Get the free Bank Franchise Tax - Kentucky Department of Revenue - revenue ky

Show details

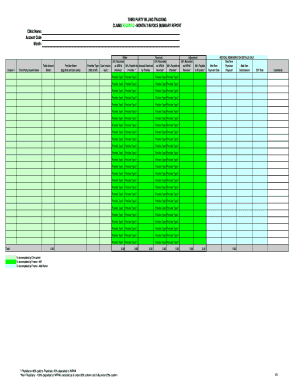

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

FRANKFORT, KENTUCKY 4062073A801(P)(119)2018 KENTUCKY BANK FRANCHISE TAX

FORMS AND INSTRUCTIONS

Bank Franchise Tax Return (Form 73A801)

Application for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your bank franchise tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank franchise tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank franchise tax online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit bank franchise tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out bank franchise tax

How to fill out bank franchise tax

01

Obtain the necessary forms to fill out the bank franchise tax. These forms can typically be found on the website of the tax authority in your jurisdiction or obtained from a local tax office.

02

Gather all the relevant financial and business information required for the tax filing. This may include details about your bank's annual revenue, assets, liabilities, and other financial statements.

03

Carefully review the instructions provided with the tax forms to understand the specific requirements and calculations involved in filling out the bank franchise tax.

04

Enter the required information accurately and in the designated fields on the tax forms. Double-check for any errors or omissions before submitting.

05

Attach any supporting documents or schedules that may be required along with the completed tax forms.

06

Calculate the amount of tax owed based on the provided guidelines and instructions. Ensure that the calculations are accurate and include any applicable deductions or exemptions.

07

Submit the completed bank franchise tax forms and payments by the specified deadline. It's important to adhere to the deadlines to avoid penalties or fines.

08

Keep copies of all the submitted documents, including the completed tax forms and any supporting documentation, for your records.

09

If you have any doubts or questions regarding the bank franchise tax filing, consult a tax professional or seek assistance from the tax authority's customer service.

Who needs bank franchise tax?

01

Banks and financial institutions typically need to pay the bank franchise tax. This tax is imposed on the income or revenue generated by banks and is usually required by the tax authority in the jurisdiction where the bank operates.

02

The specific rules and regulations regarding bank franchise tax may vary depending on the country or state. It's important for banks and financial institutions to comply with the tax regulations in their respective jurisdictions to avoid any legal or financial consequences.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify bank franchise tax without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like bank franchise tax, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I fill out bank franchise tax on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your bank franchise tax. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

How do I complete bank franchise tax on an Android device?

Use the pdfFiller Android app to finish your bank franchise tax and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your bank franchise tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.