MN DoR M1PR 2019 free printable template

Show details

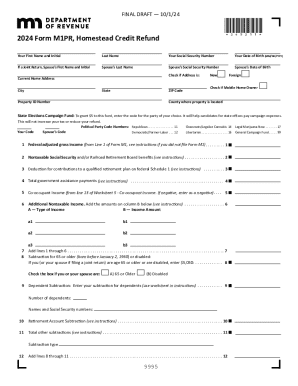

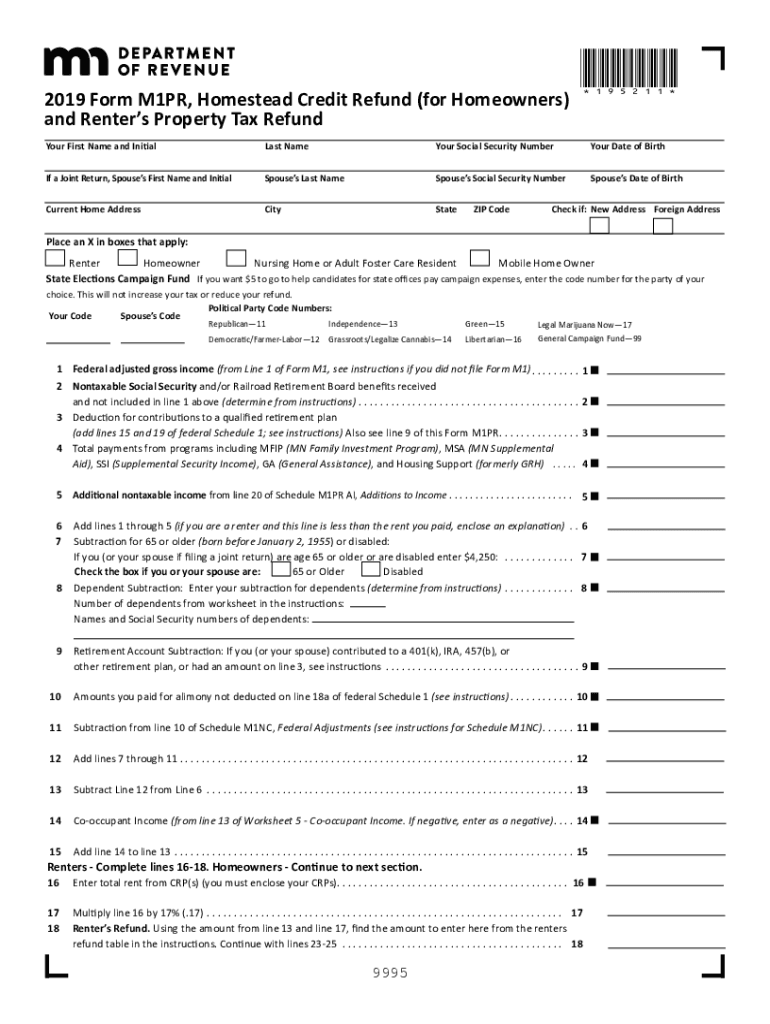

2018 Form M1PR Homestead Credit Refund for Homeowners and Renter s Property Tax Refund 185211 Leave unused boxes blank. If there is no amount on line 2 see instructions. 2 2 Special refund not your regular refund from line 12 of your 2017 Form M1PR.. 17 YOUR REFUND. Subtract line 16 from line 15. 17 2018 M1PR page 2 S chedule 1 Special refund. To qualify you must have owned and lived in this homestead both on January 2 2018 and on January 2 2019. Also see line 33 of this Form M1PR. 4 Total...

pdfFiller is not affiliated with any government organization

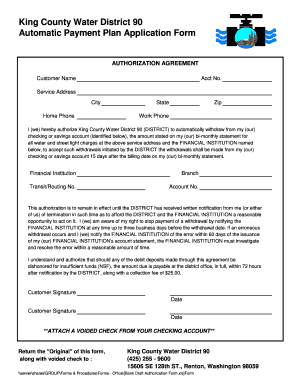

Get, Create, Make and Sign MN DoR M1PR

Edit your MN DoR M1PR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MN DoR M1PR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit MN DoR M1PR online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit MN DoR M1PR. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MN DoR M1PR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MN DoR M1PR

How to fill out MN DoR M1PR

01

Gather all necessary documents, including your tax return and income information.

02

Go to the MN Department of Revenue website and download the M1PR form.

03

Fill in your personal information, including your name, address, and Social Security number.

04

Indicate your filing status (single, married, etc.) as required.

05

Input your income details, including wages, unemployment compensation, and other sources of income.

06

Calculate your total income for the year.

07

Enter any deductions you are eligible for, such as property tax refunds.

08

Review your entries for accuracy.

09

Sign and date the form.

10

Submit the completed form by the deadline, either electronically or via mail.

Who needs MN DoR M1PR?

01

Minnesota residents who have paid property taxes on their primary residence.

02

Individuals who qualify for a property tax refund based on their income level.

03

Homeowners who wish to claim a refund for property tax overpayments.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my Minnesota property tax refund?

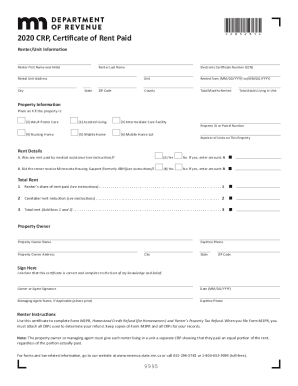

Complete and send us Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. If you are filing as a renter, include any Certificates of Rent Paid (CRPs) you received. See the Form M1PR instructions for filing details. Use our Where's My Refund?

How do I eFile a renters rebate in MN?

e-File your 2021 Minnesota Homestead Credit and Renter's Property Tax Refund return (Form M1PR) using eFile Express! Most calculations are automatically performed for you. Eliminate errors before submitting your return. Receive confirmation that your return was accepted. Get your refund as fast as Minnesota law allows*.

Who qualifies for MN property tax credit?

Your total household income (including a subtraction for dependents or if you are age 65 or older) for 2022 must be less than $69,520. The maximum refund is $2,440. You must have lived in a building in which property taxes were assessed or you made payments to a local government instead of property taxes.

What makes me eligible for a tax refund?

You will get a refund if you overpaid your taxes the year before. This can happen if your employer withholds too much from your paychecks (based on the information you provided on your W-4). If you're self-employed, you may get a refund if you overpaid your estimated quarterly taxes.

What is the income limit for MN property tax refund?

What are the maximums? For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

Can you file M1PR separately?

Yes, after completing the M1PR within the account, you can go to the E-file section of the account and electronically file the M1PR separately or with your other forms.

Can I efile form M1PR?

Your 2020 Form M1PR should be mailed, delivered, or electronically filed with the department by August 13, 2021.

Can I eFile MN property tax refund?

There are different ways to file your Property Tax Refund. The due date is August 15. You may file up to one year after the due date. You may be able to file for free using our Property Tax Refund Online Filing System.

Does everyone get a property tax refund in MN?

The Minnesota Homestead Credit Refund can provide relief to homeowners paying property taxes. To qualify, you must: Have a valid Social Security Number.Homeowner's Homestead Credit Refund. Type of refundRegularRequirements to claim the refundYou owned and lived in your home on January 2, 2022 Your household income for 2021 was less than $119,790 May 20, 2022

Where do I send my M1PR in MN?

Mail to: Minnesota Property Tax Refund St. Paul, MN 55145-0020 Renters — Include your 2020 CRP(s).

Is it too late to file renters rebate MN?

You can file up to 1 year late. To claim your 2021 refund, you have until August 15, 2023 to file.

What is IRS Form M1PR?

Complete and send us Form M1PR, Homestead Credit Refund (for Homeowners) and Renter's Property Tax Refund. If you are filing as a renter, include any Certificates of Rent Paid (CRPs) you received. See the Form M1PR instructions for filing details.

What is MN property tax refund based on?

For refund claims filed in 2022, based on property taxes payable in 2022 and 2021 household income, the maximum refund is $2,930. Homeowners whose income exceeds $119,790 are not eligible for a refund.

How do I qualify for MN property tax refund?

To qualify, all of these must be true: You spent at least 183 days in Minnesota during the year. You cannot be claimed as a dependent on someone else's tax return. Your property was assessed property taxes or the owner made payments in lieu of property taxes.

What is the deadline for filing M1PR?

Your 2021 return should be electronically filed, postmarked, or dropped off by August 15, 2022. The final deadline to claim the 2021 refund is August 15, 2023.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MN DoR M1PR in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing MN DoR M1PR and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my MN DoR M1PR in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your MN DoR M1PR and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out the MN DoR M1PR form on my smartphone?

Use the pdfFiller mobile app to fill out and sign MN DoR M1PR on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is MN DoR M1PR?

MN DoR M1PR is the Minnesota Department of Revenue's form used for claiming a property tax refund for certain homeowners and renters in the state of Minnesota.

Who is required to file MN DoR M1PR?

Individuals who either own a home or rent an apartment in Minnesota and meet specific income and eligibility criteria are required to file MN DoR M1PR to claim a property tax refund.

How to fill out MN DoR M1PR?

To fill out MN DoR M1PR, individuals must provide personal information, details about their income, property taxes paid, and whether they owned or rented their home for the tax year in question. It is important to follow the instructions provided with the form.

What is the purpose of MN DoR M1PR?

The purpose of MN DoR M1PR is to provide financial relief to eligible homeowners and renters in Minnesota by allowing them to claim refunds on property taxes.

What information must be reported on MN DoR M1PR?

The MN DoR M1PR requires reporting of personal information, total income, property tax amounts paid, rental costs, and information about the property or rental situation for the tax year.

Fill out your MN DoR M1PR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MN DoR m1pr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.