Get the free Charitable TrustsInternal Revenue ServiceCharitable TrustsInternal Revenue ServiceCh...

Show details

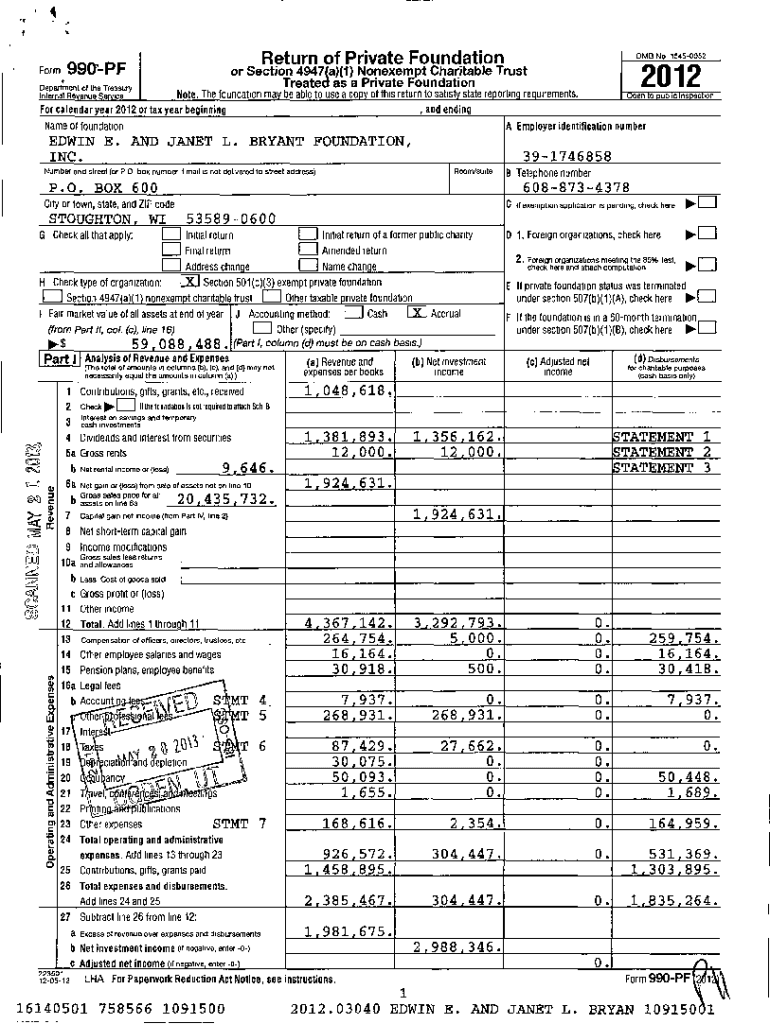

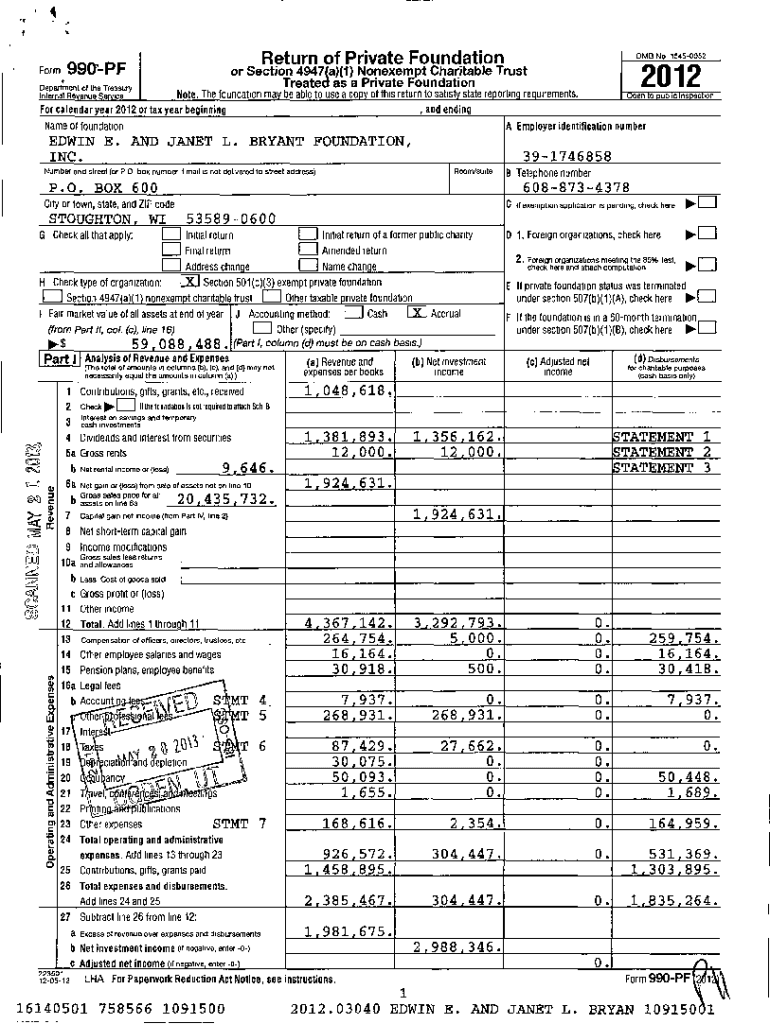

4Return of Private Foundation990PFFormor Section 49471a)(1) Nonexempt Charitable Trust Treated as a Private FoundationDepartment of the TreasuryNote. The foundation ma be able to use a co CIV of this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable trustsinternal revenue servicecharitable

Edit your charitable trustsinternal revenue servicecharitable form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable trustsinternal revenue servicecharitable form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit charitable trustsinternal revenue servicecharitable online

Follow the guidelines below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit charitable trustsinternal revenue servicecharitable. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable trustsinternal revenue servicecharitable

How to fill out charitable trustsinternal revenue servicecharitable

01

To fill out the charitable trustsinternal revenue servicecharitable form, follow these steps:

02

Start by providing your personal information, including your name, address, and social security number.

03

Indicate the type of charitable trust you are creating, whether it is a charitable lead trust or a charitable remainder trust.

04

Specify the beneficiaries of the trust and their relationship to you.

05

Provide details about the assets you are transferring to the trust, including their value and description.

06

Determine the terms and conditions of the trust, such as how income or assets will be distributed to beneficiaries.

07

Consider seeking guidance from a financial or legal professional to ensure you are completing the form accurately and meeting all requirements.

08

Review the completed form for accuracy and sign it before submitting it to the Internal Revenue Service (IRS).

09

Keep a copy of the completed form for your records.

Who needs charitable trustsinternal revenue servicecharitable?

01

Charitable trusts are commonly used by individuals or organizations who want to support charitable causes while also benefiting from certain tax advantages.

02

People who wish to leave a lasting legacy and make a substantial charitable contribution may consider setting up a charitable trust.

03

High net worth individuals who want to minimize their estate taxes and maximize their charitable giving may also find charitable trusts useful.

04

Nonprofit organizations may establish charitable trusts to receive donations and manage charitable funds.

05

Overall, anyone who desires to support charitable causes in a strategic and tax-efficient manner can benefit from charitable trusts.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my charitable trustsinternal revenue servicecharitable in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your charitable trustsinternal revenue servicecharitable right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How can I edit charitable trustsinternal revenue servicecharitable on a smartphone?

The best way to make changes to documents on a mobile device is to use pdfFiller's apps for iOS and Android. You may get them from the Apple Store and Google Play. Learn more about the apps here. To start editing charitable trustsinternal revenue servicecharitable, you need to install and log in to the app.

How do I fill out charitable trustsinternal revenue servicecharitable on an Android device?

Use the pdfFiller app for Android to finish your charitable trustsinternal revenue servicecharitable. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is charitable trusts internal revenue service charitable?

A charitable trust is a legal entity created to manage funds for charitable activities and benefits, operating under regulations set by the Internal Revenue Service (IRS).

Who is required to file charitable trusts internal revenue service charitable?

Charitable trusts are typically required to file financial reports with the IRS if they have tax-exempt status or are recognized as charitable organizations under section 501(c)(3) of the Internal Revenue Code.

How to fill out charitable trusts internal revenue service charitable?

To fill out a charitable trust form, you need to gather the required financial information, complete the IRS Form 990, providing details about income, expenses, and activities related to the trust.

What is the purpose of charitable trusts internal revenue service charitable?

The purpose of charitable trusts is to provide a legal mechanism to manage and distribute assets for charitable purposes, benefiting the public or specific groups while providing tax benefits.

What information must be reported on charitable trusts internal revenue service charitable?

Charitable trusts must report information including income, expenditures, program activities, compensation of officers, and any changes in trust assets on the applicable IRS forms.

Fill out your charitable trustsinternal revenue servicecharitable online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Trustsinternal Revenue Servicecharitable is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.