This form is a General Warranty Deed where the granter is a limited partnership and the grantees are husband and wife.

Get the free warrenty deed form

Get, Create, Make and Sign

Editing warrenty deed online

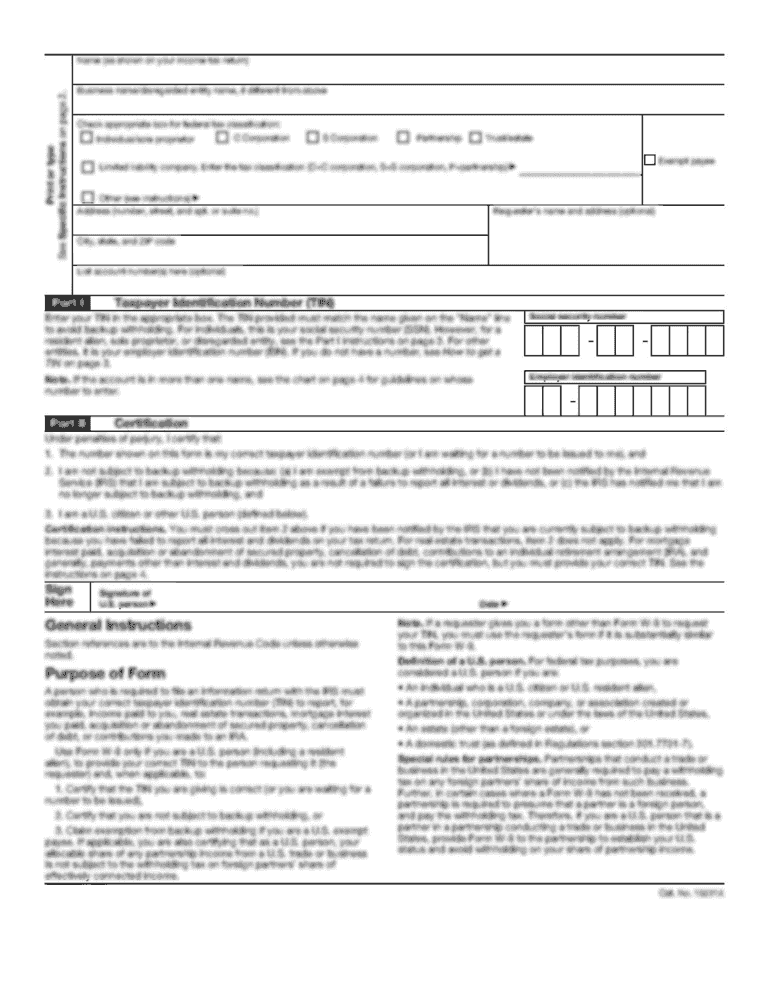

How to fill out warrenty deed form

How to fill out a warranty deed:

Who needs a warranty deed:

Video instructions and help with filling out and completing warrenty deed

Instructions and Help about warranty deed form

Hi this is John Goodman I am talking today about the differences between a general warranty deed and a special warranty deed when you're a lawyer you're asked that question all the time John what the heck is the difference between a general warranty deed and a special warranty d now I will answer that question in just a minute however what I would suggest the real focus of this is that the market will determine or the deal will determine whether the parties use a special warranty deed or a general warranty deed and the real question is what are the consequences and what should the seller and buyer do to protect themselves from the consequences of the different choices okay what's the difference between a general warranty deed and a special warranty deed is this with a general warranty deed essentially the granter the seller the signer of the deed is warranting not only that they haven't done anything to mess up the state of the title they are warranting that there are no title blemishes against the property back to the beginning of time subject to the exceptions that are mentioned in the deed, so the point of that is that the granter of a general warranty deed is warranting against title blemishes that that granter didn't cause a special warranty deed is better for the granter it's better for the seller with a special warranty deed the granter the seller is essentially saying I am conveying title in the same condition I received it I am NOT warranting against title blemishes that were created through persons before me that's the difference so what's a seller to do because in at least in the residential real estate market at the time I'm recording this in 2016 in the state of Colorado the residential real estate market generally expects resale sellers to convey a general warranty deed is the difference between the two deeds a big risk, and generally it's not a big risk for the grant or to convey a general warranty deed I personally would not hesitate to convey title to a property that I own using a general warranty deed and the reason is as though I'm liable under a general warranty deed for title blemishes that I didn't because I have title insurance from when I purchased the property and that protects me against those title claims I feel comfortable with that title insurance as long as it's in a sufficient amount you know and imagine somebody who bought a property for $400,000 they owned it for a while they sell that property for $500,000 that person who bought it for $400,000 is quite likely to have title insurance in the amount of fourth out four hundred thousand dollars which protects that seller when they sell the property it's a different story however and this is the point of this video it's there's a different risk analysis for a seller who for example bought their property in 1964 for forty thousand dollars and then is selling it now in 2016 for five hundred thousand dollars it's possible that there is a title blemish it is possible...

Fill blank deed form pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your warrenty deed form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.