Get the free of she qeasury

Show details

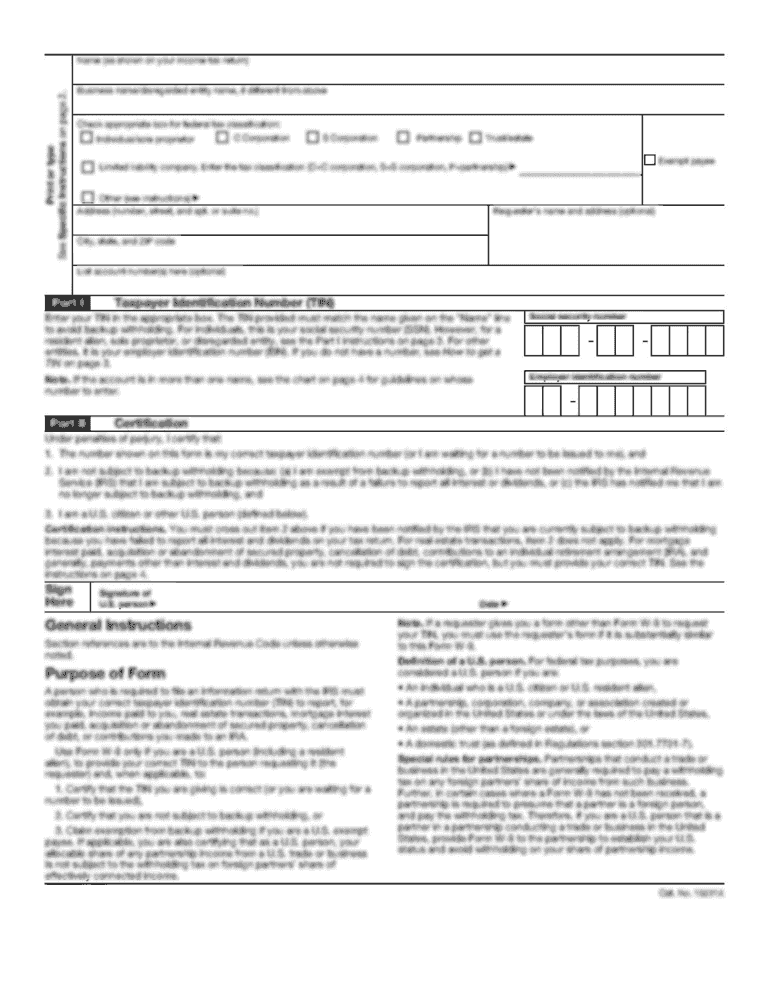

T Form Return of Private Foundation 990-PF Department or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation of she ;measure Internal Revenue Service G Check all that a people

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your of she qeasury form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your of she qeasury form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing of she qeasury online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit of she qeasury. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Check it out!

How to fill out of she qeasury

How to fill out the she qeasury:

01

Begin by gathering all the required information and documents such as receipts, invoices, and financial statements.

02

List all the income sources and categorize them accordingly.

03

Record all the expenses, making sure to allocate them to the appropriate categories.

04

Calculate the total income and total expenses to determine the net income or loss.

05

Double-check the accuracy of all entries and ensure they are properly categorized.

06

Fill out any additional sections or fields required by the she qeasury form.

07

Review the completed form for any errors or missing information before submitting it.

Who needs the she qeasury:

01

Businesses and organizations: Companies of all sizes, ranging from sole proprietorships to large corporations, require the she qeasury to fulfill their financial reporting obligations and provide an accurate overview of their financial activities.

02

Non-profit organizations: Non-profit organizations also need to fill out the she qeasury to maintain transparency and accountability in their financial operations, as well as to comply with legal and regulatory requirements.

03

Individuals: Some individuals may need to fill out the she qeasury if they are self-employed or have income from rental properties, investments, or other sources outside of traditional employment. This allows them to report their income, expenses, and deductions accurately for tax purposes.

It is important to note that the specific rules and regulations regarding the she qeasury may vary depending on the country or region. Therefore, it is always advisable to consult with a financial advisor or tax professional to ensure compliance with the applicable guidelines.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is of she qeasury?

The Treasury Department is responsible for managing the government's finances, collecting taxes, and distributing funds.

Who is required to file of she qeasury?

Individuals, businesses, and organizations that have financial transactions with the government are required to file with the Treasury Department.

How to fill out of she qeasury?

To fill out the Treasury forms, you will need to provide detailed information about your financial transactions, income, and expenses.

What is the purpose of of she qeasury?

The purpose of the Treasury Department is to ensure that the government's finances are managed efficiently and transparently.

What information must be reported on of she qeasury?

You must report information such as income, expenses, assets, and liabilities on the Treasury forms.

When is the deadline to file of she qeasury in 2023?

The deadline to file with the Treasury Department in 2023 is April 15th.

What is the penalty for the late filing of of she qeasury?

The penalty for late filing with the Treasury Department is a fine of 5% of the total amount owed per month, up to a maximum of 25%.

How do I execute of she qeasury online?

With pdfFiller, you may easily complete and sign of she qeasury online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I edit of she qeasury straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing of she qeasury.

Can I edit of she qeasury on an Android device?

The pdfFiller app for Android allows you to edit PDF files like of she qeasury. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your of she qeasury online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.