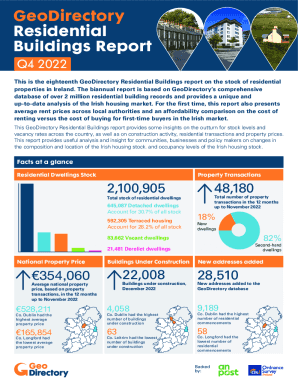

Get the free FACTSHEET: UK's withdrawal from the European Union by the CIOT... - publications par...

Show details

TAXATION (CROSSOVER TRADE) BILL

EXPLANATORY NOTES

What these notes do

These Explanatory Notes relate to the Taxation (Cross border Trade) Bill as brought from the House of

Commons on 17 July 2018

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your factsheet uks withdrawal from form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your factsheet uks withdrawal from form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit factsheet uks withdrawal from online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit factsheet uks withdrawal from. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out factsheet uks withdrawal from

How to fill out factsheet uks withdrawal from

01

Start by gathering all the relevant information about the UK's withdrawal from the European Union. This may include official statements, news articles, and any legal documents related to the withdrawal.

02

Organize the information in a logical and coherent manner. Create sections or categories to address different aspects of the withdrawal, such as political implications, economic impacts, and legal changes.

03

Use clear and concise language to explain each point. Avoid unnecessary jargon or technical terms that may confuse the reader.

04

Provide accurate and up-to-date information. Make sure to verify the sources and include any relevant updates or developments that may have occurred since the withdrawal process started.

05

Include any relevant statistics or data to support the factsheet. This can help provide a more comprehensive understanding of the withdrawal and its implications.

06

Format the factsheet in a visually appealing way. Use headers, bullet points, and visual elements like charts or graphs to make the information easier to understand and navigate.

07

Proofread and double-check the factsheet for any errors or inconsistencies. It's important to ensure that the information presented is accurate and reliable.

08

Consider getting feedback from experts or stakeholders in the field. This can help ensure that the factsheet is comprehensive and provides a balanced view of the UK's withdrawal from the EU.

09

Distribute the factsheet to the target audience. This can include government officials, policymakers, journalists, or the general public. Make it easily accessible through online platforms or by print distribution.

10

Monitor any feedback or questions received about the factsheet and address them promptly. This will help improve future versions of the factsheet and ensure its accuracy and relevance.

Who needs factsheet uks withdrawal from?

01

Government officials and policymakers who are involved in the negotiation and decision-making processes related to the UK's withdrawal from the EU.

02

Journalists and media organizations that require accurate and concise information to report on the withdrawal and its impacts.

03

Researchers and analysts studying the consequences of the UK's withdrawal from the EU in various fields such as economics, politics, or law.

04

Businesses and organizations that need to understand the potential changes and challenges resulting from the withdrawal in order to make informed decisions.

05

Citizens and voters who want to stay informed about the withdrawal process and its implications for the UK and the EU as a whole.

06

Non-governmental organizations (NGOs) and advocacy groups working on issues related to the UK's withdrawal from the EU, who need reliable information to support their work.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the factsheet uks withdrawal from electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your factsheet uks withdrawal from in seconds.

How do I edit factsheet uks withdrawal from on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share factsheet uks withdrawal from from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I edit factsheet uks withdrawal from on an Android device?

You can edit, sign, and distribute factsheet uks withdrawal from on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

Fill out your factsheet uks withdrawal from online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.