Get the free Unemployment Tax and Wage Report UC-018

Show details

Form UC-018 Form UC-020 Unemployment Tax and Wage Report Bar-coded Unemployment Tax and Wage Reports are mailed to liable employers to report their taxes and wages for the specific period indicated

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your unemployment tax and wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unemployment tax and wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unemployment tax and wage online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit unemployment tax and wage. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

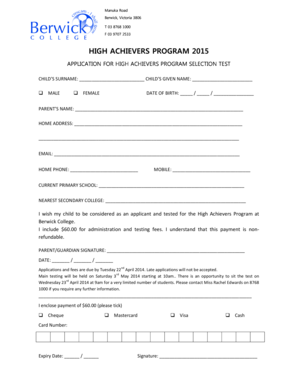

How to fill out unemployment tax and wage

How to fill out unemployment tax and wage:

01

Gather necessary information: Before filling out the unemployment tax and wage forms, ensure you have all the required information handy. This typically includes your employer's identification number (EIN), your company's address and contact details, and accurate wage and payroll information for your employees.

02

Determine the appropriate forms: Depending on your location and the regulations set by the relevant tax authority, there may be specific forms to fill out for reporting unemployment tax and wage. Visit the official website of your local tax authority to identify the correct forms required for your situation.

03

Complete the forms accurately: Take your time to carefully fill out the forms. Provide accurate information regarding your business, employees' wages, and any other details required. Double-check all the entries to ensure there are no errors or omissions.

04

Calculate and report unemployment taxes: Calculate the unemployment tax owed based on the wages paid to your employees during the taxable period. Different jurisdictions may have varying tax rates and thresholds, so refer to the instructions provided with the forms or consult with a tax professional if needed. Fill in the calculated tax amount accurately on the appropriate section of the form.

05

Submit the forms: Once you have completed the forms accurately, make sure to submit them within the prescribed deadlines. Some jurisdictions may require electronic filing, while others may accept paper submissions. Follow the instructions provided by the tax authority for submission methods.

Who needs unemployment tax and wage:

01

Employers: Employers, whether they are businesses, organizations, or governmental entities, are typically required to pay unemployment taxes and report wages. This includes both for-profit and nonprofit organizations, as well as small businesses and large corporations.

02

Employees: Although employees do not directly fill out these forms, they are affected by the unemployment tax and wage system. The taxes paid by employers contribute towards funds that provide unemployment benefits to eligible employees during periods of job loss or involuntary separation.

03

Tax authorities: Unemployment tax and wage forms are necessary for tax authorities to monitor and regulate the collection of unemployment taxes, ensuring proper funding for unemployment benefits programs. These forms also help authorities track compliance and enforce applicable tax laws.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is unemployment tax and wage?

Unemployment tax is a payroll tax paid by employers to fund unemployment benefits for workers who have lost their jobs. Unemployment wage refers to the amount of money subject to the unemployment tax.

Who is required to file unemployment tax and wage?

Employers are required to file unemployment tax and wage if they have employees.

How to fill out unemployment tax and wage?

Employers can fill out unemployment tax and wage forms provided by their state's workforce agency or department of labor.

What is the purpose of unemployment tax and wage?

The purpose of unemployment tax and wage is to provide financial assistance to workers who are unemployed through no fault of their own.

What information must be reported on unemployment tax and wage?

Employers must report wages paid to employees, as well as other relevant information such as employee Social Security numbers.

When is the deadline to file unemployment tax and wage in 2023?

The deadline to file unemployment tax and wage in 2023 is typically the last day of January.

What is the penalty for the late filing of unemployment tax and wage?

The penalty for late filing of unemployment tax and wage varies by state, but may include fines and interest on the amount owed.

How can I get unemployment tax and wage?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific unemployment tax and wage and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for signing my unemployment tax and wage in Gmail?

Create your eSignature using pdfFiller and then eSign your unemployment tax and wage immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I complete unemployment tax and wage on an Android device?

Use the pdfFiller mobile app to complete your unemployment tax and wage on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your unemployment tax and wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.