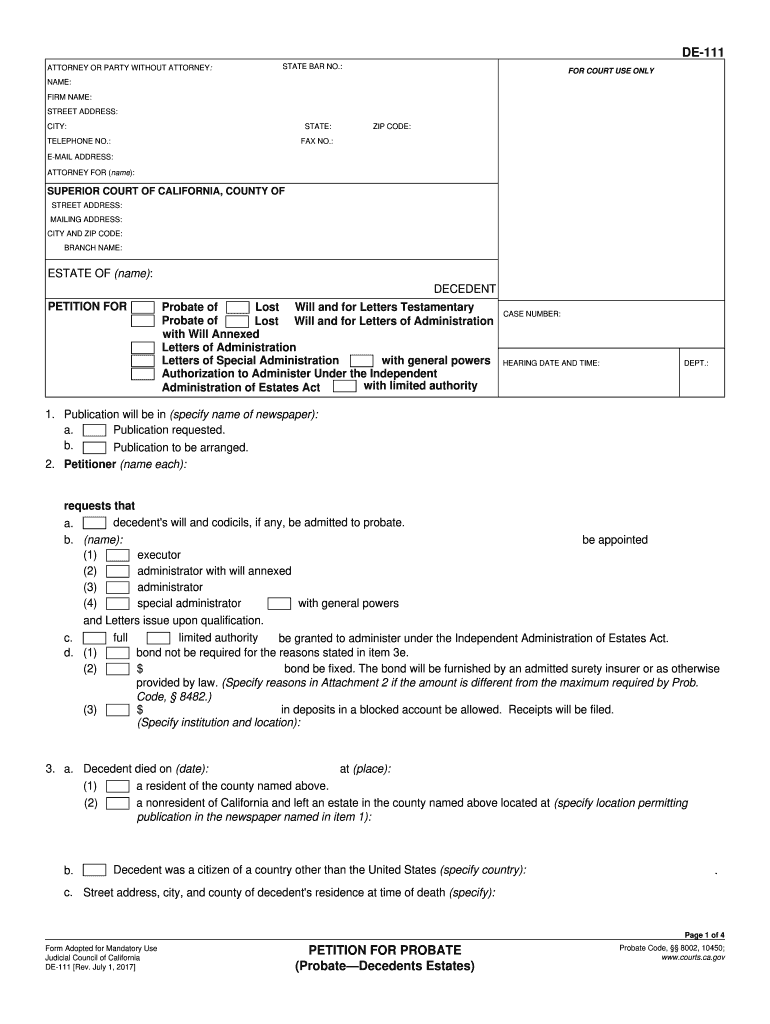

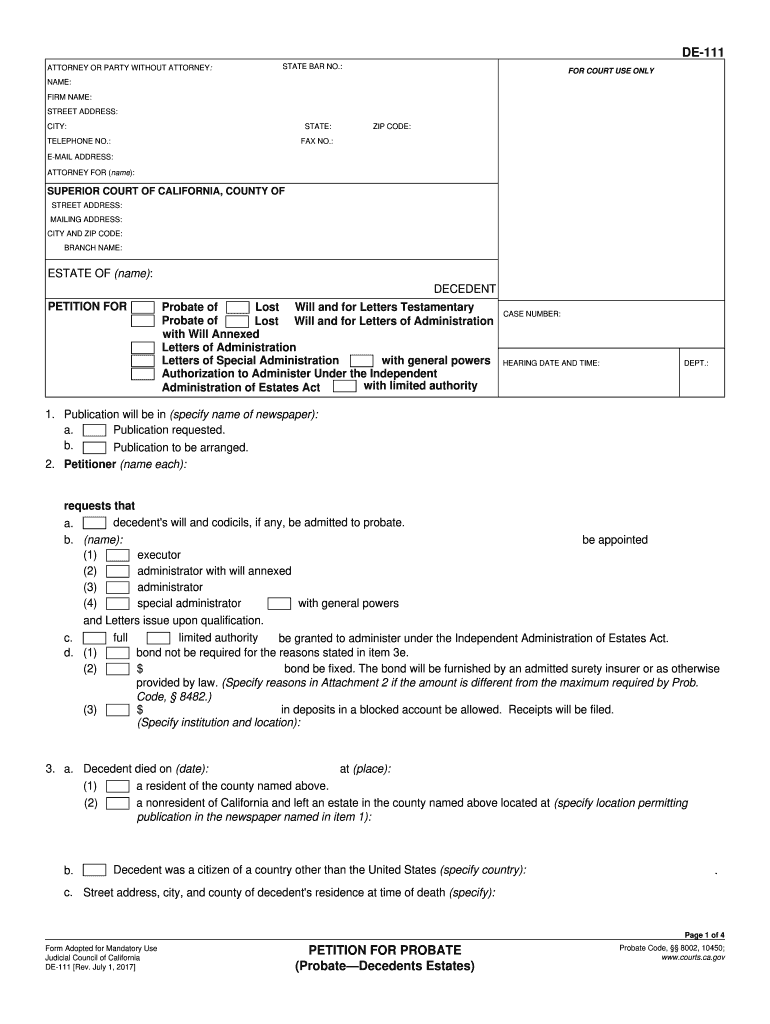

CA DE-111 2008 free printable template

Get, Create, Make and Sign

How to edit california form 111 2008-2019 online

CA DE-111 Form Versions

How to fill out california form 111 2008-2019

How to fill out California form 111 2008-2019:

Who needs California form 111 2008-2019:

Instructions and Help about california form 111 2008-2019

Hi this is Keith Davidson of Albertson Davidson I wanted to take a minute to walk you through a petition for probate the nice thing is that the petition is a pre-printed form, so it looks easy to complete, but there are a few tricky parts of it, so you need to look through the form very carefully and make sure that you have all the correct information before you file it with the court so let's take a look at a petition for probate and see how you're supposed to complete one first you need to find a petition for probate you can go to our website and click on the blog link at the top once on our blog you can simply scroll down to the topics and choose the probate topic scroll down there's a few different articles that we've posted and here's our blog post on California probate forms you can see that we've listed all the most common probate forms right here many of them you'll be using throughout the probate process let's start with the petition for probate this is the forum petition for probate this is the form that you're going to use anytime you have to file a probate in California you start off by placing your name in the upper box I'm going to use the name Bob Smith and because he doesn't have a lawyer he'll be appearing pro per then you put in your address you can also put in your telephone number fax number and email address in our example Bob Smith is representing himself, so we'll put his name here as well and then fill in the county where the petition will be filed we'll use Riverside as an example you'll put in the street address of the court which you can find online at the courts website and the mailing address which often is the same address you also put in the branch name of the court again you can find that on the courts' website, and then we'll fill in the name of the estate this is the name of the decedent, and we'll use the name Mary Smith for our example now we have to select the type of partition we are filing the first option is if you have a will the second option is if you have a will, but the named executor is not acting the third option is if the decedent died without a will you can also ask for a special administration, and you can ask to act with full authority you should check this box even if you're not sure whether the court will grant it just to be on the safe side you'll select the publication will be arranged you'll check if you're going to attach the will there is a little, and then you have to type in the name of the person who wants to be appointed as executor in our example it's Bob Smith, and we'll say that he is named in the will, so he actually will be named executor we're asking that he received full powers, and we're asking whether he needs to have a bond oftentimes a will waive a bond, so we'll select that option we'll put in the date of death on item number three and the place at which death occurred will then select that the decedent was a resident of this county, and then you have to type in the...

Fill form : Try Risk Free

People Also Ask about california form 111 2008-2019

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your california form 111 2008-2019 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.