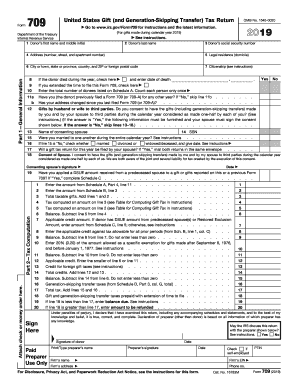

IRS 709 Instructions 2018 free printable template

Show details

General Instructions Purpose of Form Use Form 709 to report the following. Transfers subject to the federal gift and certain generation-skipping transfer GST taxes and to figure the tax due if any on those transfers. Transfer on Form 706 United States Estate and Generation-Skipping Transfer Tax Return. A transfer is subject to the gift tax if it is required to be reported on Schedule A of Form 709 under the rules contained in the gift tax portions of these instructions including the split...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign

Edit your form 709 instructions 2018 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 709 instructions 2018 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 709 instructions 2017 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2017 irs 709 instructions form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

IRS 709 Instructions Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out form 709 instructions 2018

How to fill out form 709 instructions 2017?

01

Begin by gathering all the necessary information and documents. This includes details about the donor, the recipient of the gift, the date and value of the gift, and any previous gifts made.

02

Follow the instructions provided on the form to accurately report the gifts made during the specified year. This may include filling out sections such as Part 1 - General Information, Part 2 - Calendar Year Gift and Generation-Skipping Transfer (GST) Schedule, and Part 3 - Computation of Tax.

03

Be sure to carefully calculate the gift tax owed based on the instructions provided. This may involve determining the total taxable gifts made during the year, applying any applicable exclusions or deductions, and determining the resulting tax liability.

04

Provide all required supporting documentation and attachments as instructed. This may include additional schedules, statements, or forms that are necessary to accurately report and calculate the gift tax owed.

Who needs form 709 instructions 2017?

01

Individuals who have made gifts that exceed the annual exclusion limit set by the IRS. For the year 2017, the annual exclusion limit for gifts is $14,000 per recipient.

02

Individuals who have made taxable gifts that are subject to gift tax. The IRS requires reporting of taxable gifts on form 709.

03

Executors of estates that have made gifts on behalf of a deceased individual during the calendar year.

It is important to consult with a tax professional or refer to the official IRS instructions for Form 709 to ensure accurate completion and reporting of gifts for the year 2017.

Fill gift tax form 2018 instructions : Try Risk Free

People Also Ask about form 709 instructions 2017

Where do I file my 2017 gift tax return?

Where do I file Form 709 2017?

What is the gift tax exclusion for 2017?

Can I file IRS Form 709 electronically?

What is the requirement to file Form 709?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form 709 instructions?

Form 709 instructions refer to the guidelines provided by the Internal Revenue Service (IRS) for completing and filing Form 709, which is the United States Gift (and Generation-Skipping Transfer) Tax Return. This form is used to report gifts that surpass the annual exclusion amount or certain other gift and estate tax exemptions. The instructions provide detailed information on how to fill out the form, explain the rules and regulations surrounding gift tax reporting, and provide examples and definitions to assist taxpayers in understanding the requirements. The purpose of the form is to ensure accurate reporting and assessment of any tax liability associated with gifts made during a particular tax year.

What is the purpose of form 709 instructions?

The purpose of the Form 709 instructions is to provide guidance and information to individuals who are required to file Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return. These instructions explain how to complete the form accurately and properly report any taxable gifts made during the year. The instructions also provide details about the applicable tax laws, rules, exemptions, and reporting thresholds related to gift tax. It is essential for taxpayers to review and follow the instructions to ensure compliance with the Internal Revenue Service (IRS) regulations regarding gift tax reporting.

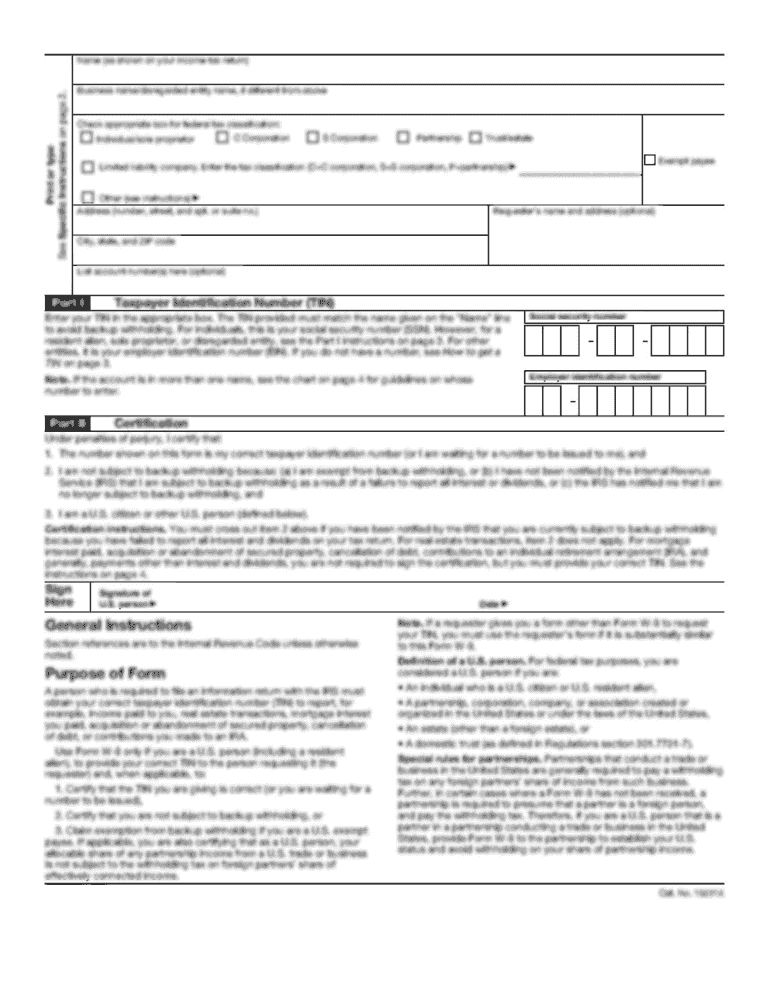

What information must be reported on form 709 instructions?

The Form 709 instructions require the following information to be reported:

1. Identity of the donor: The name, address, and social security number (or employer identification number) of the person making the gift.

2. Identity of the gift recipient (donee): The name and address of the person or entity receiving the gift.

3. Date of the gift: The precise date when the gift was made.

4. Description of the gift: A detailed description or explanation of the gift, including the nature, value, and any limitations or conditions attached to it.

5. Valuation of the gift: The method used to determine the value of the gift and the specific value assigned to it.

6. Annual exclusion gifts: If the gift falls within the annual exclusion amount (currently $15,000 per recipient), it is generally excluded from gift tax.

7. Prior taxable gifts: If the donor previously made taxable gifts in prior years, the total value of those gifts should be reported.

8. Calculation of gift tax: The formula used to calculate the gift tax owed (if any), taking into account the lifetime exemption amount.

9. Payment of gift tax: If any gift tax is due, the payment details, including the date and method of payment.

10. Signature and certification: The donor's signature, certifying under penalties of perjury that the information provided is true, correct, and complete to the best of their knowledge.

It is important to note that the instructions may vary slightly each year, so it is advisable to consult the most recent Form 709 instructions provided by the Internal Revenue Service (IRS) for detailed and up-to-date information.

When is the deadline to file form 709 instructions in 2023?

The deadline to file Form 709, which is the United States Gift (and Generation-Skipping Transfer) Tax Return, is typically April 15th of the year following the gift tax year. However, if April 15th falls on a weekend or a holiday, the deadline may be pushed forward to the next business day. Therefore, for the year 2023, assuming the regular calendar applies, the deadline to file Form 709 would be April 17, 2023. Nevertheless, it is recommended to consult with a tax professional or refer to the official IRS guidelines for the most accurate and up-to-date information.

What is the penalty for the late filing of form 709 instructions?

According to the instructions for Form 709 (United States Gift and Generation-Skipping Transfer Tax Return), the penalty for late filing is generally 5% of the gift tax liability reported on the return, for each month or part of a month that the return is late, up to a maximum penalty of 25% of the tax liability.

However, if the return is more than 60 days late, the minimum penalty is the lesser of $210 or 100% of the tax liability. It's important to note that penalties may vary based on individual circumstances and the specific details of the case.

How can I edit form 709 instructions 2017 from Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including 2017 irs 709 instructions form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I execute form 709 instructions 2019 online?

pdfFiller makes it easy to finish and sign instructions for 709 2017 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I edit 2017 form 709 instructions on an iOS device?

Create, edit, and share instructions form 709 2017 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your form 709 instructions 2018 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 709 Instructions 2019 is not the form you're looking for?Search for another form here.

Keywords relevant to form 709 line 9

Related to form 709 2015 instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.