Get the free CPA's Affidavit of Audit and Current Financial Ratio (SI 10) - dmv nv

Show details

Central Services and Records Division Processing Center 555 Wright Way Carson City, NV 89711 (775) 684-4491 Email: DMVSelfInsurance DMV.NV.gov CERTIFIED PUBLIC ACCOUNTANT S AFFIDAVIT OF AUDIT AND

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cpas affidavit of audit

Edit your cpas affidavit of audit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cpas affidavit of audit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cpas affidavit of audit online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit cpas affidavit of audit. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cpas affidavit of audit

How to fill out cpas affidavit of audit:

01

Obtain the correct form: The cpas affidavit of audit is usually provided by the Certified Public Accountant (CPA) who conducted the audit. Make sure you have the most recent version of the form.

02

Read the instructions: Before filling out the cpas affidavit of audit, carefully read the accompanying instructions. These instructions will guide you through the process and provide important information about what should be included in each section.

03

Provide identification details: Begin by providing your name, address, contact information, and any other requested identification details at the top of the form. Ensure that all the information is accurate and up to date.

04

State the purpose of the audit: In the designated section, explain the purpose of the audit in clear and concise language. This may involve providing information about the entity or organization being audited, the specific time period covered, and the reason for conducting the audit.

05

Present your findings: The cpas affidavit of audit requires you to summarize the findings of the audit. Include any significant observations, conclusions, and recommendations that resulted from the audit process. Be thorough in your explanations and provide supporting evidence where necessary.

06

Sign and date the affidavit: At the end of the form, you will typically be required to sign and date the cpas affidavit of audit. This signature verifies that the information provided is accurate and complete to the best of your knowledge.

Who needs cpas affidavit of audit?

01

Organizations undergoing financial audits: Businesses, nonprofit organizations, government agencies, and other entities may require a cpas affidavit of audit to confirm the accuracy and reliability of their financial statements.

02

Regulatory bodies: Various regulatory bodies or government agencies may request a cpas affidavit of audit as part of their oversight or compliance procedures. These affidavits help ensure that organizations are adhering to applicable laws, regulations, and standards.

03

Shareholders and stakeholders: Companies with shareholders or stakeholders may need to provide a cpas affidavit of audit to instill confidence in investors and demonstrate the financial health and integrity of the organization.

04

Lenders and creditors: Financial institutions and creditors often require a cpas affidavit of audit before granting loans or extending credit. This document helps them assess the creditworthiness and risk associated with the borrower.

05

Legal proceedings: In certain legal cases, such as disputes involving financial matters or fraud investigations, a cpas affidavit of audit may be requested to present expert opinion and evidence regarding financial statements or records.

It is important to consult with a professional CPA or legal advisor to ensure that you fully understand the requirements and implications of filling out a cpas affidavit of audit in your specific situation.

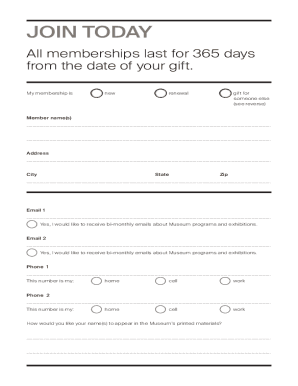

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cpas affidavit of audit?

CPAs affidavit of audit is a document that certifies the accuracy of the financial statements prepared by a certified public accountant.

Who is required to file cpas affidavit of audit?

Companies or organizations that are required by law or regulation to have an audit conducted by a certified public accountant.

How to fill out cpas affidavit of audit?

The CPAs affidavit of audit can be filled out by providing all relevant financial information and any required disclosures, and then signed by the certified public accountant.

What is the purpose of cpas affidavit of audit?

The purpose of CPAs affidavit of audit is to provide assurance to stakeholders that the financial statements are accurate and have been audited by a qualified professional.

What information must be reported on cpas affidavit of audit?

The CPAs affidavit of audit must report on the financial statements, any material misstatements, and the auditor's opinion on the accuracy of the statements.

Can I create an eSignature for the cpas affidavit of audit in Gmail?

Create your eSignature using pdfFiller and then eSign your cpas affidavit of audit immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How can I edit cpas affidavit of audit on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing cpas affidavit of audit, you need to install and log in to the app.

How can I fill out cpas affidavit of audit on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your cpas affidavit of audit. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

Fill out your cpas affidavit of audit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cpas Affidavit Of Audit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.