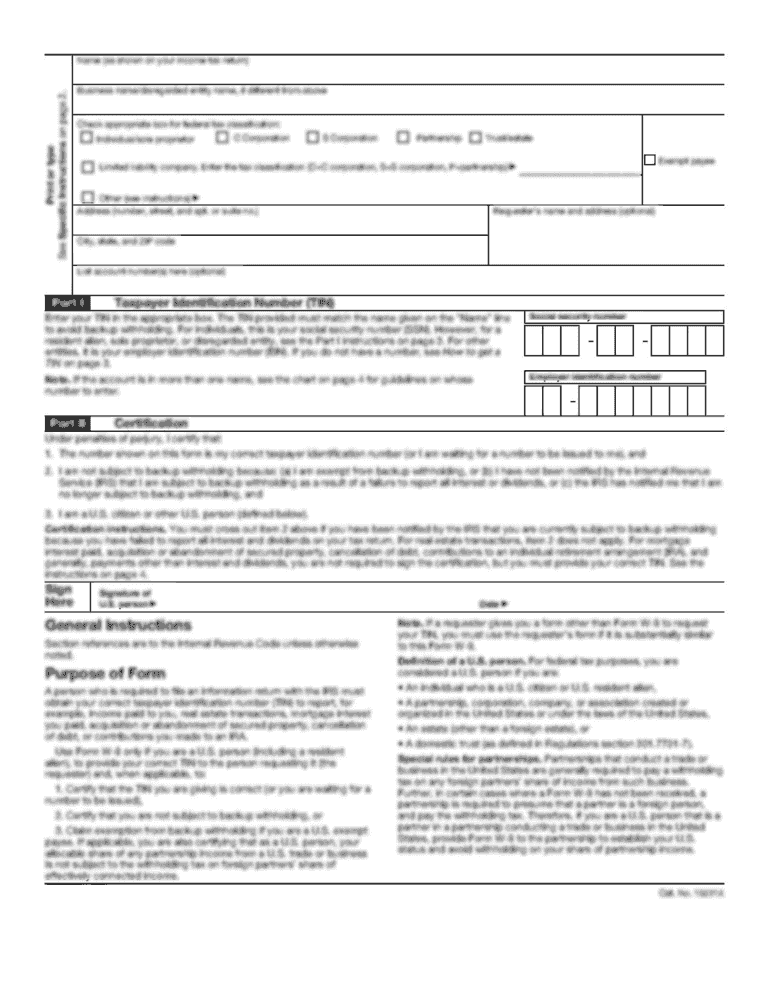

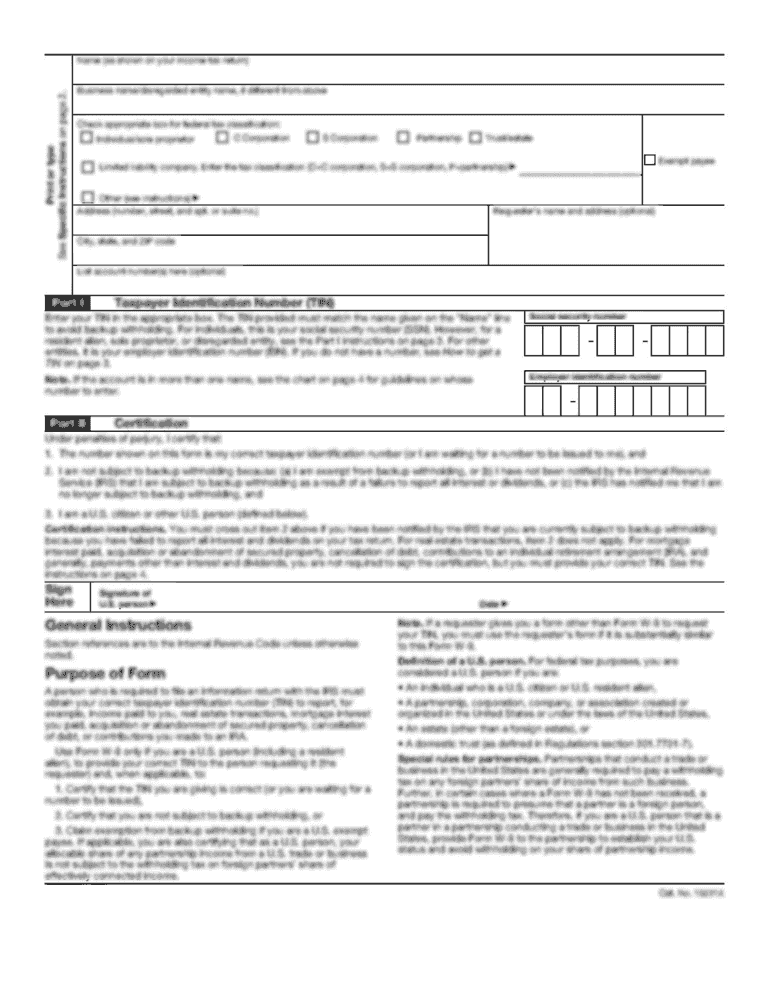

What is connecticut cpa firm permit?

A Connecticut CPA firm permit is a license that allows a CPA firm to practice public accounting in the state of Connecticut.

Who is required to file connecticut cpa firm permit?

Any CPA firm that wants to practice public accounting in Connecticut is required to file for a Connecticut CPA firm permit.

How to fill out connecticut cpa firm permit?

To fill out a Connecticut CPA firm permit, the CPA firm must complete the necessary application form, provide all required information, and submit the application to the Connecticut State Board of Accountancy.

What is the purpose of connecticut cpa firm permit?

The purpose of the Connecticut CPA firm permit is to ensure that only qualified CPA firms are allowed to practice public accounting in the state, maintaining the integrity and professionalism of the accounting profession.

What information must be reported on connecticut cpa firm permit?

The Connecticut CPA firm permit application typically requires information about the firm's structure, ownership, management, and any other relevant details about the firm's operations.

When is the deadline to file connecticut cpa firm permit in 2023?

The deadline to file for the Connecticut CPA firm permit in 2023 is typically on or before December 31st of the previous year.

What is the penalty for the late filing of connecticut cpa firm permit?

The penalty for late filing of the Connecticut CPA firm permit may result in a fine or other disciplinary actions imposed by the Connecticut State Board of Accountancy.

How can I send 2014 connecticut cpa firm for eSignature?

2014 connecticut cpa firm is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

How do I make edits in 2014 connecticut cpa firm without leaving Chrome?

2014 connecticut cpa firm can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I edit 2014 connecticut cpa firm straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing 2014 connecticut cpa firm.

Fill out your 2014 connecticut cpa firm online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.