Get the free Form W-8BEN - QT Talk

Show details

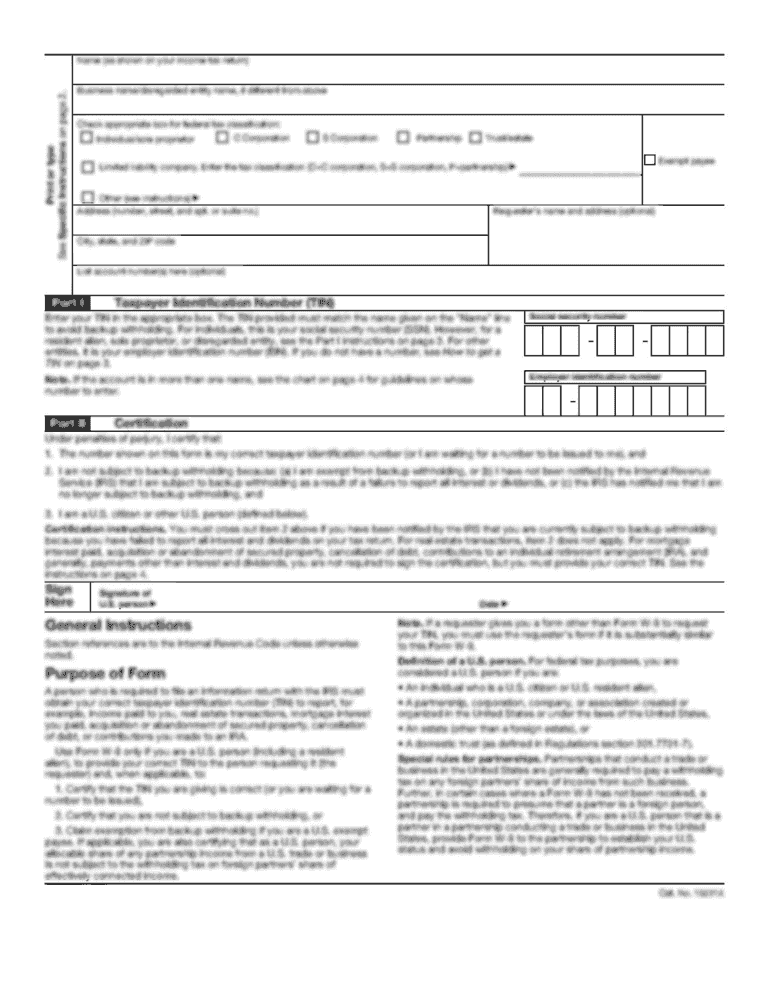

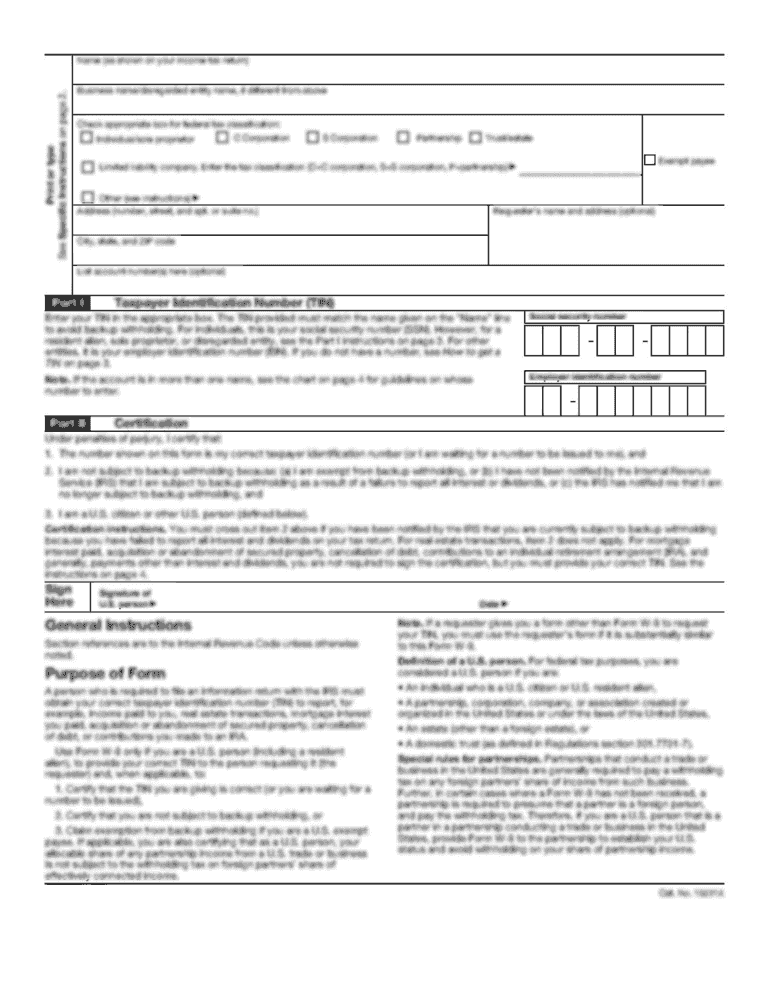

Form W-8BEN (October 1998) Department of the Treasury Internal Revenue Service) Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding CMB no. 1545-1621 Section references

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form w-8ben - qt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form w-8ben - qt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form w-8ben - qt online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form w-8ben - qt. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out form w-8ben - qt

How to fill out form w-8ben - qt?

01

Begin by providing your personal information in Section 1 of the form. This includes your name, country of citizenship, foreign tax identification number, and permanent address.

02

Move on to Section 2 and indicate the type of beneficial owner you are. This may include an individual, corporation, partnership, trust, or other types of entities. Provide any necessary details related to your entity and its tax classification.

03

In Section 3, you'll need to provide your treaty claim. Specify the country where you are a resident for tax purposes and provide the article and paragraphs of the tax treaty that justify your claim for treaty benefits.

04

Complete Section 4 if you are eligible for special rates for income effectively connected with the conduct of a trade or business in the United States. Provide any necessary information and attach supporting documents if required.

05

In Section 5, you'll need to provide your certification. Sign and date the form, confirming that the information provided is true and accurate to the best of your knowledge. If you're completing the form on behalf of a company or organization, indicate your capacity to sign on their behalf.

Who needs form w-8ben - qt?

01

Non-US individuals or entities receiving certain types of income from US sources may need to fill out form W-8BEN-QT.

02

This form is typically used by foreign taxpayers who are claiming a reduced tax withholding rate or exemption under an applicable tax treaty between their home country and the United States.

03

Additionally, entities that are not considered US persons for tax purposes, such as foreign corporations or partnerships, may need to complete this form to certify their foreign status.

04

It's important to note that the specific circumstances and requirements for using form W-8BEN-QT may vary, so it's best to consult with a tax professional or refer to the IRS instructions for this form to determine if it applies to you.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form w-8ben - qt?

Form W-8BEN-QT is a form used by foreign individuals to claim a reduced rate of withholding on payments from U.S. sources.

Who is required to file form w-8ben - qt?

Foreign individuals who are receiving income from U.S. sources and want to claim a reduced rate of withholding are required to file Form W-8BEN-QT.

How to fill out form w-8ben - qt?

Form W-8BEN-QT requires the individual to provide personal information, certify their foreign status, and claim a reduced rate of withholding. The form must be signed and dated.

What is the purpose of form w-8ben - qt?

The purpose of Form W-8BEN-QT is to establish foreign status and claim a reduced rate of withholding on payments from U.S. sources.

What information must be reported on form w-8ben - qt?

Form W-8BEN-QT requires the individual to report their name, country of citizenship, foreign tax identification number, and claim a reduced rate of withholding.

When is the deadline to file form w-8ben - qt in 2023?

The deadline to file Form W-8BEN-QT in 2023 is typically by the end of the tax year, which is December 31st.

What is the penalty for the late filing of form w-8ben - qt?

The penalty for the late filing of Form W-8BEN-QT can vary, but it may result in increased withholding rates on payments from U.S. sources.

How do I complete form w-8ben - qt online?

pdfFiller has made filling out and eSigning form w-8ben - qt easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I edit form w-8ben - qt online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your form w-8ben - qt to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my form w-8ben - qt in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your form w-8ben - qt and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

Fill out your form w-8ben - qt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.