Get the free CLIENT-PAID EXPENSE FORM

Show details

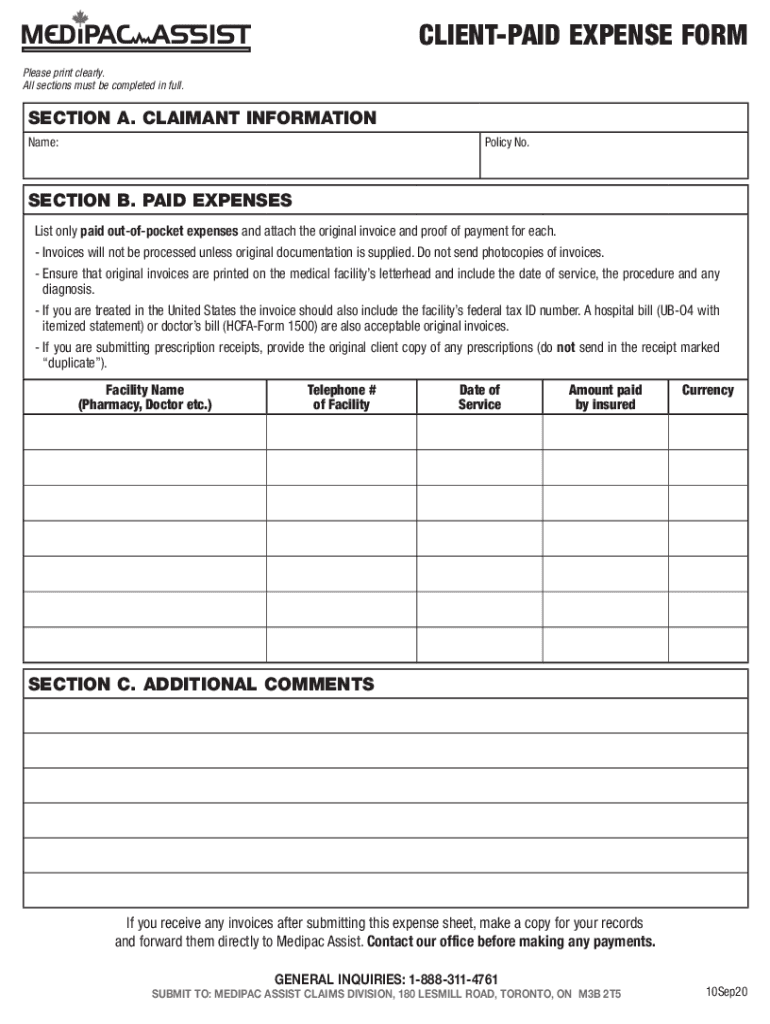

CLIENTPAID EXPENSE FORM Please print clearly. All sections must be completed in full. SECTION A. CLAIMANT INFORMATION Name:Policy No. SECTION B. PAID EXPENSES List only paid outofpocket expenses and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign client-paid expense form

Edit your client-paid expense form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your client-paid expense form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit client-paid expense form online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in to your account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit client-paid expense form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out client-paid expense form

How to fill out client-paid expense form

01

Start by entering the client's information, such as their name, contact details, and client ID.

02

Specify the date and purpose of the expenses incurred by the client.

03

Next, itemize the expenses in detail, including the date, description, quantity, unit price, and total amount for each item.

04

If applicable, attach any supporting documentation for the expenses, such as receipts or invoices.

05

Calculate the subtotal amount by summing up all the individual expenses.

06

Deduct any applicable taxes or discounts from the subtotal to arrive at the total amount payable by the client.

07

Provide payment instructions or details, including the preferred payment method and any specific terms or conditions.

08

Finally, review the form for accuracy and completeness before submitting it to the appropriate department or person for further processing.

Who needs client-paid expense form?

01

Any client who has incurred expenses that are eligible for reimbursement from the company.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit client-paid expense form from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your client-paid expense form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I send client-paid expense form for eSignature?

To distribute your client-paid expense form, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How can I fill out client-paid expense form on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your client-paid expense form, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is client-paid expense form?

The client-paid expense form is a document used by businesses to report expenses that are paid on behalf of a client. This form helps in tracking and documenting the expenditures to ensure proper accounting and reimbursements.

Who is required to file client-paid expense form?

Typically, service providers, consultants, or professionals who incur expenses while providing services to clients are required to file the client-paid expense form.

How to fill out client-paid expense form?

To fill out the client-paid expense form, you must enter the client's information, detail the specific expenses incurred, provide receipts or proof of payment, and include any relevant dates and descriptions to justify the expenses.

What is the purpose of client-paid expense form?

The purpose of the client-paid expense form is to document and justify expenses incurred on behalf of a client, ensuring transparency and enabling clients to reimburse the service provider for costs that were necessary for delivering services.

What information must be reported on client-paid expense form?

The form should typically include the client's name, date of the expense, nature of the expense, total amount spent, receipts or documentation, and any other relevant notes explaining the expense.

Fill out your client-paid expense form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Client-Paid Expense Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.