Get the free private registered bond for setoff form

Show details

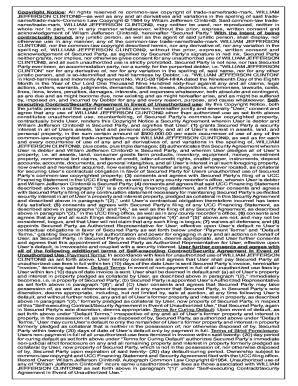

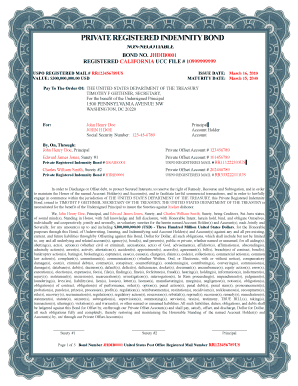

PRIVATE REGISTERED BOND FOR STAFF NONNEGOTIABLE VALUE: $100,000,000,000.00 (One Hundred Billion) US Dollars RE: CERTIFICATE OF LIVE BIRTH # 123412345 ACCEPTED FOR VALUE and EXEMPT FROM LEVY DEPOSITED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your private registered bond for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your private registered bond for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing private registered bond for setoff online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit private registered bond for setoff non negotiable form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out private registered bond for

How to fill out private registered bond for:

01

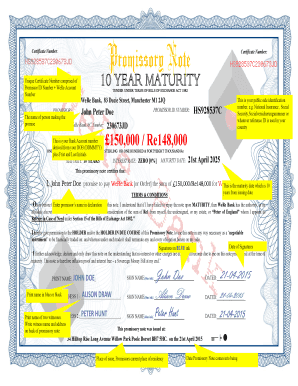

Gather all necessary information and documents, such as the bond issuer's name, purpose of the bond, maturity date, interest rate, and any collateral involved.

02

Complete the bond application form, providing accurate and detailed information about the bond issuer and any co-signers or guarantors.

03

Attach any required supporting documents, such as financial statements, proof of assets or collateral, and legal agreements.

04

Review the application form and supporting documents for accuracy and completeness before submitting.

05

Pay any applicable fees or costs associated with the bond registration process.

06

Submit the completed application form and supporting documents to the relevant authority or agency responsible for registering private bonds.

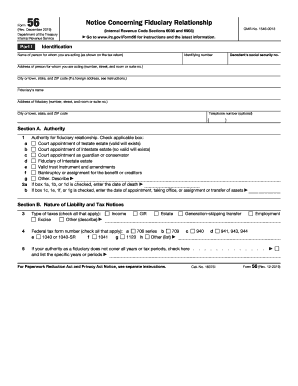

Who needs private registered bond for:

01

Individuals or businesses seeking to raise capital while providing investors with a fixed income stream through interest payments.

02

Companies or municipalities looking for financing options to fund projects, expansions, or public infrastructure improvements.

03

Investors who are looking for diversified investment opportunities beyond traditional stocks and bonds, as private registered bonds can offer higher yields and potential tax advantages.

Fill form : Try Risk Free

People Also Ask about private registered bond for setoff

What is an example of a private bond?

What is the difference between a public bond and a private bond?

What is the difference between a registered bond and a coupon bond?

What is a fully registered bond?

What is the difference between a bearer bond and a registered bond?

What is a private registered bond?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is private registered bond for?

A private registered bond is a bond that is registered with a third party, such as a bank, to provide additional security to the bondholder. It is generally used when the bond issuer is a private company and not a government or public entity. The third-party registration ensures that the bondholder's rights are protected, and that any payments due are made in a timely manner.

How to fill out private registered bond for?

1. Obtain the bond form from the county court.

2. Fill out the bond form with the information of the defendant, the plaintiff, and the amount of the bond.

3. Sign and date the bond form.

4. Have the bond form notarized.

5. Pay the required bond amount to the county court.

6. File the bond form with the county court.

What is the purpose of private registered bond for?

A private registered bond serves as a long-term debt instrument issued by a corporation or governmental entity to raise capital. The purpose of such a bond is to finance various projects or initiatives undertaken by the issuer. The funds obtained through the issuance of bonds can be utilized to support infrastructure development, fund research and development activities, implement expansion plans, or meet general operating expenses.

Private registered bonds are typically offered to a limited number of investors, such as institutional investors, insurance companies, or wealthy individuals, through a private placement. Unlike publicly traded bonds, which are listed on stock exchanges and accessible to the general public, private registered bonds offer a more exclusive investment opportunity.

Investors in private registered bonds receive periodic interest payments, known as coupon payments, based on the bond's stated interest rate. These bonds also have a maturity date, after which the issuer has an obligation to redeem the bonds and repay the principal amount to the bondholders.

Overall, the purpose of private registered bonds is to enable corporations or governmental entities to raise large sums of capital for specific purposes, while providing investors with a fixed income investment option.

What is the penalty for the late filing of private registered bond for?

The penalty for the late filing of a private registered bond can vary depending on the jurisdiction and terms of the bond issuance. However, common penalties may include:

1. Late filing fees: The issuer of the bond may be required to pay a certain amount as a penalty for each day the filing is delayed beyond the specified deadline. This fee can vary based on the terms of the bond contract.

2. Legal consequences: Late filing may result in potential legal consequences, such as the bond being declared null and void, or the issuer facing legal action from bondholders or regulatory authorities.

3. Reputation damage: Late filing can damage the reputation of the issuer, potentially affecting their ability to raise funds in the future or attracting negative attention from investors, stakeholders, or credit rating agencies.

It is important to consult the terms and conditions of the specific bond issuance and seek legal advice to understand the penalties associated with late filing in a particular jurisdiction.

How do I execute private registered bond for setoff online?

With pdfFiller, you may easily complete and sign private registered bond for setoff non negotiable form online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in private registered bond without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing private registered bond for investment and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I create an eSignature for the private bond for set off non negotiable in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your what is a private registered bond for setoff non negotiable form right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

Fill out your private registered bond for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Private Registered Bond is not the form you're looking for?Search for another form here.

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.