Last updated on Feb 20, 2026

Get the free Checklist for Business Loans Secured by Real Estate template

Show details

This is a generic suggested checklist for a commercial loan where real property is the primary collateral.

We are not affiliated with any brand or entity on this form

Why choose pdfFiller for your legal forms?

All-in-one solution

pdfFiller offers a PDF editor, eSignatures, file sharing, collaboration tools, and secure storage—all in one place.

Easy to use

pdfFiller is simple, cloud-based, has a mobile app, and requires no downloads or a steep learning curve.

Secure and compliant

With encryption, user authentication, and certifications like HIPAA, SOC 2 Type II, and PCI DSS, pdfFiller keeps sensitive legal forms secure.

What is checklist for business loans

A checklist for business loans is a detailed guide that outlines the necessary documents and information required to apply for a business loan.

pdfFiller scores top ratings on review platforms

It is excellent. I had some problem in he beginning as to how to use it.it would be helpful if you could make is more user friendly

Simple and versatile. Since it is new "technology" for me, I must use it with some guidance to understand all its utility, so the tutorials that are included will be handy without having to go to school to learn it.

Good product to use for form filling. User friendly and would highly recommend.

I HAVE TRIED MANY MANY TIMES TO MAKE YOUR PROGRAM WORK FO ME WITHOUT SUCCESS.

I love the idea of being able to populate any form, I just hate the tutorial that slows everything down and gets in the way of populating boxes

So far very good, but it is my first dau using it...

Who needs checklist for business loans?

Explore how professionals across industries use pdfFiller.

Checklist for Business Loans Form

How to fill out a checklist for business loans form?

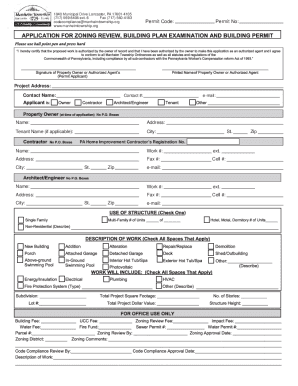

To effectively fill out a checklist for business loans form, begin by gathering all necessary documents such as financial statements and identifications. Utilize platforms like pdfFiller that simplify editing and signing. This ensures your application is organized, comprehensive, and meets lender requirements.

Understanding the business loan application process

Applying for a business loan begins with understanding the types of loans available. Different loans cater to various purposes, including equipment financing, working capital, or real estate purchases. Critical considerations include interest rates, loan terms, and your business's creditworthiness. Engaging with a comprehensive checklist aids in preparing essential documents and enhances approval chances.

-

There are secured loans, which require collateral, and unsecured loans that rely on the borrower's creditworthiness. Selecting the right type impacts your business cash flow and repayment strategy.

-

Be mindful of interest rates, payment schedules, and total loan costs, which can vary significantly between lenders. Understand your business's financial situation to evaluate how much you can responsibly borrow.

-

Gather all required documents in advance to streamline the application process. This preparation not only saves time but also reduces stress when meeting lender deadlines.

Essential document list for business loans

A well-organized document list is vital for successfully navigating the application process. Ensure to compile all necessary paperwork that lenders require to evaluate your loan application.

-

Detail the amount you wish to borrow, along with how you plan to use the funds, to clarify your objectives.

-

This document should include asset and liability information to provide lenders with insights into your business's financial health.

-

Know Your Customer (KYC) regulatory requirements compel lenders to confirm your identity using this disclosure.

-

Lenders typically require identification for all individuals authorized to sign loan documents.

Required closing documents

Closing documents ensure all contractual obligations are met and provide a legal framework for the loan. Without these important papers, the transaction may face delays or complications.

-

This document outlines the repayment terms, including interest rates and timeframes.

-

These documents serve as proof of ownership and secure the loan with the property itself.

-

Used primarily in residential transactions, this form summarizes settlement costs for the transaction.

Additional compliance and risk assessment documents

Ensuring compliance and conducting a risk assessment are integral while applying for a business loan. This layer of scrutiny helps lenders evaluate potential risks.

-

Insurance companies use this report to identify properties located in flood-prone areas to determine risk.

-

The Home Mortgage Disclosure Act requires banks to report these details for racial and geographical unbiased lending practices.

-

Often required for property purchases, providing assurance that the property is free from pest damage.

Financial and approval requirements

Lenders also require specific financial documents to determine loan eligibility. Understanding these requirements can position borrowers more favorably.

-

A legal document certifying that the property title is clear and can be transferred to the lender.

-

Depending on the lender, other approvals may be needed to complete your request.

-

Most lenders require a recent credit report, reflecting the borrower's credit history to assess risk.

Using pdfFiller to streamline your application

pdfFiller simplifies the process of completing your checklist for business loans forms. By utilizing this platform, you can edit, eSign, and manage documents with ease.

-

Log in to pdfFiller to find a plethora of fillable forms tailored for business loans.

-

eSigning enhances the speed at which documents are handled, allowing for quicker approvals.

-

Keeps all vital financial paperwork in one central location, facilitating collaboration with others involved in the loan process.

Improving your chances of approval

In a competitive lending market, presenting a well-organized application is essential. Clarity and accuracy in your loan documents can significantly boost approval odds.

-

Ensure all necessary documents are easy to find, accurately presented, and free from errors.

-

Have a second set of eyes review your application for potential errors before submission.

-

Clearly illustrate how the loan will fund your operations or initiatives, demonstrating tangible benefits.

Interactive tools and resources available on pdfFiller

pdfFiller not only simplifies document submission but offers a suite of tools for a seamless experience. These resources can guide users through the business loan landscape.

-

Utilize tools for step-by-step guidance on filling out your business loan forms effectively.

-

Link to articles explaining different business loan types and suitable applications.

-

Explore further insights into business financing strategies tailored for various enterprises.

How to fill out the checklist for business loans

-

1.Start by downloading the checklist for business loans from pdfFiller.

-

2.Open the PDF file in the pdfFiller application.

-

3.Review the items on the checklist to understand what documents are required.

-

4.Gather the necessary documentation, such as financial statements, business plans, and tax returns.

-

5.Fill in any personal information requested in the checklist, including your business name and contact details.

-

6.Check off each item on the checklist as you gather the corresponding documents.

-

7.If needed, add notes or comments to clarify any details related to your documents.

-

8.Once completed, save the filled checklist to your pdfFiller account.

-

9.Finally, print or download the checklist for your records or to submit with your loan application.

Related Catalogs

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.