Get the free Credit Approval Criteria

Show details

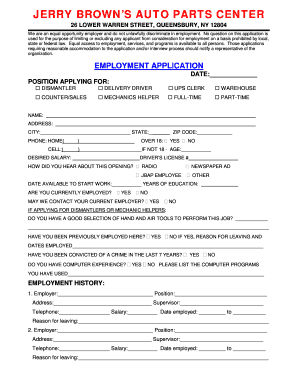

STOUT MANAGEMENT PROPERTY

HANDLEABLE

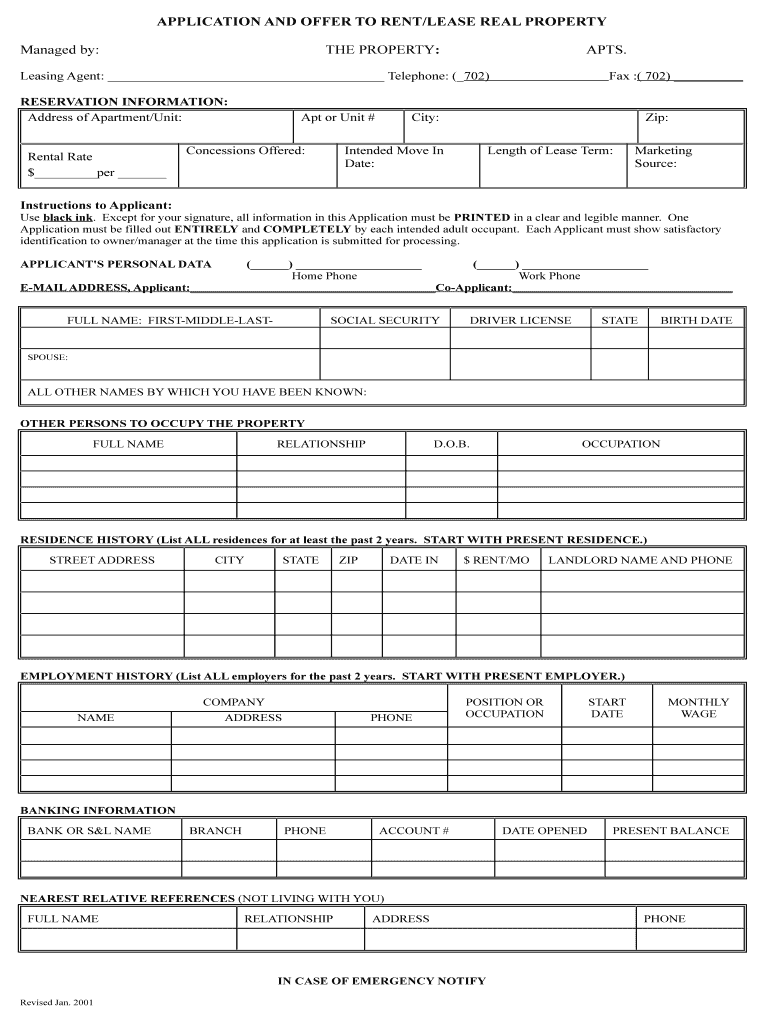

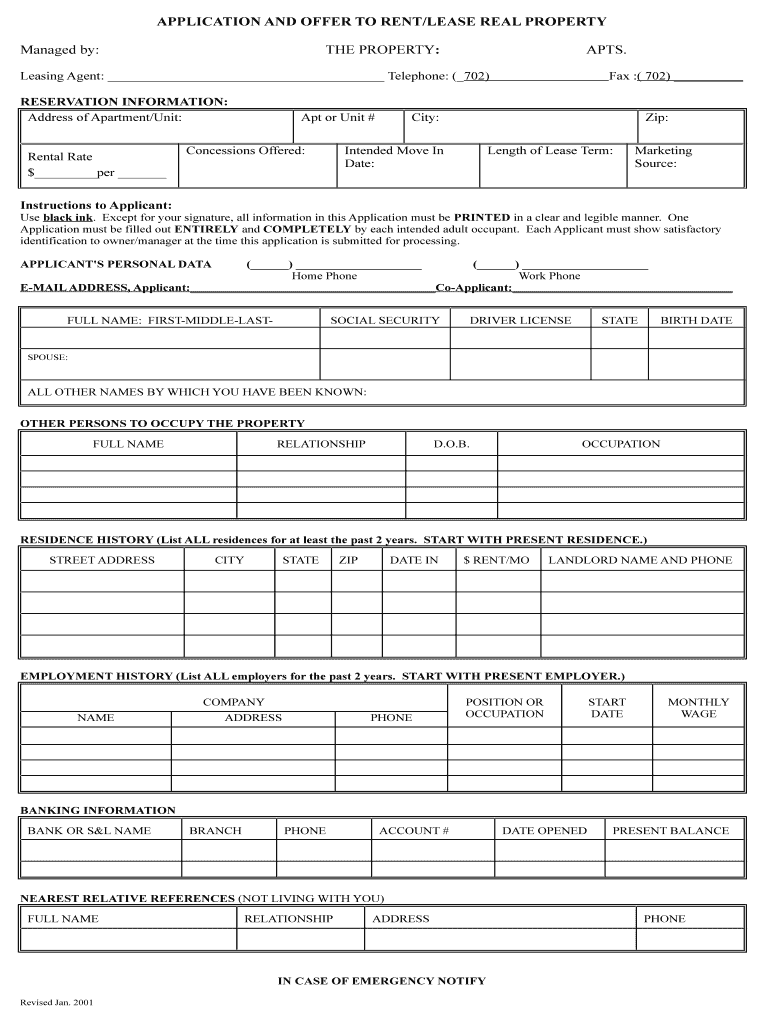

GENERAL RENTAL AND OCCUPANCY CRITERIA GUIDELINESCredit Approval Criteria

ALL APPLICANTS WILL BE APPROVED ON THE FOLLOWING CRITERIA:

A RENTAL APPLICATION MUST BE

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit approval criteria

Edit your credit approval criteria form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit approval criteria form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit approval criteria online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit approval criteria. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit approval criteria

How to fill out credit approval criteria

01

To fill out credit approval criteria, follow these steps:

02

Understand the requirements: Familiarize yourself with the credit approval criteria for the specific institution or organization you are dealing with. These criteria may vary between different lenders or creditors.

03

Gather necessary documents: Collect all the documents and information required to complete the credit approval criteria. This may include financial statements, income proof, identification documents, and any other supporting documents as specified.

04

Review and organize information: Review the criteria and ensure that you have all the necessary details and documents. Organize the information in a systematic manner for easy reference.

05

Complete the application form: Fill out the application form provided by the lender or creditor accurately and legibly. Provide all the requested information truthfully.

06

Provide supporting documents: Attach all the required supporting documents along with the application form. Ensure that the documents are valid and meet the specified criteria.

07

Double-check for accuracy: Before submitting the application, double-check all the information provided and verify its accuracy. Any errors or discrepancies may affect the credit approval decision.

08

Submit the application: Submit the completed application form along with the supporting documents to the relevant authority or institution as instructed.

09

Follow up if necessary: If there are any additional steps or follow-ups required, stay proactive and promptly respond to any inquiries or requests from the lender or creditor.

10

Await the decision: Once the application is submitted, wait for the credit approval decision. This may take some time, depending on the review process of the institution.

11

Take necessary actions based on the decision: If the credit approval is granted, follow the instructions provided by the lender or creditor. If the credit is not approved, consider alternative options or address any concerns mentioned in the decision.

Who needs credit approval criteria?

01

Credit approval criteria is needed by various individuals and entities including:

02

- Individuals applying for personal loans, mortgages, or credit cards

03

- Businesses seeking financing or loans for expansion, investment, or day-to-day operations

04

- Financial institutions and banks to assess the creditworthiness of borrowers

05

- Credit card issuers and payment processors to evaluate potential customers

06

- Government agencies and organizations offering grants or funding, requiring a screening process

07

- Landlords or property managers when screening potential tenants

08

- Individuals or organizations involved in loan underwriting or risk assessment processes

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit credit approval criteria from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your credit approval criteria into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I fill out the credit approval criteria form on my smartphone?

Use the pdfFiller mobile app to fill out and sign credit approval criteria on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I edit credit approval criteria on an Android device?

You can make any changes to PDF files, like credit approval criteria, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is credit approval criteria?

Credit approval criteria refers to the set of guidelines and requirements that a borrower must meet in order to be approved for a loan or line of credit.

Who is required to file credit approval criteria?

Lenders and financial institutions are typically required to establish and maintain credit approval criteria.

How to fill out credit approval criteria?

Credit approval criteria can be filled out by outlining the specific requirements and guidelines that borrowers must meet in order to be approved for credit.

What is the purpose of credit approval criteria?

The purpose of credit approval criteria is to assess the creditworthiness of borrowers and minimize the risk of loan defaults.

What information must be reported on credit approval criteria?

Information such as credit score, income, employment history, and debt-to-income ratio may be reported on credit approval criteria.

Fill out your credit approval criteria online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Approval Criteria is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.