Get the free Charitable TrustsInternal Revenue ServicePrivate FoundationsInternal Revenue Service...

Show details

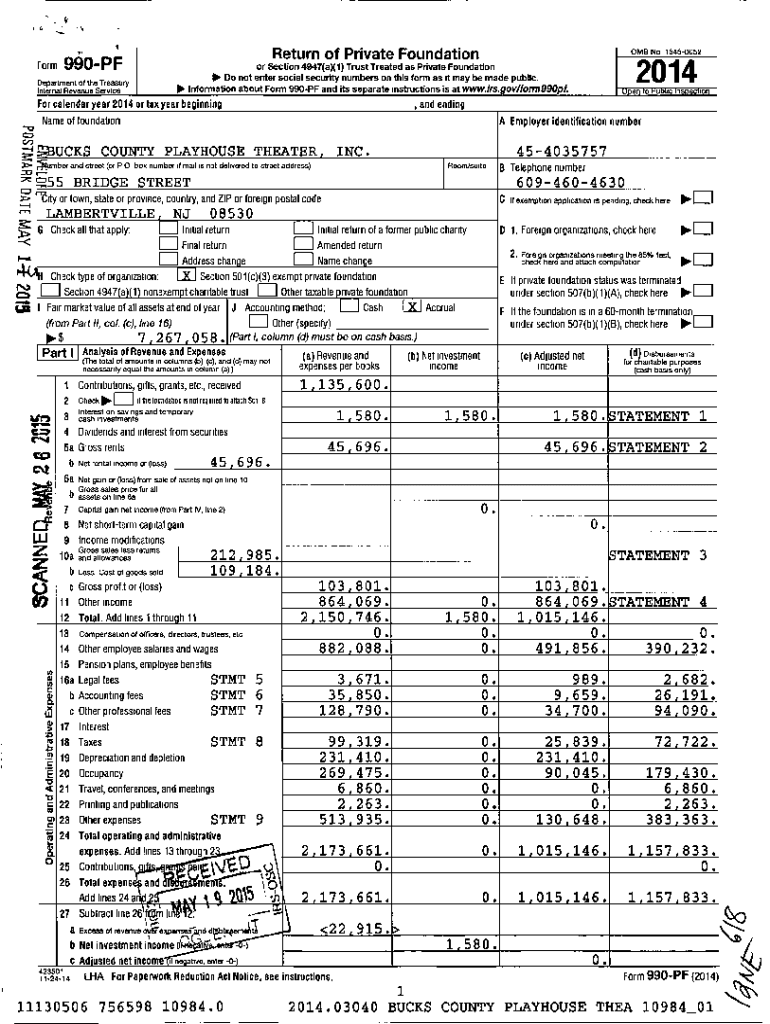

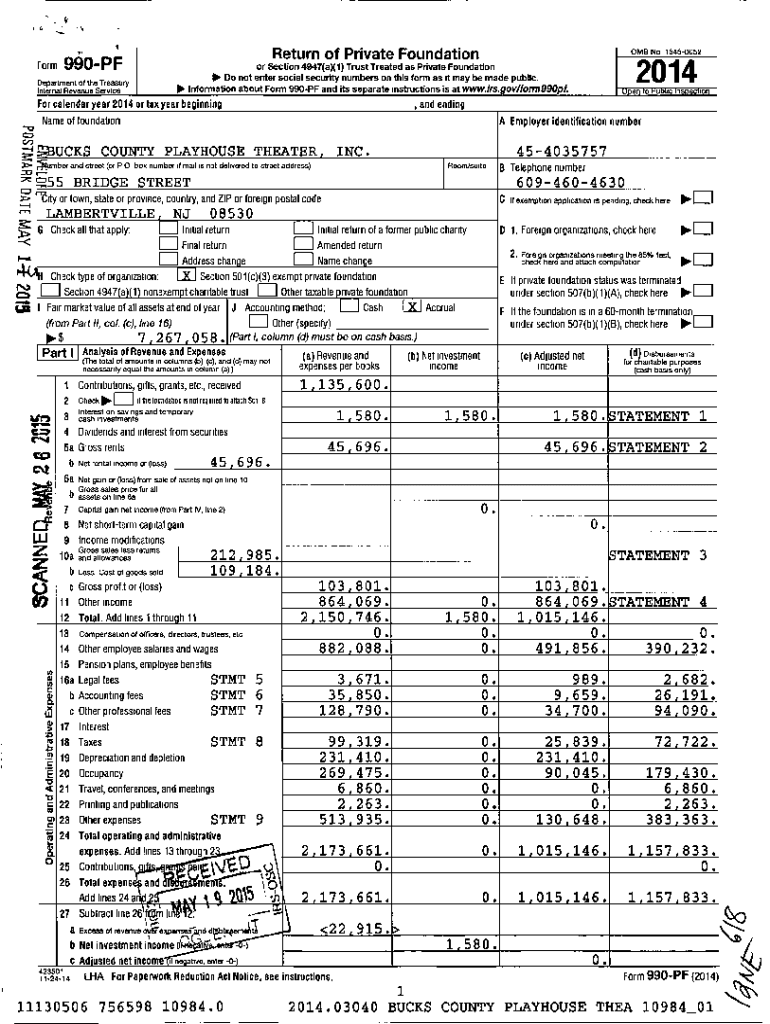

. oFormReturn of Private Foundation990PF2014or Section 4947(ax1) Trust Treated as Private Foundation Do not enter social security numbers on this form as it may be made public. Information about Form

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trustsinternal revenue serviceprivate

Edit your charitable trustsinternal revenue serviceprivate form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trustsinternal revenue serviceprivate form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable trustsinternal revenue serviceprivate online

Follow the steps down below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit charitable trustsinternal revenue serviceprivate. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trustsinternal revenue serviceprivate

How to fill out charitable trustsinternal revenue serviceprivate

01

To fill out charitable trusts, follow these steps:

02

Gather all necessary information: Before starting the process, collect all relevant information such as the name of the organization, its tax identification number, and details about the charitable assets.

03

Understand the legal requirements: Familiarize yourself with the guidelines provided by the Internal Revenue Service (IRS) regarding charitable trusts. Make sure to comply with all necessary regulations and procedures.

04

Determine the type of charitable trust: There are different types of charitable trusts, including charitable lead trusts and charitable remainder trusts. Choose the one that suits your specific intentions and goals.

05

Consult with legal and financial professionals: It is highly recommended to seek advice from professionals experienced in dealing with charitable trusts. They can help you navigate the legal and financial complexities involved.

06

Prepare necessary documents: Prepare the required legal documents, including trust agreements, tax forms, and beneficiary designations. Make sure to accurately fill out all the necessary information.

07

File with the Internal Revenue Service: Submit the completed forms and documents to the Internal Revenue Service for processing. Follow their guidelines for submission and keep copies for your records.

08

Monitor and update: Once the charitable trust is established, it is important to monitor its performance and ensure it remains in compliance with regulations. Regularly review and update the trust as needed.

09

Seek professional guidance periodically: As laws and regulations may change over time, consider seeking professional advice periodically to ensure your charitable trust remains up-to-date and effective.

Who needs charitable trustsinternal revenue serviceprivate?

01

Charitable trusts are beneficial for individuals or organizations looking to make charitable donations while receiving certain tax advantages. It can be useful for:

02

- High-net-worth individuals who wish to manage their assets and make a lasting impact through philanthropy.

03

- Organizations or foundations seeking to establish a permanent source of funding for charitable causes.

04

- Individuals who want to support specific charities or causes even after their lifetime.

05

- Donors who aim to minimize estate taxes and maximize the impact of their donations.

06

Overall, charitable trusts can be of interest to those who are passionate about giving back to their community and want to leave a philanthropic legacy.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the charitable trustsinternal revenue serviceprivate in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your charitable trustsinternal revenue serviceprivate in minutes.

How do I fill out charitable trustsinternal revenue serviceprivate using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign charitable trustsinternal revenue serviceprivate and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out charitable trustsinternal revenue serviceprivate on an Android device?

On an Android device, use the pdfFiller mobile app to finish your charitable trustsinternal revenue serviceprivate. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is charitable trustsinternal revenue serviceprivate?

Charitable trusts regulated by the Internal Revenue Service (IRS) are legal entities that hold and manage assets for charitable purposes, allowing donors to make tax-deductible contributions to support various philanthropic activities.

Who is required to file charitable trustsinternal revenue serviceprivate?

Generally, charitable trusts that have gross income of $100,000 or more or that have assets greater than $250,000 at the end of the year are required to file with the IRS.

How to fill out charitable trustsinternal revenue serviceprivate?

To fill out the required forms for charitable trusts, you must gather financial information related to income, expenses, and assets, and accurately complete Form 990 or Form 990-EZ as applicable, providing all necessary documentation.

What is the purpose of charitable trustsinternal revenue serviceprivate?

The purpose of charitable trusts is to provide a means for individuals to allocate and manage assets for charitable activities while benefiting from potential tax advantages.

What information must be reported on charitable trustsinternal revenue serviceprivate?

Charitable trusts must report their financial activities, including income, expenditures, program services, and balance sheet items, as well as details on governance, and compliance with applicable laws.

Fill out your charitable trustsinternal revenue serviceprivate online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trustsinternal Revenue Serviceprivate is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.