Get the free GASOLINE TAX REFUND REGISTRATION FOR FARMERS - rev louisiana

Show details

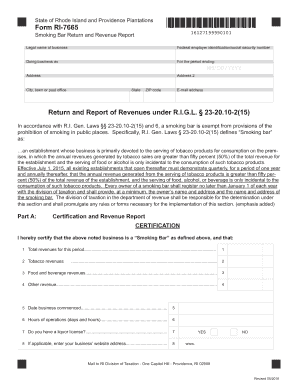

R-5328 (07/07) GASOLINE TAX REFUND REGISTRATION FOR FARMERS This form must be completed and submitted to the Department of Revenue before the applicant may purchase gasoline for which a refund claim

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gasoline tax refund registration form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gasoline tax refund registration form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gasoline tax refund registration online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit gasoline tax refund registration. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out gasoline tax refund registration

How to fill out gasoline tax refund registration:

01

Gather necessary documents: Before filling out the registration form, make sure you have all the required documents handy. These may include receipts for gasoline purchases, proof of payment for the gasoline tax, and any other supporting documents.

02

Obtain the registration form: Visit the official website of the relevant tax authority or contact your local tax office to obtain the gasoline tax refund registration form. You may also find the form at tax offices or through online portals.

03

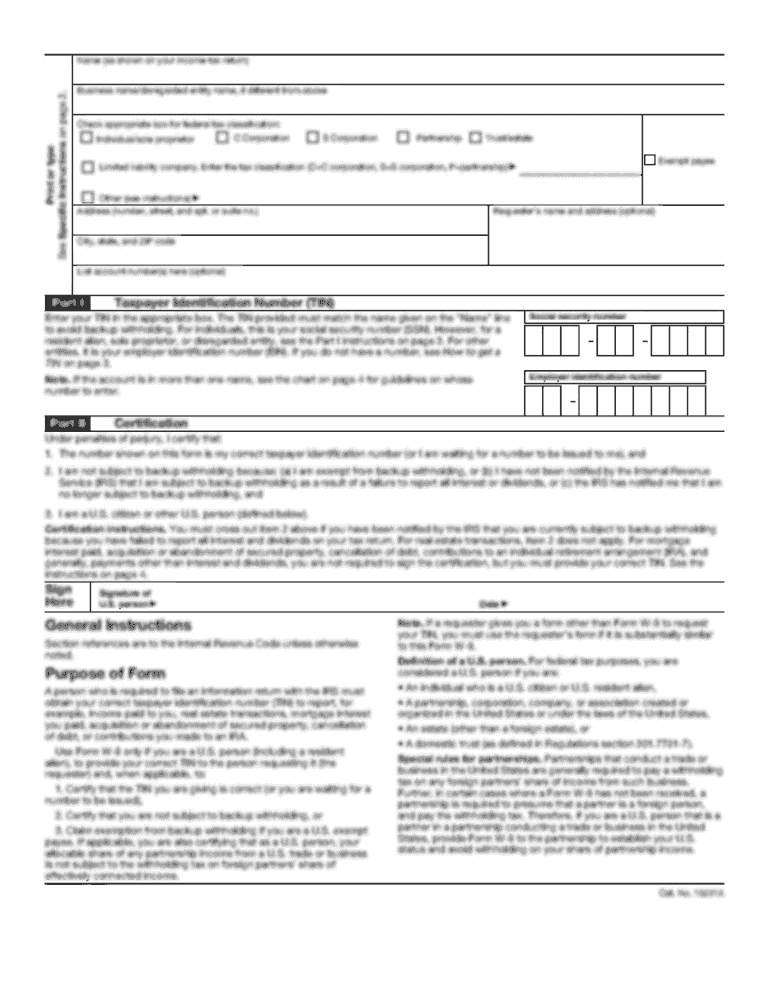

Fill in personal information: Start by providing your personal information such as your full name, address, contact details, and social security number. Ensure that you provide accurate information to avoid any complications or delays in the refund process.

04

Provide vehicle details: Include the necessary information about the vehicle for which the gasoline tax refund is being claimed. This may include the make, model, year, license plate number, and VIN (Vehicle Identification Number).

05

Calculate refund amount: Calculate the amount of refund you are eligible for based on the gasoline purchases and tax paid during the specified period. Check if the registration form requests this information and input the accurate figures accordingly.

06

Attach supporting documents: As mentioned earlier, attach all the required supporting documents along with the registration form. These may include gasoline receipts, tax payment receipts, and any other relevant records that prove your eligibility for a refund.

07

Review and submit: Once you have completed filling out the registration form and attached all the necessary documents, review all the information to ensure accuracy. Make any necessary corrections or additions, if required. Finally, submit the completed form and supporting documents to the designated tax office either by mail or in person.

Who needs gasoline tax refund registration?

01

Commuters driving a personal vehicle for work purposes: People who use their personal vehicle for commuting to and from work may be eligible for a gasoline tax refund. This includes individuals who do not have access to public transportation or use their personal vehicle due to specific job requirements.

02

Business owners and employees using vehicles for business purposes: Individuals who own or work for businesses that require frequent use of vehicles for business-related activities, such as deliveries or client visits, may qualify for gasoline tax refunds. This can help alleviate the financial burden of fuel costs.

03

Non-profit organizations: Non-profit organizations that utilize vehicles for their charitable or educational activities may also be eligible for gasoline tax refunds. This can help these organizations save money and allocate resources towards their noble causes.

It is important to note that the eligibility criteria and specific guidelines for gasoline tax refund registration may vary depending on the country or region. It is recommended to consult with your local tax authority or seek professional advice to understand the specific requirements and procedures applicable in your jurisdiction.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is gasoline tax refund registration?

Gasoline tax refund registration is the process by which individuals or businesses can apply to receive a refund on the taxes they paid on gasoline purchases.

Who is required to file gasoline tax refund registration?

Individuals or businesses that use gasoline for certain non-taxable purposes, such as farming or commercial fishing, may be required to file gasoline tax refund registration.

How to fill out gasoline tax refund registration?

To fill out gasoline tax refund registration, individuals or businesses must provide information about their gasoline purchases and usage, as well as any applicable exemptions.

What is the purpose of gasoline tax refund registration?

The purpose of gasoline tax refund registration is to provide relief to individuals or businesses that use gasoline for non-taxable purposes, reducing their overall tax burden.

What information must be reported on gasoline tax refund registration?

Information such as the amount of gasoline purchased, the purpose for which it was used, and any applicable exemptions must be reported on gasoline tax refund registration.

When is the deadline to file gasoline tax refund registration in 2023?

The deadline to file gasoline tax refund registration in 2023 is December 31st.

What is the penalty for the late filing of gasoline tax refund registration?

The penalty for late filing of gasoline tax refund registration may include fines or interest on the refund amount.

How can I edit gasoline tax refund registration on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing gasoline tax refund registration right away.

Can I edit gasoline tax refund registration on an Android device?

With the pdfFiller Android app, you can edit, sign, and share gasoline tax refund registration on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

How do I complete gasoline tax refund registration on an Android device?

Use the pdfFiller mobile app to complete your gasoline tax refund registration on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your gasoline tax refund registration online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.