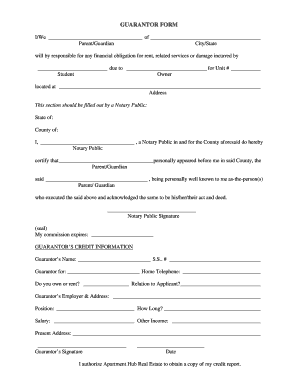

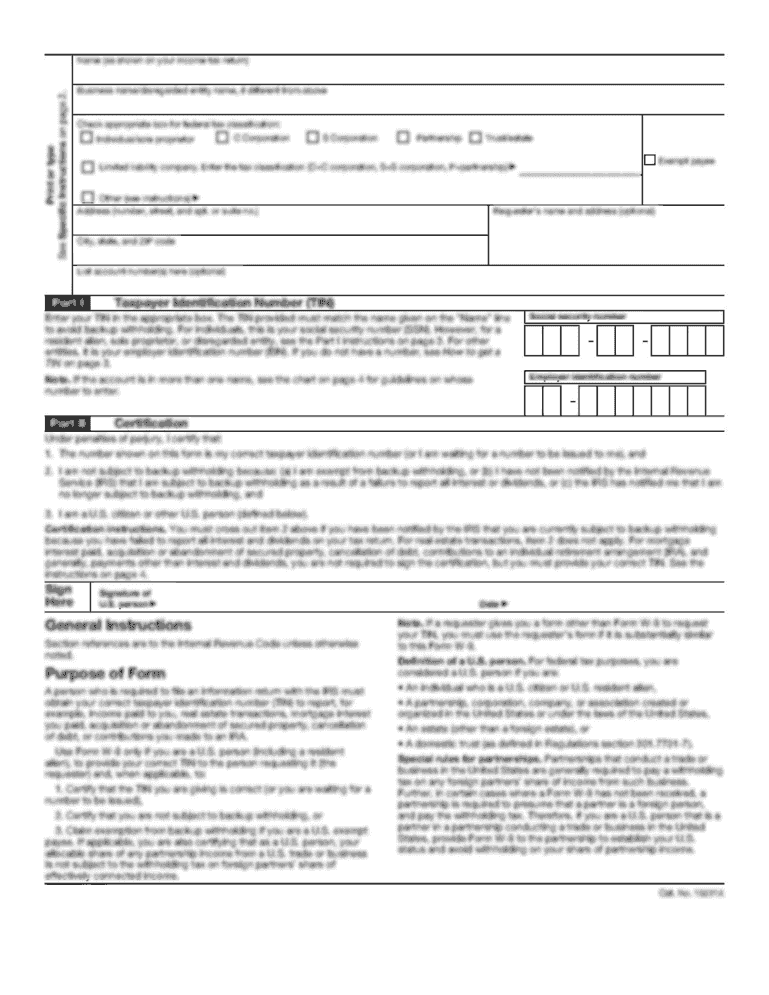

Get the free loan guarantor form pdf

Get, Create, Make and Sign

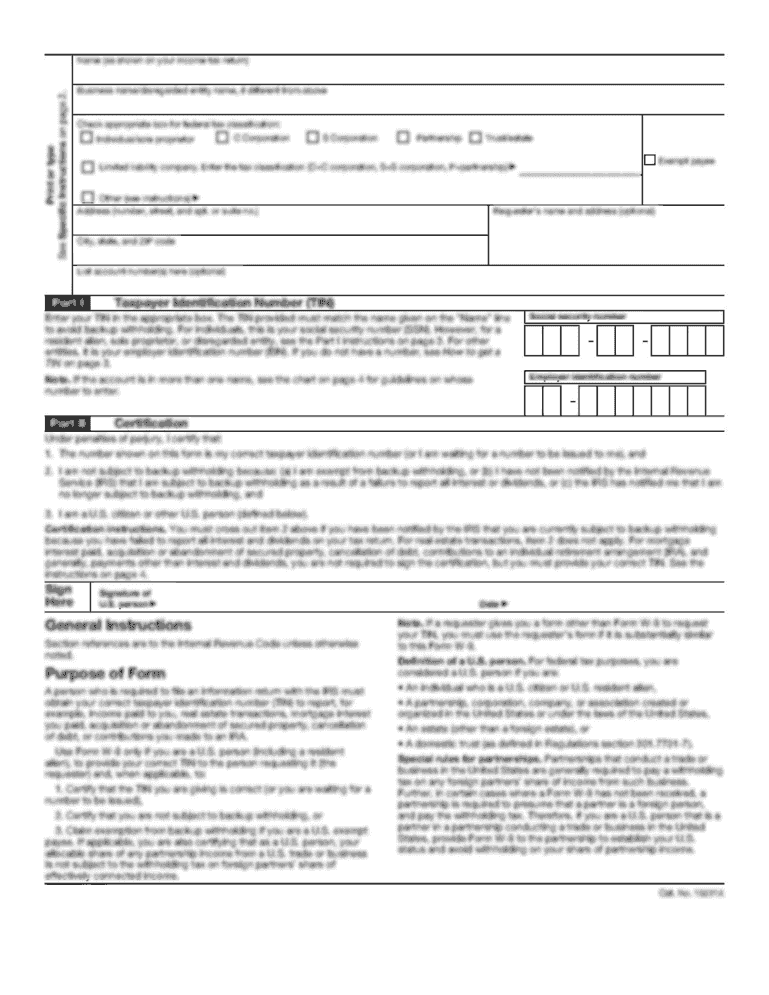

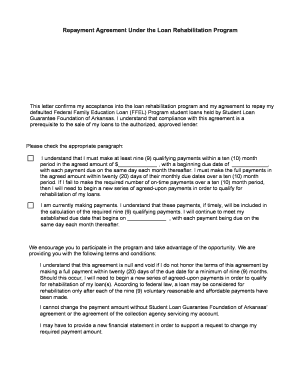

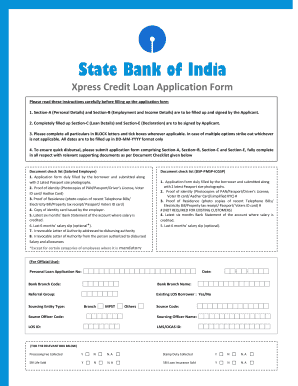

Editing loan guarantor form pdf online

How to fill out loan guarantor form pdf

How to fill out loan guarantor form pdf:

Who needs loan guarantor form pdf:

Video instructions and help with filling out and completing loan guarantor form pdf

Instructions and Help about guarantor form sample

Let's start with an email query Praveen Kumar data has written in, and he says that his friend applied to LIC housing for a home loan of 12 lakh rupees to purchase a newly built-up flat in Halle in West Bengal now all the processor almost complete he's received loan approval via SMS however LIC housing is now telling him to assign an LIC policy or to find a guarantor on his behalf which means he has to buy the policy he wants to know whether this is mandatory is there any statutory guideline or ruled from the RBI or any concerned authority on the same you know this is something has had a lot of banks have and home finance companies have taken to doing they plug an insurance policy alongside the home loan now you can't dispute the importance of the insurance policy beach but do you need to take that take it from that very same company yes, so I think excellent point that you make their Carina I think three things first I think just for the benefit of Praveen and all other viewers who are watching this there are two regulators in the housing finance industry when banks lend money to you the regulator is RBI when the housing finance companies lend money to you which means HDFC limited LIC housing finance they won housing finance a lot of others the regulator is national housing bank or HP the regulations are more or less similar between what RBI and NH v has more or less let us come to straight to the point that provide has raised no regulations do not require that you have to have an insurance policy when you take a home loan, but it is open to the banks to make it mandatory and that's the reason for that as you have yourself mentioned is very simple what happens to the bank's loan should something happen to the borrower during the loan term if the borrower dies during the loan term the loan is likely to default because the family may not be in a position to pay, so I think it is in the borrower's interest as well as the bank's interest that a policy should be taken a life insurance policy should be taken I think, and they can make it mandatory the question is what they cannot make mandatory is they try and push a policy of favorite policy from a favored provider typically that policy tends to be more expensive, or it tends to be an unsuitable policy you are not forced to buy the same policy however it is in your own interest that to take a term policy if you take it from LIC in this particular case which is what they are favoring the advantage is that the premium that you pay the one-time premium that you pay for that policy can be funded as a loan so that effectively the premium is also paired along with the Emil, so it is convenient though it might be expensive so that but take a policy and that I think is something that's quite essential right so key takeaway coming for all you viewers there right on the top of the show if you are in the market to for a home loan if you're looking to borrow a loan for a home remember that you need not buy the...

Fill bank guarantor form : Try Risk Free

People Also Ask about loan guarantor form pdf

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your loan guarantor form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.