Get the free Indiana Tax Court Rules - Clinton County Government

Show details

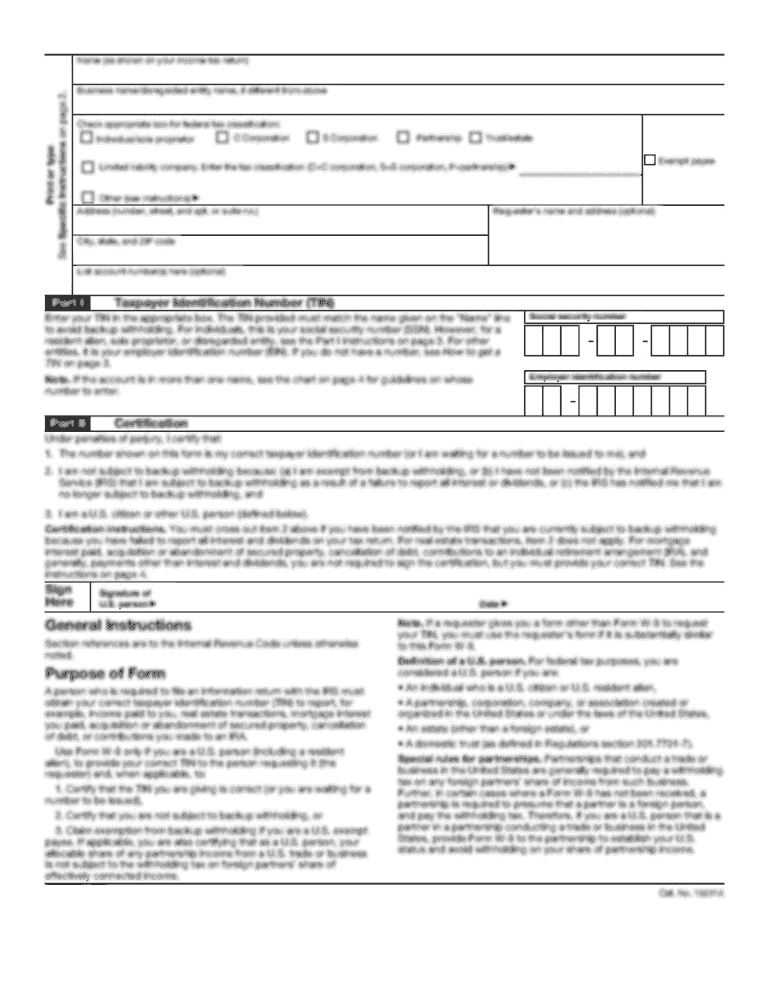

Indiana Rules of Court Tax Court Rules Effective July 1, 1986, Including Amendments made through January 1, 2010, TABLE OF CONTENTS Rule 1. Scope of the rules ............................................................................................................................................................

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your indiana tax court rules form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your indiana tax court rules form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing indiana tax court rules online

To use our professional PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit indiana tax court rules. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out indiana tax court rules

How to fill out Indiana tax court rules:

01

Familiarize yourself with the Indiana tax court rules by reading and understanding the rules and regulations document provided by the court. This will help you understand the procedures and requirements for filing and submitting documents.

02

Determine if you are eligible to file a case in the Indiana tax court. The court has jurisdiction over certain tax-related matters, such as appeals of tax assessments and disputes between taxpayers and government agencies. Make sure your case falls within the court's jurisdiction.

03

Collect all relevant documents and information related to your tax case. This may include tax returns, assessment notices, correspondence with tax authorities, and any other supporting documents. Organize these documents in a logical order for easy reference.

04

Prepare the necessary forms and pleadings required by the Indiana tax court. These may include petitions, motions, responses, and any other legal documents that need to be filed with the court. Follow the instructions provided by the court and ensure that all necessary information is included accurately.

05

Pay attention to deadlines. The Indiana tax court has specific deadlines for filing documents and responding to motions. Make sure to adhere to these deadlines to avoid any penalties or delays in your case.

06

File your documents with the appropriate court clerk. Make sure to follow the court's instructions on how to file, whether it is in person, by mail, or electronically. Keep copies of all filed documents for your records.

07

Serve the opposing party with copies of the filed documents if required by the court rules. This ensures that all parties involved are aware of the case and have an opportunity to respond.

08

Attend all scheduled hearings and follow the court's instructions regarding court appearances. Be prepared to present your case, provide evidence, and answer any questions from the judge.

Who needs Indiana tax court rules?

01

Individuals or businesses who have a tax-related dispute with the government in Indiana may need to refer to the Indiana tax court rules. These rules provide guidance on how to file cases, present evidence, and follow the procedural requirements of the tax court system.

02

Tax professionals, such as accountants, tax attorneys, and enrolled agents, who represent clients in tax disputes may also need to be familiar with the Indiana tax court rules. Understanding these rules can help them effectively navigate the court system and advocate for their clients.

03

Anyone who wants to understand their rights and responsibilities when it comes to tax matters in Indiana may find it useful to refer to the Indiana tax court rules. These rules provide transparency and clarity regarding the procedures and processes of the tax court, ensuring that all individuals involved are aware of their rights and obligations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is indiana tax court rules?

The Indiana Tax Court Rules are the rules that govern the procedures and practices of the Indiana Tax Court.

Who is required to file indiana tax court rules?

Those who have a tax dispute in Indiana and wish to have it resolved by the Indiana Tax Court are required to follow the Indiana Tax Court Rules.

How to fill out indiana tax court rules?

The Indiana Tax Court Rules can be filled out by following the instructions provided in the rules themselves.

What is the purpose of indiana tax court rules?

The purpose of the Indiana Tax Court Rules is to ensure fair and consistent administration of tax laws in Indiana.

What information must be reported on indiana tax court rules?

The information that must be reported on the Indiana Tax Court Rules includes details of the tax dispute, supporting documentation, and any relevant legal arguments.

When is the deadline to file indiana tax court rules in 2023?

The deadline to file Indiana Tax Court Rules in 2023 is normally determined by the court and specified in the rules.

What is the penalty for the late filing of indiana tax court rules?

The penalty for late filing of Indiana Tax Court Rules may result in dismissal of the case or other sanctions as determined by the court.

How can I edit indiana tax court rules on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing indiana tax court rules.

Can I edit indiana tax court rules on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share indiana tax court rules from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

How do I fill out indiana tax court rules on an Android device?

Complete indiana tax court rules and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your indiana tax court rules online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.