Get the free installment sale agreement form

Show details

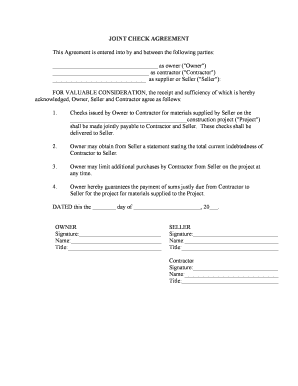

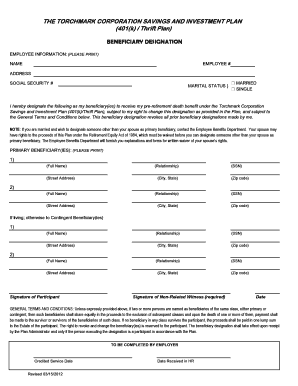

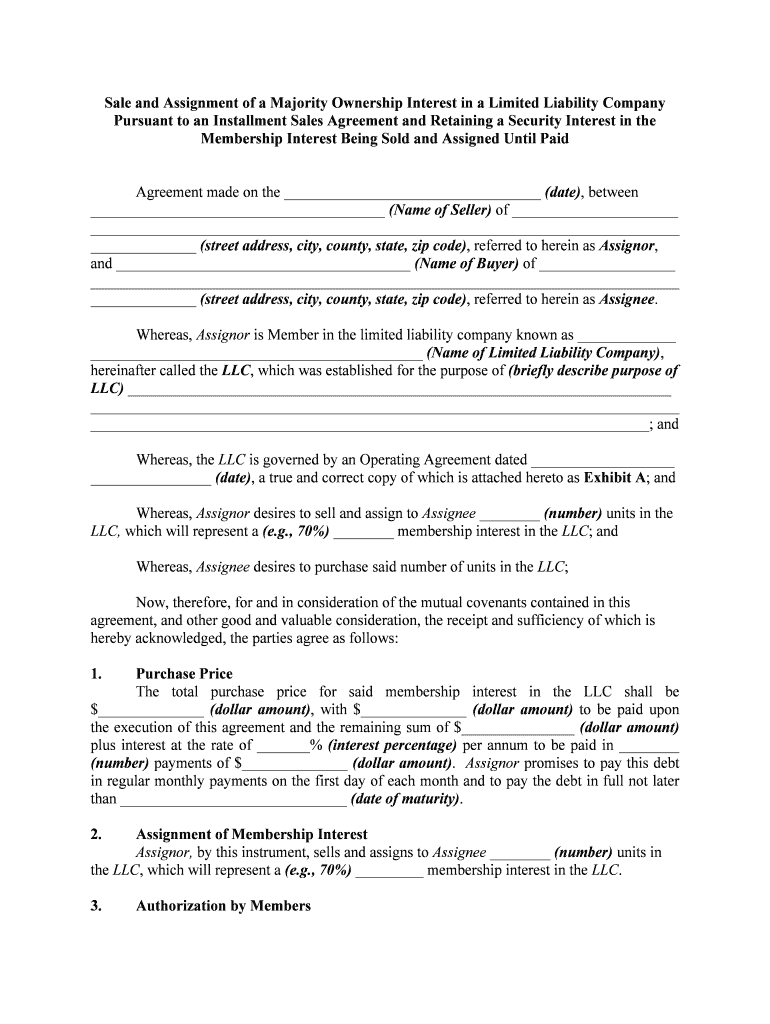

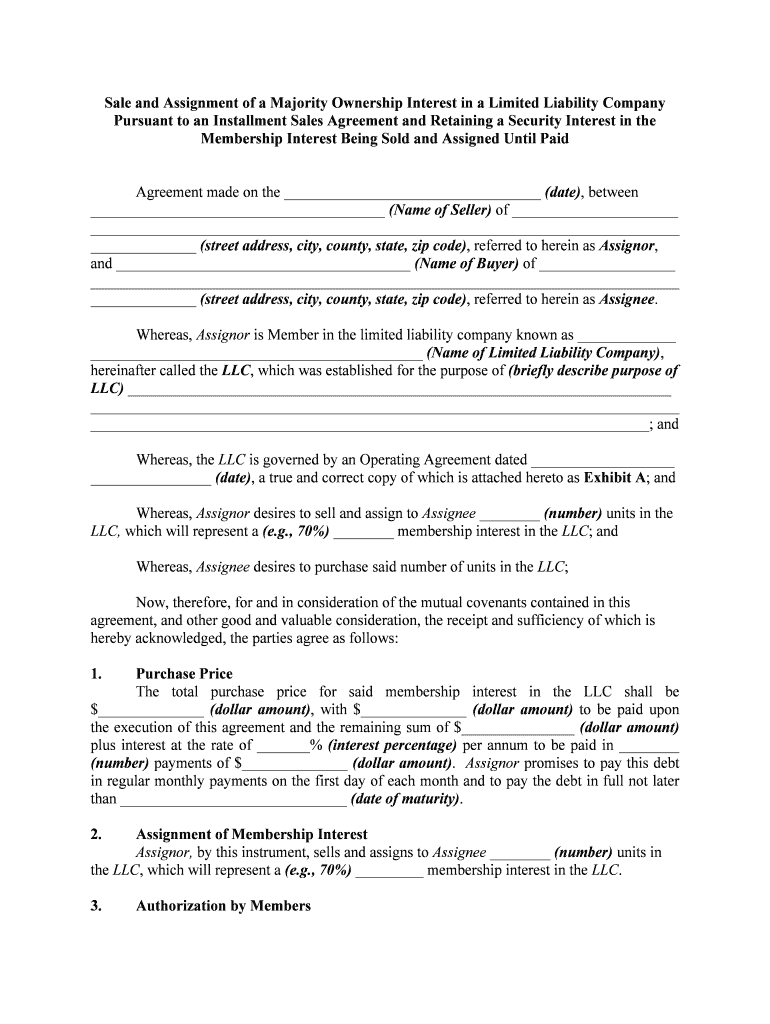

Sale and Assignment of a Majority Ownership Interest in a Limited Liability Company Pursuant to an Installment Sales Agreement and Retaining a Security Interest in the Membership Interest Being Sold

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your installment sale agreement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment sale agreement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit installment sale agreement online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit installment sale of personal property form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out installment sale agreement form

How to fill out an installment sale agreement:

01

Review the template or form provided: Familiarize yourself with the installment sale agreement template or form that you are using. Read through all the sections and understand the information required.

02

Gather necessary information: Collect all the relevant details such as the names and contact information of the buyer and seller, the description of the item being sold, the agreed-upon price, payment terms, and any additional conditions or warranties.

03

Fill in the basic information: Start by filling in the basic information at the beginning of the agreement, such as the date, buyer's and seller's names, addresses, and contact information.

04

Provide item description: Describe the item being sold in detail, including any unique features, specifications, or conditions. This helps avoid potential misunderstandings.

05

Specify payment terms: Clearly outline the payment plan, including the installment amounts, due dates, and any interest or late payment fees. Include the total amount to be paid and indicate if there is any down payment or initial deposit required.

06

Include any special conditions: If there are any special conditions or contingencies, such as a return policy, delivery terms, or a satisfaction guarantee, make sure to include them in the agreement.

07

Seek legal advice if necessary: If you are unsure about any legalities or want to ensure that the agreement is enforceable, consider seeking legal advice from a qualified professional.

08

Sign and date the agreement: Once all the necessary information has been filled out and reviewed, both the buyer and seller should sign and date the installment sale agreement. Keep copies for future reference.

Who needs an installment sale agreement?

01

Individuals selling goods or property on an installment basis to buyers who cannot afford to pay the full amount upfront.

02

Businesses that offer installment payment options for their products or services.

03

Buyers and sellers who want to formalize their agreement and establish clear terms and conditions for the sale.

04

Individuals or businesses looking to protect their interests in cases of default or disputes.

05

Both parties involved in the sale who want to ensure a legally binding agreement that is enforceable in court, if necessary.

Fill installment sales contract real estate : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is installment sale agreement?

An installment sale agreement refers to a legal contract between a buyer and a seller in which the buyer makes periodic payments to the seller to purchase a product or property. This agreement allows the buyer to take immediate possession of the goods while paying for them over a specified period of time. The buyer usually pays interest on the outstanding balance until the full amount is settled. Additionally, the seller retains ownership rights until the buyer fulfills all the agreed-upon payments. Installment sale agreements are commonly used for purchasing high-value items, such as cars, real estate, or appliances.

Who is required to file installment sale agreement?

The person who sells an asset using an installment sale agreement is typically required to file the agreement. This includes individuals, businesses, or other entities that are selling the asset. The buyer may also be required to report the installment sale on their tax return. It is advisable to consult with a tax professional or refer to the specific tax laws of the relevant jurisdiction for accurate and detailed information.

How to fill out installment sale agreement?

To fill out an installment sale agreement, follow these steps:

1. Gather the necessary information: Collect all the relevant information, such as the buyer's and seller's names and addresses, the description of the item to be sold, the purchase price, the down payment amount, and the terms of the installment payments.

2. Create a title: At the top of the agreement, create a title such as "Installment Sale Agreement" or "Agreement for the Sale of Goods."

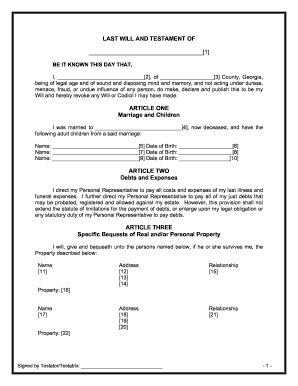

3. Identify the parties: Clearly state the full legal names and addresses of both the buyer and the seller. Indicate whether the buyer and seller are individuals or entities, and if entities, specify their legal status (e.g., corporation, partnership, or LLC).

4. Describe the item or property: Provide a detailed description of the item being sold. Include specific identifying information, such as serial numbers, model numbers, or any other relevant details to ensure clarity.

5. Set the purchase price: State the total purchase price for the item. If a down payment is required, specify the amount and the method of payment. If there are any special conditions regarding the down payment, such as a deadline or a specific payment method, include those details as well.

6. Define installment payments: Outline the terms of the installment payments, including the number of installments, the due dates, and the amount of each payment. Specify the method of payment (e.g., cash, check, or electronic transfer) and where to send the payments (provide the seller's address and contact information).

7. Discuss interest or finance charges (if applicable): Determine whether any interest or finance charges will be applied to the outstanding balance. If so, state the interest rate and how it will be calculated. Ensure compliance with local regulations and laws regarding interest charges.

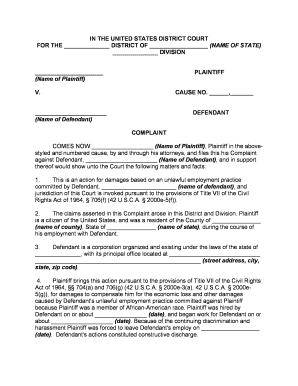

8. Address default and remedies: Include provisions related to default by either party and the available remedies. Specify the consequences of default, such as cancellation of the agreement, acceleration of the remaining balance, or the imposition of penalties or fees.

9. Include warranties: If any warranties or guarantees are being provided by the seller, clearly state them in the agreement. Specify the duration of the warranty and any limitations or exclusions.

10. Review and sign: Carefully review the agreement to ensure accuracy and completeness. Make sure both parties understand the terms and agree to them. Once satisfied, both the buyer and seller should sign and date the document. If desired, consider having the signatures notarized for added legal validation.

11. Distribute copies: Provide copies of the signed agreement to both the buyer and seller. It is also advisable to keep a copy for your own records.

Remember, an installment sale agreement is a legally binding document, so it is recommended to seek legal advice or consult with an attorney to ensure compliance with local laws and regulations.

What is the purpose of installment sale agreement?

The purpose of an installment sale agreement is to allow a buyer to make a purchase by making regular payments over a set period of time. It provides a structured payment plan that allows the buyer to spread out the cost of the purchase rather than making a full payment upfront. This can make expensive items or real estate more affordable and accessible to the buyer. The installment sale agreement also benefits the seller by providing a way to sell goods or property and receive payments over time, potentially generating additional revenue from interest charges or finance charges.

What information must be reported on installment sale agreement?

The information that must be reported on an installment sale agreement includes:

1. Identification of the parties involved: The agreement should contain the names and contact details of both the buyer and the seller.

2. Description of the property: The agreement should clearly describe the property being sold, including its location, size, condition, and any relevant details.

3. Terms of the sale: This includes the total purchase price of the property, the down payment amount (if applicable), the interest rate, and the length of the installment period.

4. Payment details: The agreement should outline how the payments will be made, including the amount, frequency, and due dates.

5. Security interest: If the seller retains a security interest in the property until the debt is fully paid, this should be clearly stated in the agreement.

6. Default and remedies: The agreement should specify what will happen in case the buyer defaults on the payments, including any penalties, late fees, or repossession procedures.

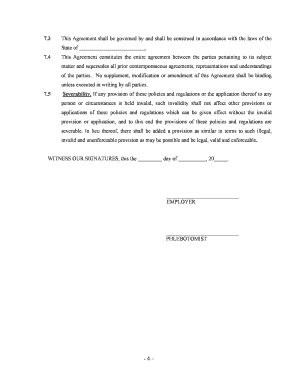

7. Governing law: The agreement should state which jurisdiction's laws will govern the transaction and any disputes arising from it.

8. Signatures: The agreement must be signed by both parties to indicate their acceptance and agreement to the terms.

It's important to note that the specific information required on an installment sale agreement may vary depending on the jurisdiction and the nature of the transaction. It's always advisable to consult with a legal professional to ensure compliance with local laws and regulations.

What is the penalty for the late filing of installment sale agreement?

The penalty for the late filing of an installment sale agreement can vary depending on the jurisdiction and the specific terms of the agreement. In some cases, late fees or interest charges may be imposed based on the terms outlined in the agreement. Additionally, there may be legal consequences if the late filing is seen as a breach of contract. It is recommended to consult with an attorney or tax professional to understand the specific penalties that may apply in your situation.

How can I send installment sale agreement for eSignature?

installment sale of personal property form is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Can I create an eSignature for the sale installment sales in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your assignment of llc interest form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I edit installment sale contract on an Android device?

The pdfFiller app for Android allows you to edit PDF files like installment sales agreement form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your installment sale agreement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sale Installment Sales is not the form you're looking for?Search for another form here.

Keywords relevant to llc sales agreement form

Related to interest installment sales

If you believe that this page should be taken down, please follow our DMCA take down process

here

.