Get the free How Payday Loans Work: Interest Rates, Fees and Costs - dmva alaska

Show details

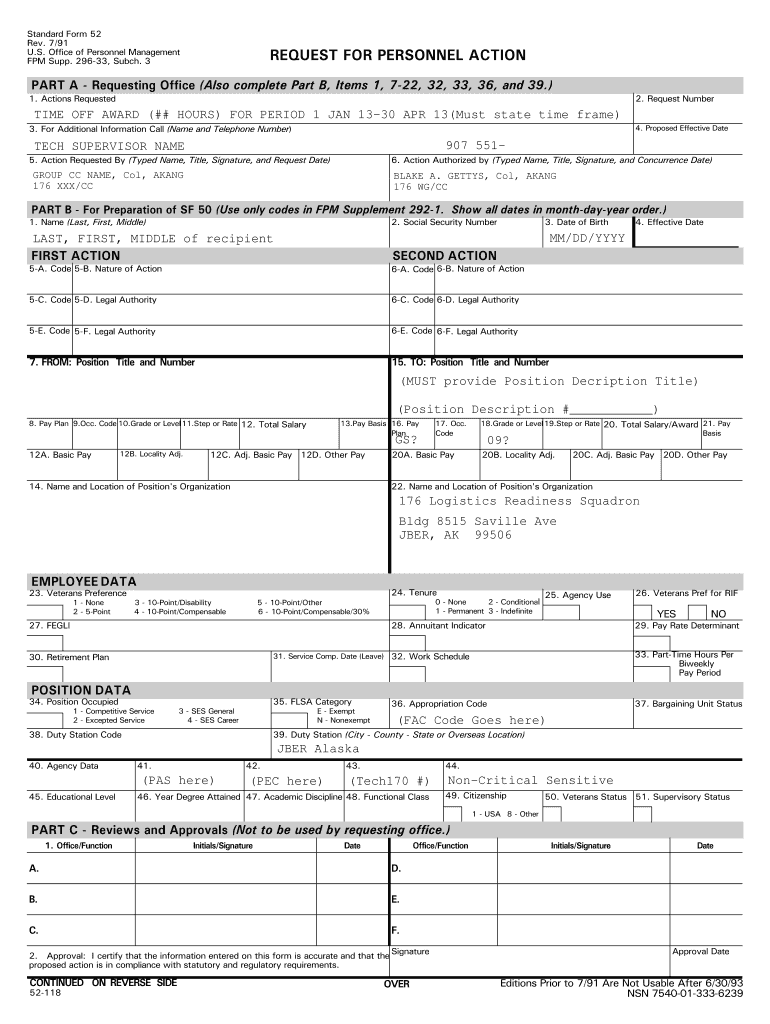

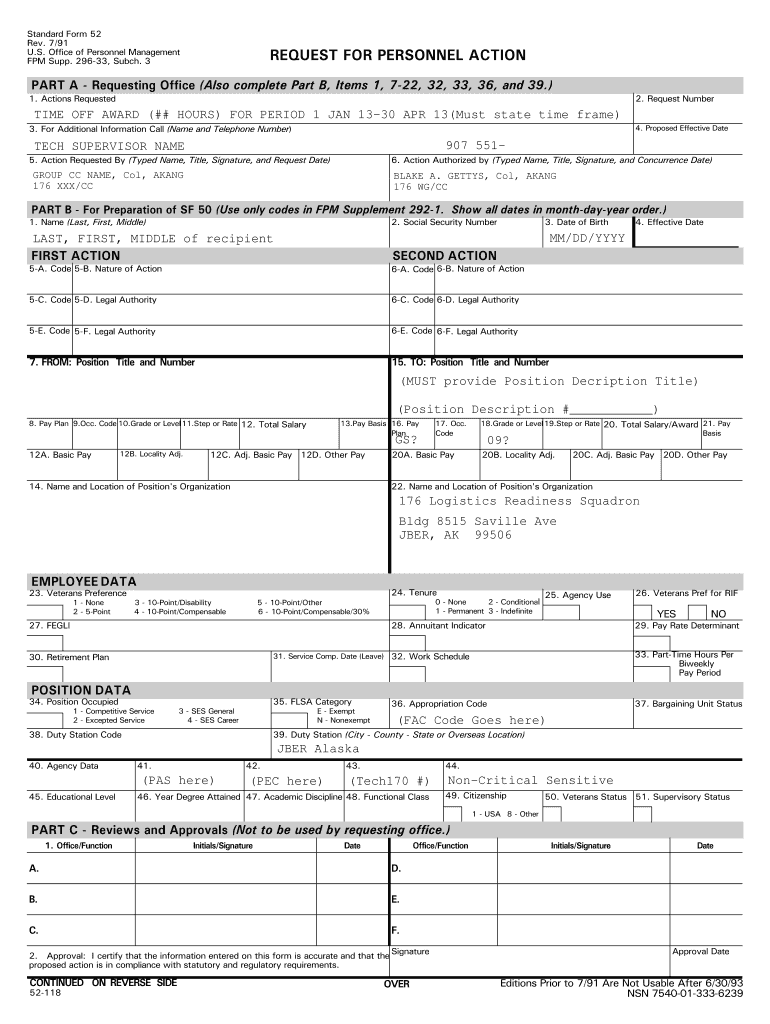

6WDQGDUG)RUP 5HY 862IILFHRI3HUVRQQHO0DQDJHPHQW)306XSS6XEFK5(48(67)253(56211(/$&7,213×$575HTXHVWLQJ2IILFH $OVRFRPSOHWH3DUW%, WHPVDQG$FWLRQV5HTXHVWHG5HTXHVW1XPEHUTIME OFF AWARD (## HOURS) FOR PERIOD

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how payday loans work

Edit your how payday loans work form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how payday loans work form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how payday loans work online

Follow the guidelines below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit how payday loans work. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how payday loans work

How to fill out how payday loans work

01

Here is a step-by-step guide on how to fill out payday loans:

02

Research and compare lenders: Find reputable lenders and compare their interest rates, terms, and fees.

03

Gather necessary documents: Collect the required documents such as proof of income, identification, and bank statements.

04

Complete the application: Fill out the payday loan application accurately by providing personal information, employment details, and financial information.

05

Review the terms: Carefully read and understand the loan terms, including the repayment schedule, interest rates, and any additional fees.

06

Submit the application: Submit the completed application online or in-person, depending on the lender's requirements.

07

Provide additional information if needed: Some lenders may require additional documentation or verification before approving the loan.

08

Receive loan decision: The lender will review the application and inform you of their decision, which can be approved, denied, or need more information.

09

Accept the loan: If approved, carefully review the loan terms once again and decide whether you want to accept the offer.

10

Receive funds: If you accept the loan, the lender will disburse the funds to your bank account, usually within one business day.

11

Repay the loan: Make timely payments according to the agreed-upon repayment schedule to avoid penalties or additional fees.

12

Understand the consequences: Familiarize yourself with the consequences of late or missed payments, as it may negatively affect your credit score and incur higher interest rates in the future.

13

Seek financial counseling if needed: If you consistently rely on payday loans, consider seeking financial counseling to explore alternative options and improve your financial situation.

Who needs how payday loans work?

01

Payday loans can be helpful for individuals who have an urgent need for cash and are unable to access traditional loans or credit.

02

People who may need payday loans include:

03

- Individuals facing unexpected emergencies, such as medical expenses or car repairs.

04

- Those with poor or no credit history, as payday lenders often provide loans without extensive credit checks.

05

- Individuals with low-income or irregular income who may struggle to qualify for traditional loans.

06

- People who need short-term cash flow solutions to bridge the gap until their next paycheck.

07

It is important to note that payday loans come with high-interest rates and fees, so they should only be used as a last resort and with careful consideration of the repayment terms.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my how payday loans work directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your how payday loans work and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

How do I execute how payday loans work online?

Completing and signing how payday loans work online is easy with pdfFiller. It enables you to edit original PDF content, highlight, blackout, erase and type text anywhere on a page, legally eSign your form, and much more. Create your free account and manage professional documents on the web.

How do I fill out how payday loans work on an Android device?

Complete how payday loans work and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is how payday loans work?

Payday loans are short-term loans that are typically repaid on the borrower's next pay date.

Who is required to file how payday loans work?

Lenders offering payday loans are required to provide information on how payday loans work to potential borrowers.

How to fill out how payday loans work?

To fill out how payday loans work, lenders must explain the loan terms, interest rates, fees, and repayment options to borrowers.

What is the purpose of how payday loans work?

The purpose of how payday loans work is to ensure that borrowers have a clear understanding of the terms and conditions of the loan before agreeing to borrow.

What information must be reported on how payday loans work?

Information that must be reported on how payday loans work includes the loan amount, interest rate, fees, repayment schedule, and total amount due.

Fill out your how payday loans work online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How Payday Loans Work is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.