Get the free MWWFA - Lifetime Allowance Declaration Form.doc. English

Show details

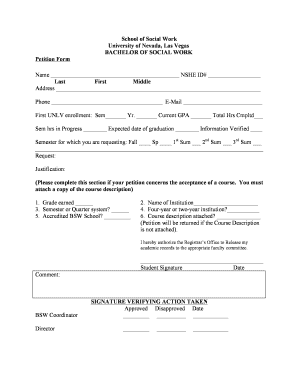

Finance Act 2004 Lifetime Allowance Declaration of benefits from all sources If the total amount of benefits due to a person from all registered pension schemes exceeds a Lifetime Allow an e” set

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your mwwfa - lifetime allowance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mwwfa - lifetime allowance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mwwfa - lifetime allowance online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit mwwfa - lifetime allowance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

How to fill out mwwfa - lifetime allowance

How to fill out mwwfa - lifetime allowance?

01

Gather all relevant information: Before filling out the mwwfa - lifetime allowance, make sure you have all the necessary information at hand. This includes your personal details, financial statements, and any relevant documentation related to your pension or investments.

02

Understand the guidelines: Familiarize yourself with the guidelines and rules surrounding the mwwfa - lifetime allowance. This will ensure that you fill out the form correctly and avoid any potential mistakes or penalties.

03

Provide accurate information: Ensure that you provide accurate and up-to-date information when filling out the mwwfa - lifetime allowance. Double-check all the details you enter, such as your name, address, date of birth, and pension portfolio information.

04

Seek professional guidance if needed: If you find the process of filling out the mwwfa - lifetime allowance confusing or overwhelming, it is recommended to seek professional guidance. A financial advisor or pension specialist can provide you with expert advice and assistance to ensure everything is completed accurately.

Who needs mwwfa - lifetime allowance?

01

Individuals with a significant pension pot: The mwwfa - lifetime allowance is relevant to individuals who have a substantial pension pot or retirement savings. This allowance sets a limit on the amount of tax-advantaged pension savings you can accumulate throughout your lifetime.

02

High-income earners nearing retirement: Those who are high-income earners and approaching retirement age may need to consider the mwwfa - lifetime allowance. This allowance ensures that individuals do not exceed the set limit on their pension savings, which could lead to tax penalties.

03

Individuals with multiple sources of retirement income: If you have multiple sources of retirement income, such as pension funds, investments, and other savings, it is important to understand and manage your mwwfa - lifetime allowance. This will help you avoid any unnecessary tax charges and optimize your retirement planning.

04

Employees contributing to workplace pension schemes: Employees who contribute to workplace pension schemes may also need to be aware of the mwwfa - lifetime allowance. It is essential to monitor your pension contributions and ensure they do not exceed the limit set by the allowance to avoid potential tax implications.

Remember, it is always advisable to consult with a qualified financial professional to assess your specific situation and determine whether the mwwfa - lifetime allowance is applicable to you.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mwwfa - lifetime allowance?

The mwwfa - lifetime allowance is the maximum amount of pension savings that can be built up over a lifetime without incurring an additional tax charge.

Who is required to file mwwfa - lifetime allowance?

Individuals with pension savings that exceed the mwwfa - lifetime allowance threshold are required to file mwwfa - lifetime allowance.

How to fill out mwwfa - lifetime allowance?

The mwwfa - lifetime allowance can be filled out online through the relevant tax authority's website or by submitting a paper form.

What is the purpose of mwwfa - lifetime allowance?

The purpose of the mwwfa - lifetime allowance is to limit the amount of tax-advantaged pension savings an individual can build up over their lifetime.

What information must be reported on mwwfa - lifetime allowance?

Information such as total pension savings, contributions, and any withdrawals must be reported on the mwwfa - lifetime allowance form.

When is the deadline to file mwwfa - lifetime allowance in 2023?

The deadline to file mwwfa - lifetime allowance in 2023 is typically April 5th of the following tax year.

What is the penalty for the late filing of mwwfa - lifetime allowance?

The penalty for late filing of mwwfa - lifetime allowance can vary, but typically includes financial penalties and potential additional taxes on pension savings.

How can I modify mwwfa - lifetime allowance without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like mwwfa - lifetime allowance, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How can I send mwwfa - lifetime allowance for eSignature?

When you're ready to share your mwwfa - lifetime allowance, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit mwwfa - lifetime allowance straight from my smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing mwwfa - lifetime allowance.

Fill out your mwwfa - lifetime allowance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.