Get the free Credit Union Deductions

Show details

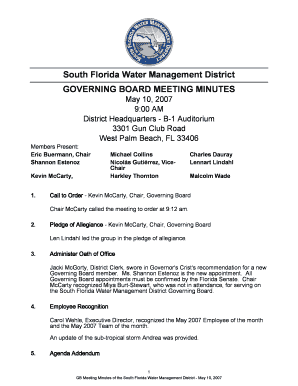

Schedule 17 Code 1701Credit Union Deductions (2017 and later tax years) Corporation's nameProtected B when completedBusiness number yearend Year MonthDayIf you are a credit union, use this schedule

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign credit union deductions

Edit your credit union deductions form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit union deductions form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit union deductions online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit credit union deductions. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit union deductions

How to fill out credit union deductions

01

Step 1: Obtain the necessary forms from your credit union. These forms may include a membership application, a direct deposit authorization form, and a payroll deduction form.

02

Step 2: Fill out the membership application form with your personal information, such as your name, address, and social security number. Follow any instructions provided by the credit union.

03

Step 3: Complete the direct deposit authorization form if you wish to have a portion of your paycheck directly deposited into your credit union account. Provide your bank account details, including the routing and account numbers.

04

Step 4: Fill out the payroll deduction form to indicate the specific deductions you want to make from your paycheck. These deductions may include savings contributions, loan repayments, or other specified expenses.

05

Step 5: Double-check all the forms for accuracy and ensure that you have provided all the required information.

06

Step 6: Submit the completed forms to the credit union as instructed. It is advisable to make copies of the forms for your records.

07

Step 7: Wait for confirmation from the credit union regarding the processing of your deductions. You may need to wait for a specified period for the deductions to take effect.

08

Step 8: Monitor your pay stubs or bank account statements to ensure that the credit union deductions are being accurately applied.

Who needs credit union deductions?

01

Credit union deductions are beneficial for individuals who are members of a credit union and want to conveniently save money or make loan repayments.

02

Employees who prefer to have a portion of their paycheck automatically deposited into a credit union account can benefit from credit union deductions.

03

Individuals who are looking for a disciplined way to save money and earn potential interest on their savings can utilize credit union deductions.

04

Those who have loans with the credit union and want to ensure timely repayments can opt for credit union deductions to automate the process.

05

Members who want to take advantage of certain credit union benefits or exclusive offers may require credit union deductions for eligibility purposes.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send credit union deductions for eSignature?

Once your credit union deductions is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How can I get credit union deductions?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the credit union deductions in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I fill out credit union deductions using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign credit union deductions and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is credit union deductions?

Credit union deductions are amounts of money subtracted from an employee's paycheck to contribute to their credit union accounts.

Who is required to file credit union deductions?

Employers are required to file credit union deductions on behalf of their employees.

How to fill out credit union deductions?

Employers can fill out credit union deductions by accurately recording the amount deducted from each employee's paycheck and transferring the funds to the credit union.

What is the purpose of credit union deductions?

The purpose of credit union deductions is to help employees save money and build their financial stability through their credit union accounts.

What information must be reported on credit union deductions?

Employers must report the amount deducted from each employee's paycheck, the employee's name, and the credit union account number.

Fill out your credit union deductions online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Union Deductions is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.