Get the free latest changes in tax audit report form 3CD - cajatinminocha.com

Show details

Category of person Carrying on businessThreshold Total sales, turnover or gross receipts exceeds Rs.1 croreCarrying on profession Gross receipts exceeds Rs.50 lakhsCarrying on business eligible for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your latest changes in tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your latest changes in tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing latest changes in tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit latest changes in tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out latest changes in tax

How to fill out latest changes in tax

01

To fill out the latest changes in tax, follow these steps:

02

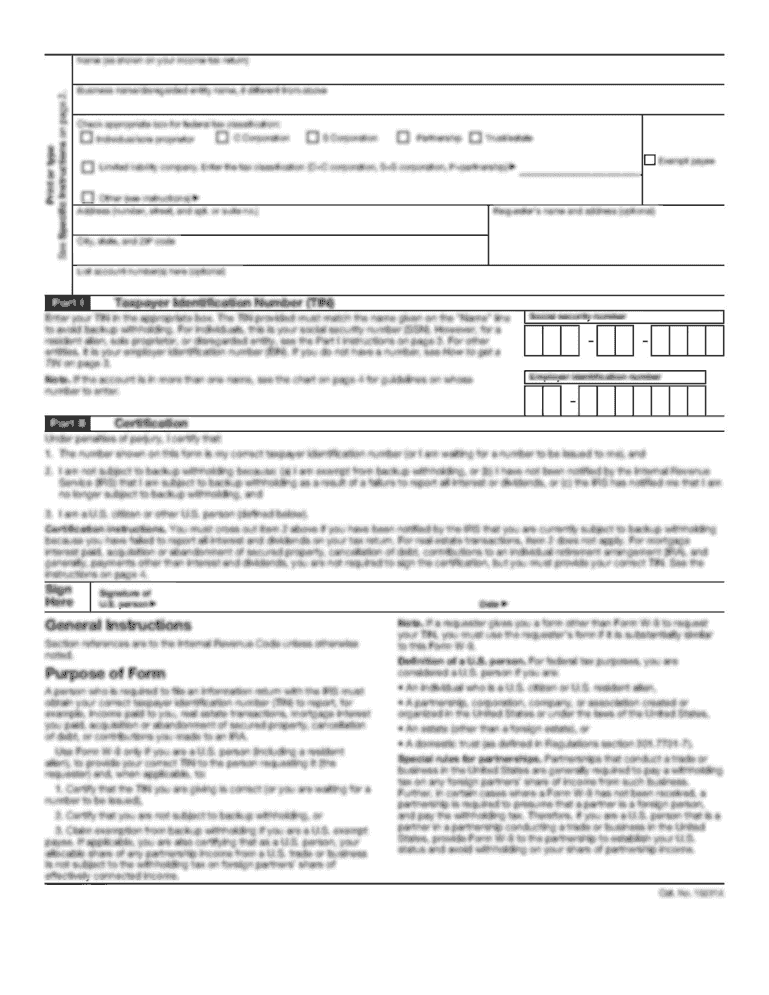

Collect all necessary tax forms and documents, such as W-2s, 1099s, and receipts.

03

Familiarize yourself with the latest tax laws and regulations by referring to official sources or consulting with a tax professional.

04

Determine the appropriate tax forms to use based on your financial situation and any changes in tax laws.

05

Carefully read and understand the instructions provided with the tax forms.

06

Fill out the tax forms accurately and completely, providing all required information and calculations.

07

Double-check all entered information for accuracy, ensuring that you haven't missed any deductions or credits that you're eligible for.

08

If you encounter any difficulties or uncertainties, consider seeking assistance from a tax professional or using tax preparation software.

09

Sign and date the completed tax forms, and make copies for your records.

10

Submit the filled-out tax forms to the appropriate tax agency by the specified deadline, either electronically or by mail.

11

Keep copies of all submitted documents and receipts for future reference or in case of an audit.

Who needs latest changes in tax?

01

Various individuals and entities may need to be aware of the latest changes in tax, including:

02

- Individuals who are required to file tax returns and pay taxes.

03

- Small business owners and self-employed individuals who need to accurately report their income and expenses.

04

- Tax professionals and accountants who provide tax-related advice and assistance.

05

- Employers and payroll administrators responsible for withholding and reporting taxes on behalf of employees.

06

- Government agencies and tax authorities responsible for enforcing tax laws and regulations.

07

- Legal professionals involved in tax planning and compliance.

08

- Individual taxpayers who want to stay informed about changes that may affect their personal finances and tax liabilities.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the latest changes in tax form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign latest changes in tax and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit latest changes in tax on an Android device?

With the pdfFiller Android app, you can edit, sign, and share latest changes in tax on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I fill out latest changes in tax on an Android device?

On Android, use the pdfFiller mobile app to finish your latest changes in tax. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your latest changes in tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.