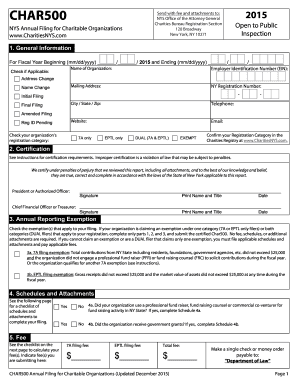

What is Form CHAR500?

Form CHAR500 is called the Annual Filing for Charitable Organizations. This document must be filed by all registered agencies, including those that meet the requirements of the annual report exemption. Take into account that the fee must be paid for the consideration of this form.

What is Form CHAR500 for?

This form is used to report all annual charitable contributions that a single charitable agency has made. Before reporting, determine the status of your organization checking the section Registration Statuses and Types in the instructions to the form.

When is Form CHAR500 Due?

The Charities Bureau requires to file this form on the annual basis. However, the due date can be different for the organizations with different registration categories. Additionally, the time extension may be requested.

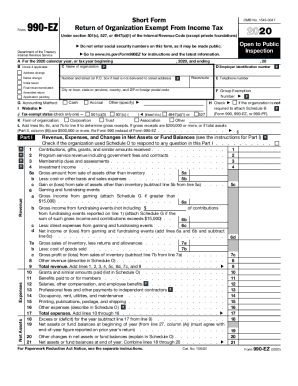

Is Form CHAR500 Accompanied by Other Forms?

First, you must attach the receipt of the fee payment. Remember to file also Form 990-EZ. It is the Short Form Return of Organization Exempt from Income Tax.

What Information do I Include in Form CHAR500?

You must include the following information when completing the Annual Filing for Charitable Organizations:

- Beginning and ending of the fiscal year;

- Name of organization;

- Mailing address;

- Website;

- Employer identification number;

- NY registration number;

- Telephone and email;

- Type of organization;

The document must be signed by the president of the authorized officer and chief financial treasurer.

Where do I Send Form CHAR500?

Complete the form properly, check it and send to the following address:

NYS Office of the Attorney General

Charities Bureau Registration Section

120 Broadway

New York, NY 10271