Get the free California Resale Certificate - WeMakeMagnets.com

Show details

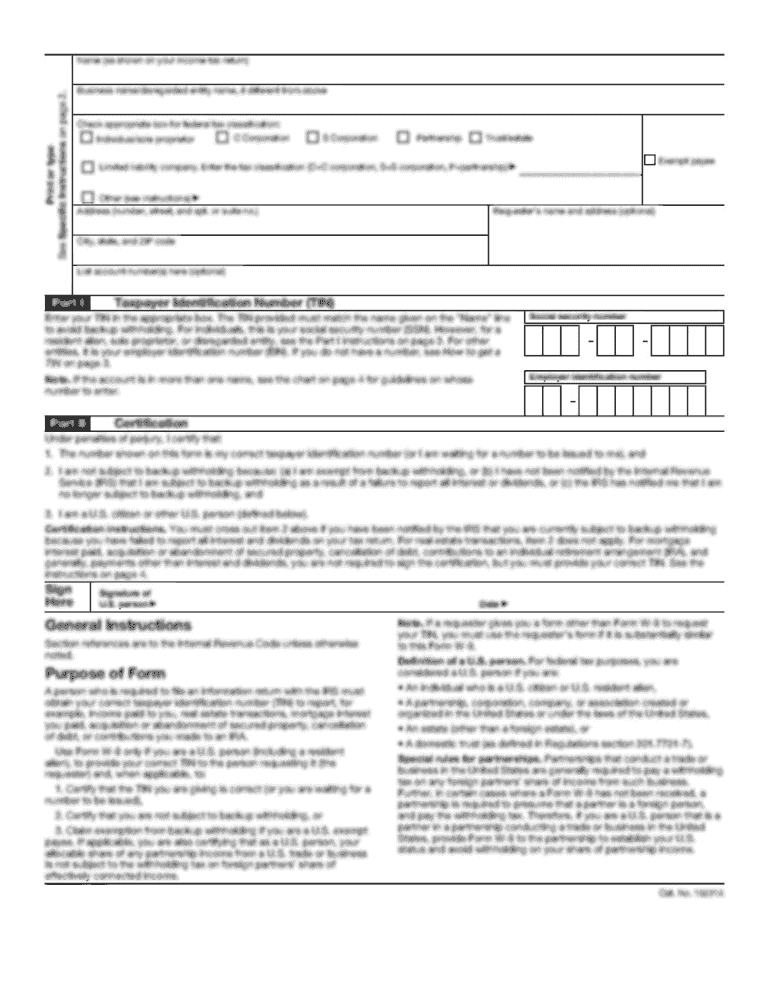

WeMakeMagnets.com Dear Valued Customer: California state law requires that we have a resale card on file for all accounts that are nontaxable. The resale card must have an original signature to be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your california resale certificate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california resale certificate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing california resale certificate online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit california resale certificate. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out california resale certificate

How to fill out the California resale certificate:

01

Obtain a copy of the California resale certificate form, which can be found on the website of the California Department of Tax and Fee Administration (CDTFA).

02

Fill in your business name and address at the top of the form. Ensure that the information provided is accurate and matches the details on your business license or registration.

03

Include your Seller’s Permit number, which is a unique identifier assigned by the CDTFA. This number is necessary to document your status as a business entity eligible for resale transactions.

04

Indicate the purchase from or the vendor's name and address. Provide the vendor's California Seller's Permit number if known.

05

Carefully describe the type of property you are purchasing for resale. Include details such as item descriptions, quantities, and prices. The more specific you are, the better it is for tax purposes.

06

If applicable, provide the expiration date of your California Seller’s Permit.

07

Sign and date the form to attest that the information provided is true, accurate, and complete to the best of your knowledge.

08

Retain a copy of the completed resale certificate for your records.

Who needs a California resale certificate:

01

California-based retailers and wholesalers who are purchasing goods for resale are required to obtain a California resale certificate.

02

Individuals or businesses engaged in selling tangible personal property or certain services are eligible for a resale certificate.

03

The certificate allows these entities to make tax-free purchases of goods that will be resold to customers, preventing double taxation.

04

Customers who are not reselling the purchased goods or who are not engaged in business activities are not eligible for the resale certificate.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is california resale certificate?

A California resale certificate is a document that allows businesses to buy products for resale without paying sales tax.

Who is required to file california resale certificate?

Retailers and wholesalers who purchase goods for resale in California are required to file a resale certificate.

How to fill out california resale certificate?

You can fill out a California resale certificate by providing your business information, including your seller's permit number, and certifying that the items purchased will be resold.

What is the purpose of california resale certificate?

The purpose of a California resale certificate is to exempt businesses from paying sales tax on items that will be resold.

What information must be reported on california resale certificate?

The California resale certificate must include the purchaser's name, address, seller's permit number, and a description of the items being purchased for resale.

When is the deadline to file california resale certificate in 2023?

The deadline to file a California resale certificate in 2023 is usually determined by the date of the transaction or purchase.

What is the penalty for the late filing of california resale certificate?

The penalty for the late filing of a California resale certificate can vary, but it may result in fines or penalties for failure to comply with tax laws.

How can I edit california resale certificate from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your california resale certificate into a dynamic fillable form that you can manage and eSign from anywhere.

How can I send california resale certificate to be eSigned by others?

Once your california resale certificate is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How can I edit california resale certificate on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing california resale certificate, you can start right away.

Fill out your california resale certificate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.