Get the free Critical Illness Insurance Plans and Coverage BenefitsUnum

Show details

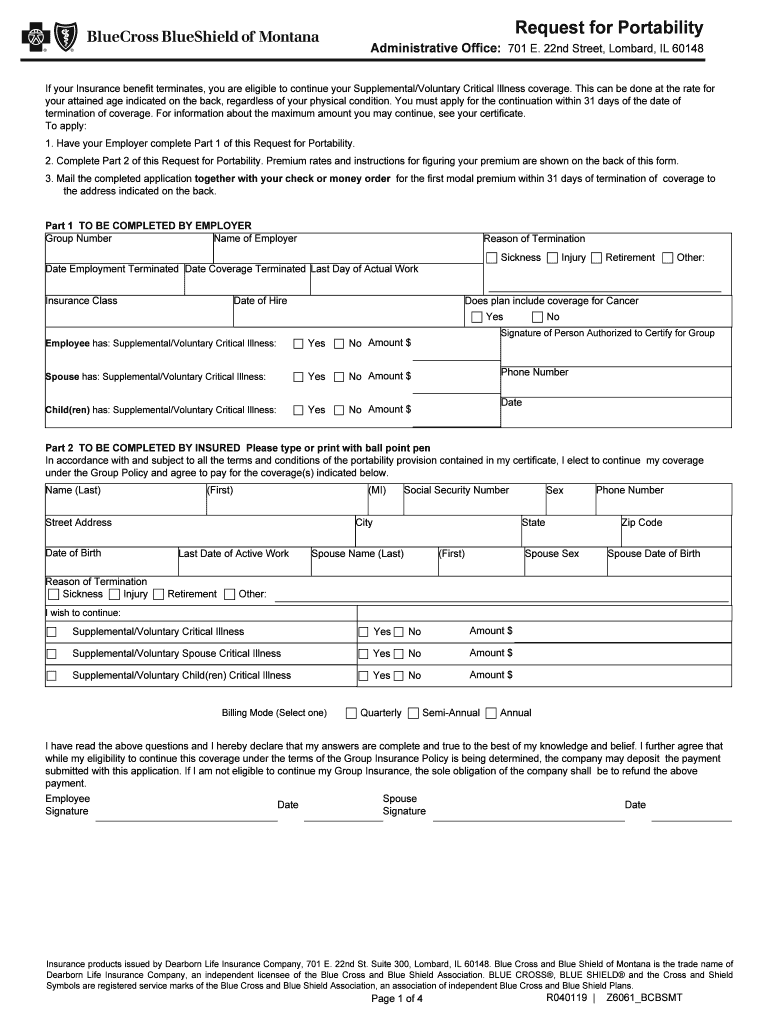

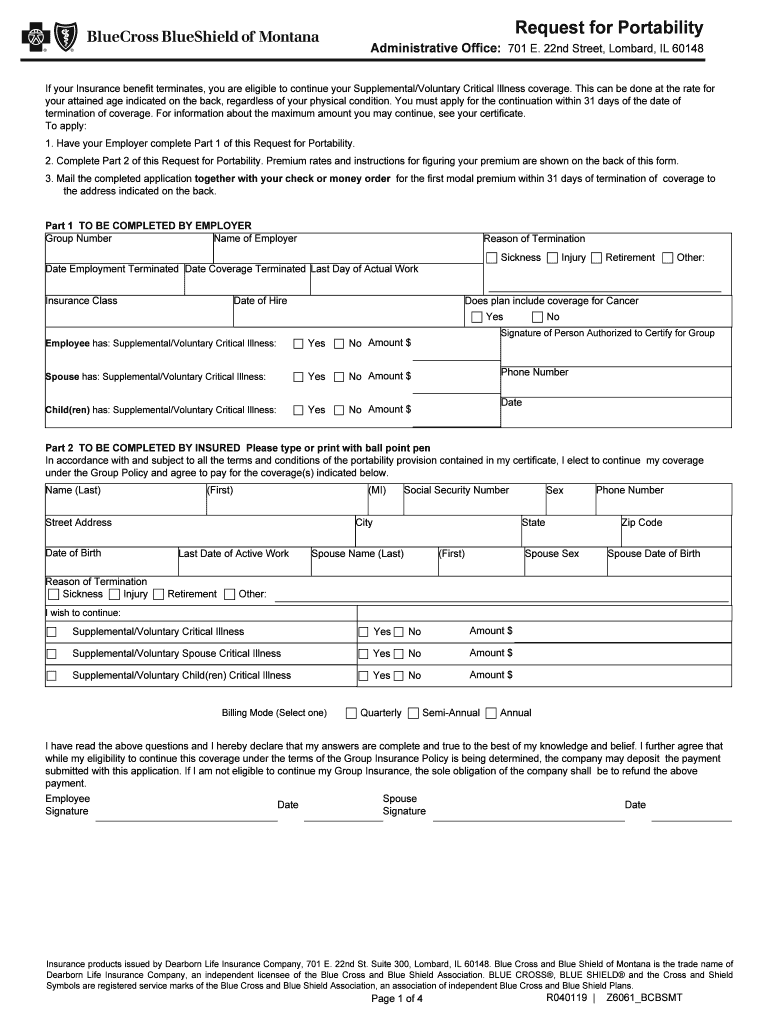

Request for PortabilityAdministrative Office: 701 E. 22nd Street, Lombard, IL 60148If your Insurance benefit terminates, you are eligible to continue your Supplemental/Voluntary Critical Illness coverage.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign critical illness insurance plans

Edit your critical illness insurance plans form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your critical illness insurance plans form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit critical illness insurance plans online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit critical illness insurance plans. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out critical illness insurance plans

How to fill out critical illness insurance plans

01

Gather all necessary information about your health history, including any previous illnesses or medical conditions.

02

Research and compare different critical illness insurance plans offered by various insurance providers.

03

Determine the coverage amount you need based on factors like your income, family expenses, and potential medical costs.

04

Fill out the application form accurately, providing detailed information about your personal and medical history.

05

Consult with an insurance agent or representative if you have any questions or need assistance with the application process.

06

Review the policy terms and conditions carefully before signing any documents.

07

Pay the premium amount as specified by the insurance provider to activate your critical illness insurance plan.

08

Keep a copy of all the documents related to your critical illness insurance plan for future reference.

09

Understand the claim process and requirements in case you need to make a claim in the future.

10

Regularly review and update your critical illness insurance plan as your health or financial situation changes.

Who needs critical illness insurance plans?

01

Individuals who have a family history of critical illnesses and want financial protection against potential medical expenses.

02

People with high-stress jobs or lifestyles that may increase their risk of developing critical illnesses.

03

Individuals who do not have sufficient savings or emergency funds to cover the costs of a critical illness diagnosis and treatment.

04

Those who want to ensure their loved ones are financially secure in the event of a critical illness.

05

Individuals who have dependent family members or children who rely on their income.

06

People who want additional coverage beyond their regular health insurance policy.

07

Individuals who have experienced a critical illness in the past and want to protect themselves against potential future occurrences.

08

Those who want peace of mind knowing they have financial support to cover medical expenses and other related costs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send critical illness insurance plans to be eSigned by others?

To distribute your critical illness insurance plans, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I complete critical illness insurance plans online?

Easy online critical illness insurance plans completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out the critical illness insurance plans form on my smartphone?

Use the pdfFiller mobile app to complete and sign critical illness insurance plans on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is critical illness insurance plans?

Critical illness insurance plans provide coverage for specific illnesses or medical conditions, offering a lump sum payment upon diagnosis to help with medical expenses and other financial needs.

Who is required to file critical illness insurance plans?

Individuals who purchase critical illness insurance plans are required to file the necessary documentation with their insurance provider.

How to fill out critical illness insurance plans?

Critical illness insurance plans typically require basic personal information, medical history, and details of the specific conditions covered.

What is the purpose of critical illness insurance plans?

The purpose of critical illness insurance plans is to provide financial support in case of a serious illness, helping policyholders cover medical costs and other expenses.

What information must be reported on critical illness insurance plans?

Critical illness insurance plans require details of the policyholder's personal information, medical history, and specific conditions covered by the policy.

Fill out your critical illness insurance plans online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Critical Illness Insurance Plans is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.