VA SCC544 2020-2025 free printable template

Show details

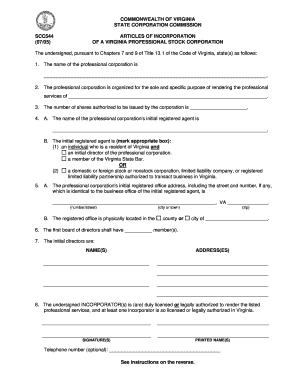

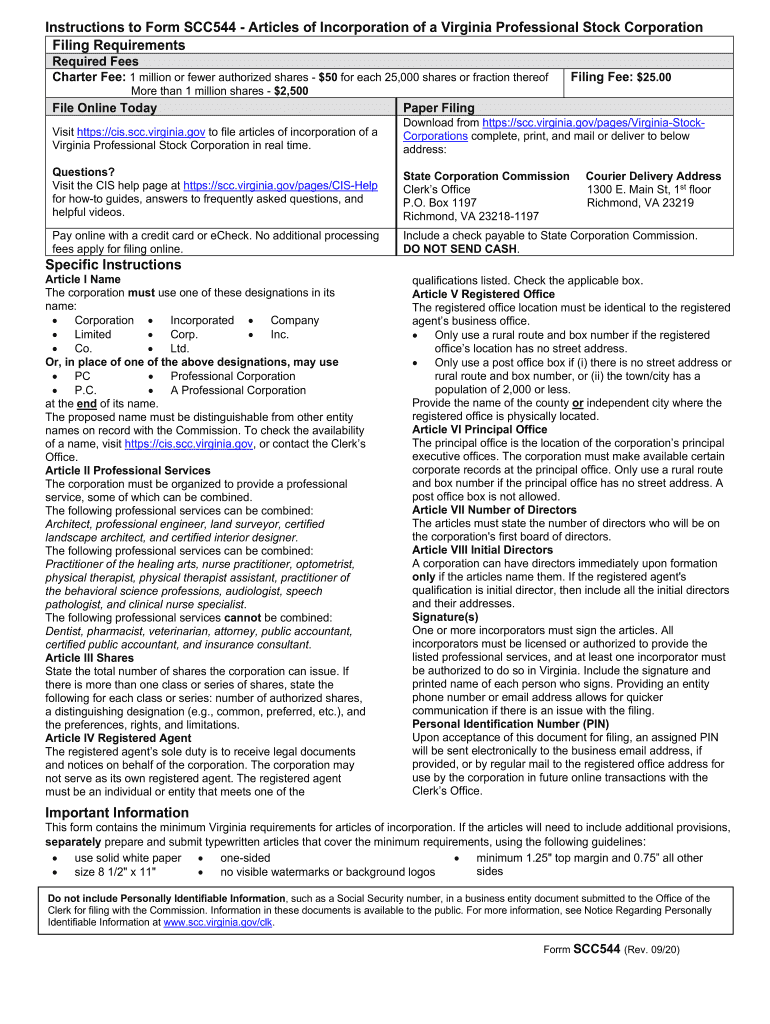

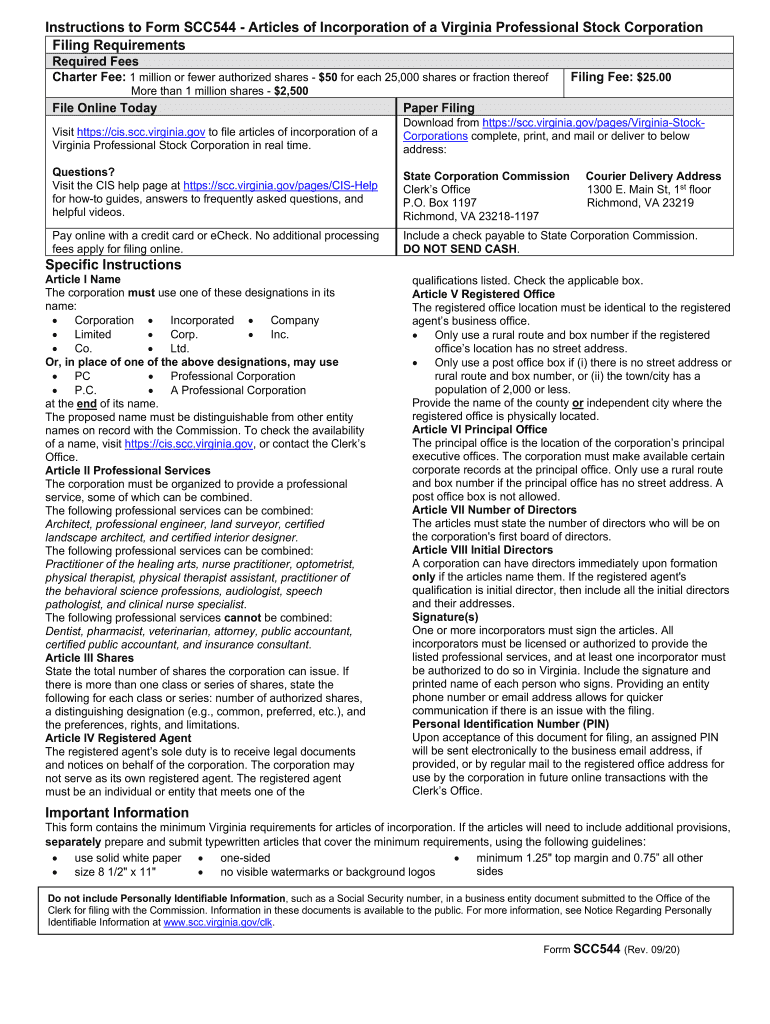

Instructions to Form SCC544 Articles of Incorporation of a Virginia Professional Stock Corporation Filing Requirements Required Fees Charter Fee: 1 million or fewer authorized shares $50 for each

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign VA SCC544

Edit your VA SCC544 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your VA SCC544 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit VA SCC544 online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit VA SCC544. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

VA SCC544 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out VA SCC544

How to fill out VA SCC544

01

Obtain a copy of VA Form SCC544 from the official VA website or your local VA office.

02

Read the instructions carefully to understand each section of the form.

03

Provide your personal identification information, including your full name, address, and contact details.

04

Fill out the detailed information about your military service, including dates of service and branch.

05

Specify the type of benefits or services you are seeking assistance with.

06

Review the completed form for accuracy and completeness.

07

Sign and date the form to certify that the information provided is correct.

08

Submit the form through the appropriate channels as indicated in the instructions.

Who needs VA SCC544?

01

Individuals seeking VA benefits or services who have served in the military.

02

Veterans who need to provide documentation of their service for claims or assistance.

03

Survivors or dependents of veterans applying for specific VA programs.

Fill

form

: Try Risk Free

People Also Ask about

What is the IRS form for involuntary conversion?

Use Form 4797 to report: The sale or exchange of property. The involuntary conversion of property and capital assets.

What is the IRS Code 544?

Stock owned, directly or indirectly, by or for a corporation, partnership, estate, or trust shall be considered as being owned proportionately by its shareholders, partners, or beneficiaries.

How do I report involuntary conversion on 4797?

To stop the item from depreciating, a date sold must be entered. If the asset involved in the involuntary conversion should be reported on Form 4797, the following items are required to be entered: date sold, sale price (even if zero), property type, and the involuntary conversion checkbox must be marked.

How do you treat involuntary conversion on tax return?

Gain or loss from an involuntary conversion of your property is usually recognized for tax purposes unless the property is your main home. You report the gain or deduct the loss on your tax return for the year you realize it.

What is an example of depreciation recapture?

Examples of Depreciation Recapture The adjusted cost basis will be $1,000,000 – ($5,000 * 5) = $975,000. The gain from the sale will be the adjusted cost basis subtracted from the sale price: $990,000 – $975,000 = $15,000. As a result, when filing taxes, the property owner will need to file $15,000 in ordinary income.

What is the IRS abandonment of assets?

An abandonment of property is not treated as a sale or exchange. Thus, an abandonment loss is an ordinary loss regardless of whether or not the abandoned asset is a capital asset. The loss is reported on Form 4797 ( IRS Pub. 544).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify VA SCC544 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including VA SCC544. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit VA SCC544 on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign VA SCC544. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Can I edit VA SCC544 on an Android device?

You can make any changes to PDF files, such as VA SCC544, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is VA SCC544?

VA SCC544 is a document used to register a business as a sole proprietorship or partnership in the state of Virginia.

Who is required to file VA SCC544?

Any individual or business entity that intends to conduct business in Virginia under a trade name or conducting business as a sole proprietorship or partnership must file VA SCC544.

How to fill out VA SCC544?

To fill out VA SCC544, provide your business name, your name and address, the type of business, and any relevant legal information. Make sure to follow the instructions provided with the form.

What is the purpose of VA SCC544?

The purpose of VA SCC544 is to officially register a business in Virginia, ensuring legal recognition and compliance with state regulations.

What information must be reported on VA SCC544?

The VA SCC544 requires reporting the business name, owner's name and address, type of business entity, and other pertinent details necessary for registration.

Fill out your VA SCC544 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

VA scc544 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.