Get the free Secured Rate Annuity - The Standard

Show details

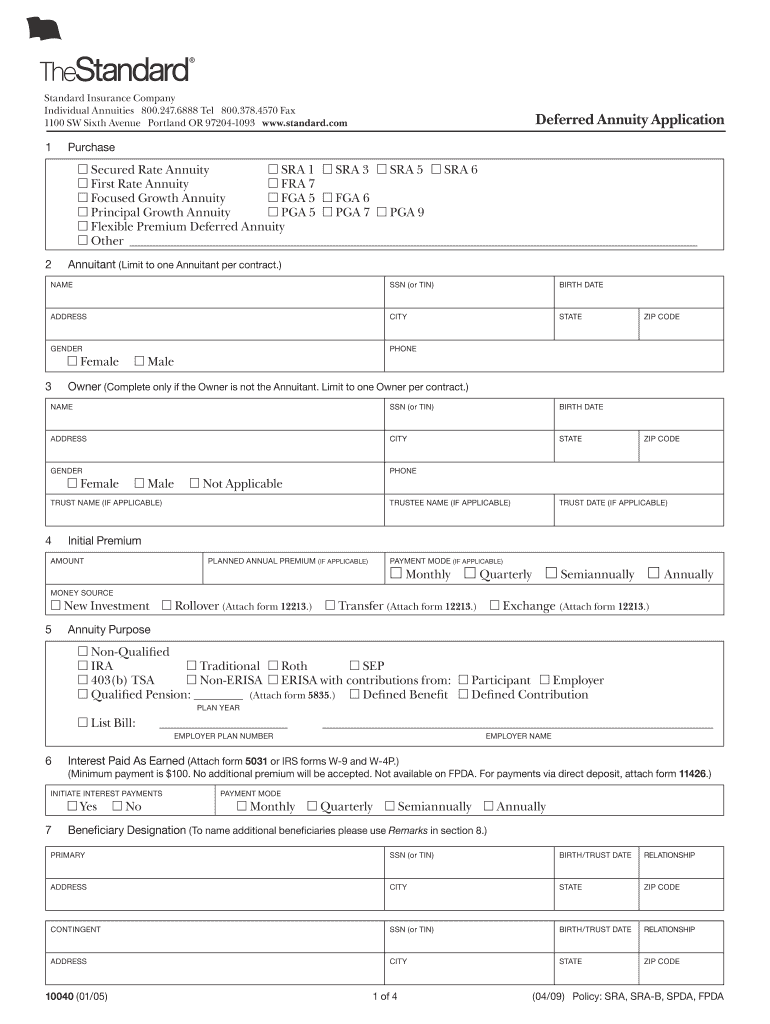

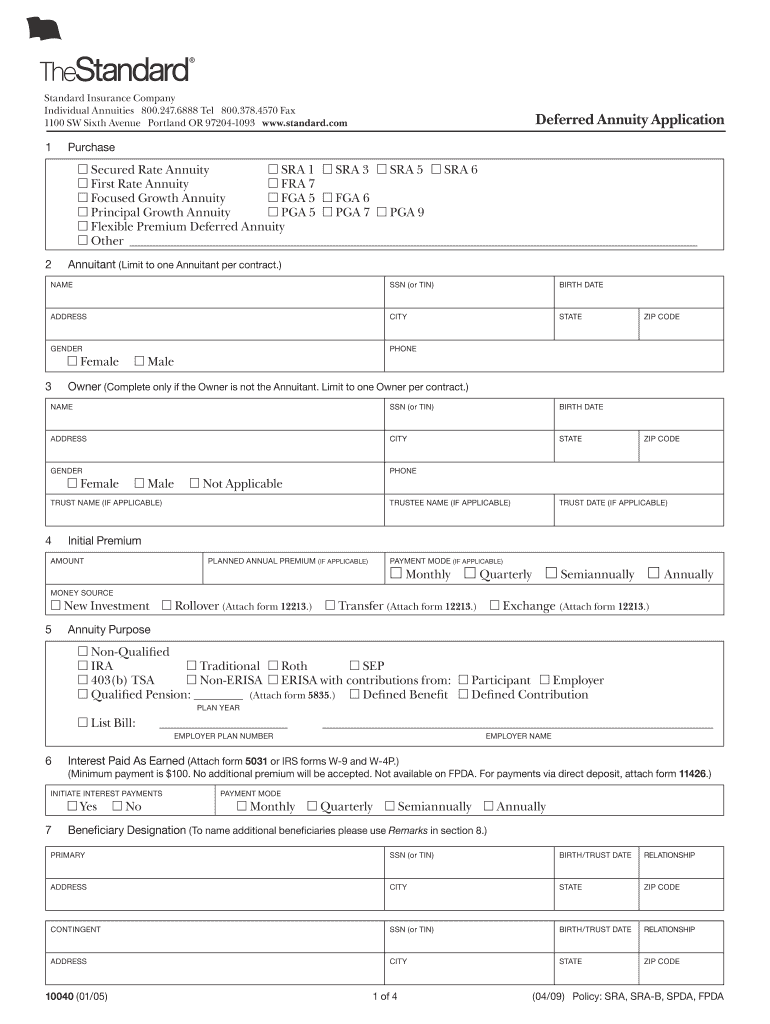

Standard Insurance Company Individual Annuities 800.247.6888 Tel 800.378.4570 Fax 1100 SW Sixth Avenue Portland OR 972041093 www.standard.com1Deferred Annuity ApplicationPurchaseG Secured Rate Annuity

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign secured rate annuity

Edit your secured rate annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your secured rate annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit secured rate annuity online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit secured rate annuity. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out secured rate annuity

How to fill out secured rate annuity

01

Start by gathering all the necessary information such as your personal details, financial information, and investment preferences.

02

Research and compare different insurance companies that offer secured rate annuities to find a reputable and reliable provider.

03

Once you have chosen an insurance company, reach out to their representative or visit their website to obtain the application form for the secured rate annuity.

04

Read the instructions provided with the application form carefully to understand the requirements and terms of the annuity.

05

Fill out the application form accurately and completely, providing all the requested details such as your name, address, social security number, beneficiary information, and investment amount.

06

If you have any doubts or questions while filling out the form, don't hesitate to contact the insurance company's representative for assistance.

07

Review the completed application form to ensure all the information provided is correct and all the mandatory fields are filled.

08

Sign and date the application form as required.

09

Prepare any additional documents or identification proofs that may be required along with the application.

10

Submit the filled-out application form and any additional documents to the insurance company either through mail or electronically, as per their specified instructions.

11

Wait for the insurance company to review your application and conduct any necessary verification processes.

12

Once your application is approved, the insurance company will provide you with the secured rate annuity contract and any related documents. Read them carefully and understand the terms and conditions before signing the contract.

13

If you have any concerns or questions regarding the contract, seek clarification from the insurance company's representative.

14

Once you are satisfied with the terms, sign the contract and return it to the insurance company.

15

Make the initial investment payment as specified in the contract, either through a lump sum or installment basis.

16

Keep a copy of the contract and all related documents for your records.

17

Regularly review the performance of your secured rate annuity and stay updated with any updates or changes provided by the insurance company.

Who needs secured rate annuity?

01

Secured rate annuity can be beneficial for individuals who are looking for a stable and reliable long-term investment option.

02

Retirees who want a fixed income stream after retirement and are not comfortable with market fluctuations may find secured rate annuity suitable.

03

Individuals who prioritize capital preservation and want to protect their principal investment amount from losses may opt for secured rate annuities.

04

Those who are willing to commit their funds for a specific period and are willing to comply with the annuity contract terms may find secured rate annuity suitable.

05

Secured rate annuities can also be suitable for individuals who want to diversify their investment portfolio and mitigate risks.

06

It is important for individuals considering secured rate annuities to have a clear understanding of their financial goals, risk tolerance, and investment time horizon.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify secured rate annuity without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your secured rate annuity into a dynamic fillable form that can be managed and signed using any internet-connected device.

Can I edit secured rate annuity on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign secured rate annuity on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I edit secured rate annuity on an Android device?

The pdfFiller app for Android allows you to edit PDF files like secured rate annuity. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is secured rate annuity?

Secured rate annuity is a type of annuity contract where the insurance company guarantees a specific rate of return on the investment.

Who is required to file secured rate annuity?

Individuals who own secured rate annuity contracts are required to file them with the appropriate authorities.

How to fill out secured rate annuity?

To fill out a secured rate annuity, individuals need to provide detailed information about the contract, investment amount, and beneficiaries.

What is the purpose of secured rate annuity?

The purpose of secured rate annuity is to provide a guaranteed rate of return on investment and secure a stable income stream for the future.

What information must be reported on secured rate annuity?

Information such as contract details, investment amount, beneficiaries, and any changes to the contract must be reported on secured rate annuity.

Fill out your secured rate annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Secured Rate Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.