Get the free Credit Card Policy and Payment Agreement

Show details

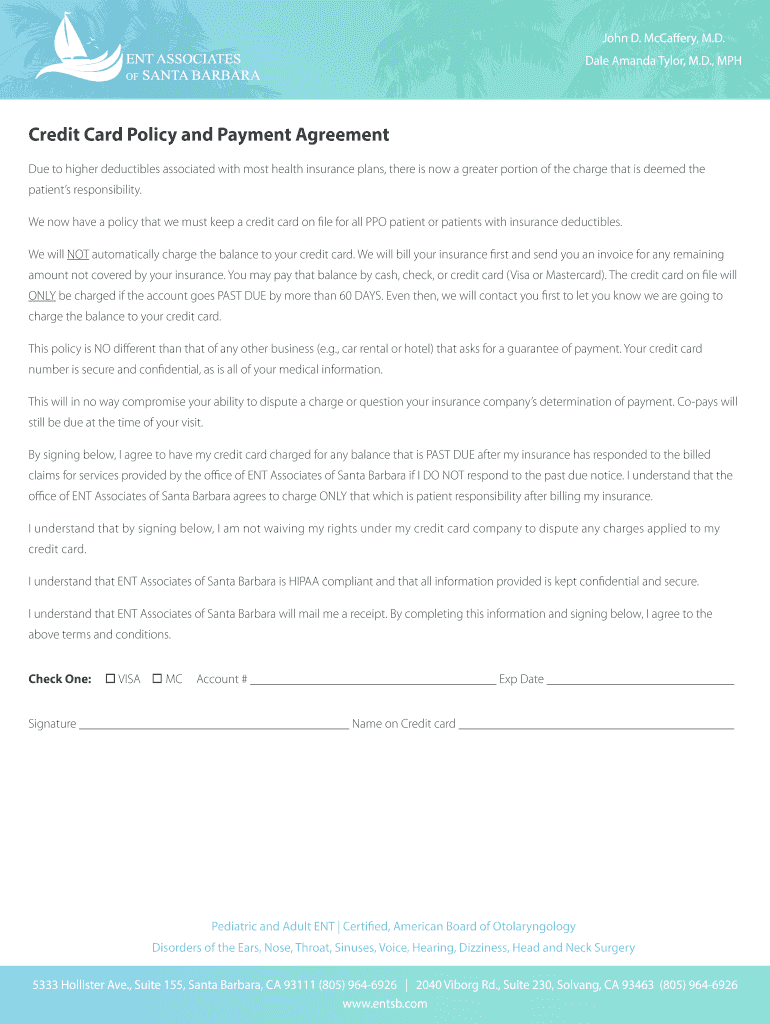

John D. McGuffey, M.D.

Dale Amanda Taylor, M.D., Credit Card Policy and Payment Agreement

Due to higher deductibles associated with most health insurance plans, there is now a greater portion of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card policy and

Edit your credit card policy and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card policy and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card policy and online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit card policy and. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card policy and

How to fill out credit card policy and

01

Gather all necessary information such as credit card provider information, policy guidelines, and relevant legal requirements.

02

Begin by outlining the purpose of the policy and its scope. Specify whether it applies to all employees or specific departments.

03

Clearly define the credit card usage guidelines and restrictions. Include information on how the cards should be used for business expenses only.

04

Specify the credit limits and spending thresholds that employees must adhere to. Clearly explain the consequences of exceeding those limits.

05

Include details about the process of applying for a credit card, including the required documentation and approvals.

06

Outline the procedures for reporting lost or stolen credit cards and the immediate actions that employees must take.

07

Provide instructions on how to reconcile credit card statements and the necessary documentation that employees must submit for reimbursement.

08

Specify the consequences of policy violations and the disciplinary actions that may be taken in case of non-compliance.

09

Review and proofread the policy to ensure clarity and accuracy. Make sure to obtain necessary approvals before implementing the policy.

10

Communicate the credit card policy to all employees and provide training on its contents.

Who needs credit card policy and?

01

Any organization that provides its employees with company credit cards requires a credit card policy.

02

Companies that want to establish clear guidelines for credit card usage, expense reporting, and reimbursement would benefit from having a credit card policy.

03

Organizations that handle sensitive financial information or deal with a significant volume of financial transactions may also need a credit card policy to ensure proper controls and compliance.

04

Additionally, organizations that aim to minimize the risk of fraud, misuse, or unauthorized use of credit cards would find a credit card policy essential.

05

By implementing a credit card policy, employers can establish expectations, promote accountability and transparency, and ensure responsible use of company credit cards.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute credit card policy and online?

Easy online credit card policy and completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit credit card policy and on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign credit card policy and on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

How do I fill out credit card policy and on an Android device?

Complete credit card policy and and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

What is credit card policy and?

A credit card policy is a set of guidelines and regulations that dictate how credit card transactions are to be handled within an organization, including usage, approval processes, and reporting.

Who is required to file credit card policy and?

Typically, all departments within an organization that use credit cards for purchases must adhere to and file the credit card policy. This includes finance departments and any staff authorized to use credit cards on behalf of the organization.

How to fill out credit card policy and?

To fill out a credit card policy, organizations should outline the purpose, set guidelines for usage, detailed approval processes, and reporting requirements. Additionally, they should include any constraints on spending limits and consequences for misuse.

What is the purpose of credit card policy and?

The purpose of a credit card policy is to mitigate financial risk, ensure compliance with regulatory standards, provide clear usage guidelines, prevent fraud, and maintain proper internal controls over expenditures.

What information must be reported on credit card policy and?

Credit card policy must report on usage details such as transaction amounts, dates, merchant names, and the purpose of purchases. It should also include information on cardholders and any approvals required.

Fill out your credit card policy and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Policy And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.