Get the free Limited-Equity Cooperative Tax Fairness Application - otr - otr cfo dc

Show details

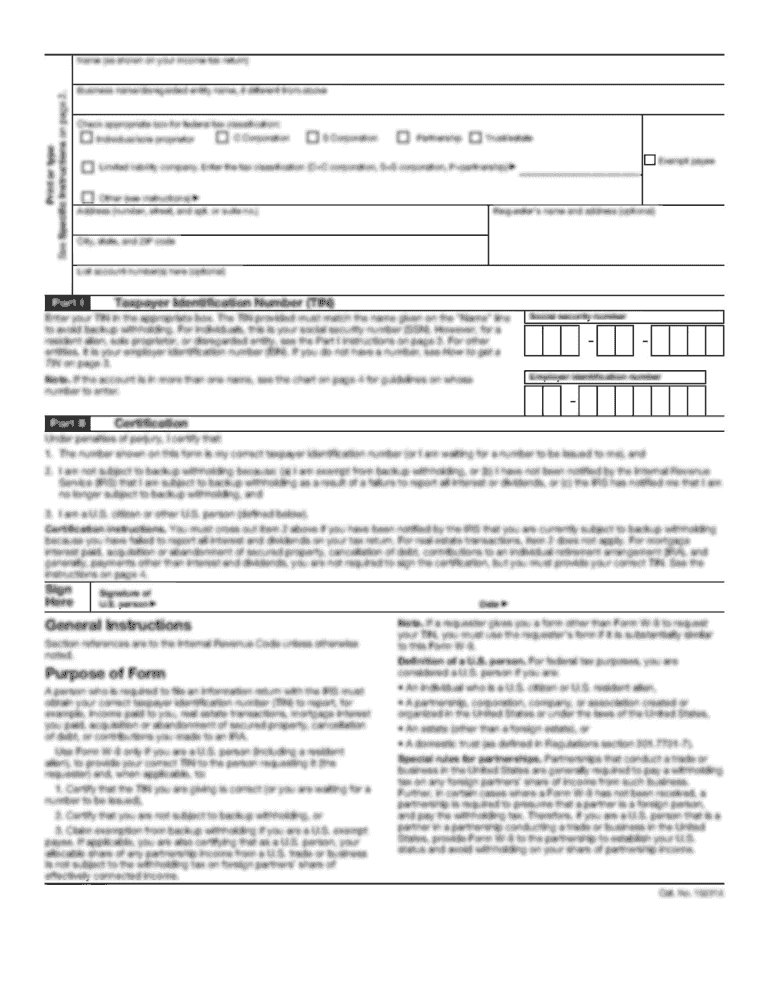

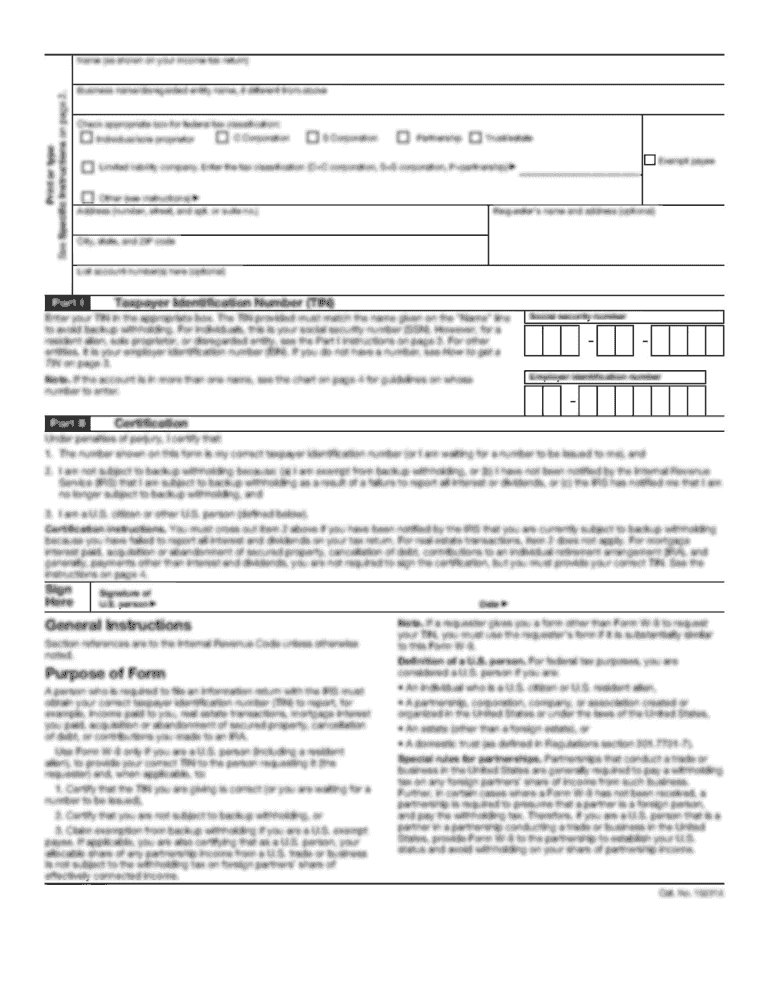

LimitedEquity Cooperative Tax Fairness Office of Tax and Revenue Real Property Tax Administration Limited equity cooperatives (LEC) are defined in the DC Official Code in 47802 (11) as, one required

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your limited-equity cooperative tax fairness form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your limited-equity cooperative tax fairness form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit limited-equity cooperative tax fairness online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit limited-equity cooperative tax fairness. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out limited-equity cooperative tax fairness

How to fill out limited-equity cooperative tax fairness:

01

Gather all necessary documents: Start by collecting all the essential documents needed to complete the limited-equity cooperative tax fairness form. This may include income statements, expenses records, and any relevant financial documents.

02

Understand the tax regulations: Familiarize yourself with the tax regulations specific to limited-equity cooperatives. It is crucial to comprehend the guidelines and requirements for this type of organization to accurately fill out the tax form.

03

Determine your income and expenses: Calculate the total income and expenses for your limited-equity cooperative. Keep in mind that some expenses may be deductible, so make sure to properly categorize and document each item.

04

Report income: Enter the total income of the cooperative on the appropriate line of the tax form. This should include any rental income, investment earnings, or other sources of income related to the cooperative.

05

Deductible expenses: Identify any deductible expenses that your limited-equity cooperative incurred during the tax year. This may include maintenance costs, repairs, utilities, or any other expenses directly related to the operation of the cooperative.

06

Fill out the tax form: Carefully fill out each section of the limited-equity cooperative tax fairness form, ensuring accuracy and attention to detail. Double-check all figures and calculations before submitting the form.

Who needs limited-equity cooperative tax fairness:

01

Limited-equity cooperative members: Individuals who are part of a limited-equity cooperative and are responsible for managing its financial affairs may need to consider limited-equity cooperative tax fairness. This ensures compliance with tax regulations specific to this type of organization.

02

Cooperative management teams: Those responsible for overseeing the financial aspects of a limited-equity cooperative, such as board members or managers, need to understand and implement limited-equity cooperative tax fairness to accurately report income and expenses.

03

Tax professionals: Tax professionals who specialize in cooperative tax law may need to have a deep understanding of limited-equity cooperative tax fairness. They can provide guidance and assistance to cooperative members or management teams in properly completing the tax form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is limited-equity cooperative tax fairness?

Limited-equity cooperative tax fairness refers to tax regulations that are designed to provide tax benefits to limited-equity housing cooperatives.

Who is required to file limited-equity cooperative tax fairness?

Limited-equity housing cooperatives are required to file limited-equity cooperative tax fairness.

How to fill out limited-equity cooperative tax fairness?

Limited-equity cooperative tax fairness forms are typically filled out by providing relevant financial and ownership information of the cooperative.

What is the purpose of limited-equity cooperative tax fairness?

The purpose of limited-equity cooperative tax fairness is to provide tax benefits to housing cooperatives with limited equity, making housing more affordable for its members.

What information must be reported on limited-equity cooperative tax fairness?

Information such as financial statements, ownership details, and tax-related information must be reported on limited-equity cooperative tax fairness forms.

When is the deadline to file limited-equity cooperative tax fairness in 2023?

The deadline to file limited-equity cooperative tax fairness in 2023 is typically April 15th, unless extended by the IRS.

What is the penalty for the late filing of limited-equity cooperative tax fairness?

The penalty for late filing of limited-equity cooperative tax fairness can vary, but typically includes fines or interest charges on any taxes owed.

How can I manage my limited-equity cooperative tax fairness directly from Gmail?

Using pdfFiller's Gmail add-on, you can edit, fill out, and sign your limited-equity cooperative tax fairness and other papers directly in your email. You may get it through Google Workspace Marketplace. Make better use of your time by handling your papers and eSignatures.

Where do I find limited-equity cooperative tax fairness?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the limited-equity cooperative tax fairness. Open it immediately and start altering it with sophisticated capabilities.

Can I create an eSignature for the limited-equity cooperative tax fairness in Gmail?

Create your eSignature using pdfFiller and then eSign your limited-equity cooperative tax fairness immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your limited-equity cooperative tax fairness online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.