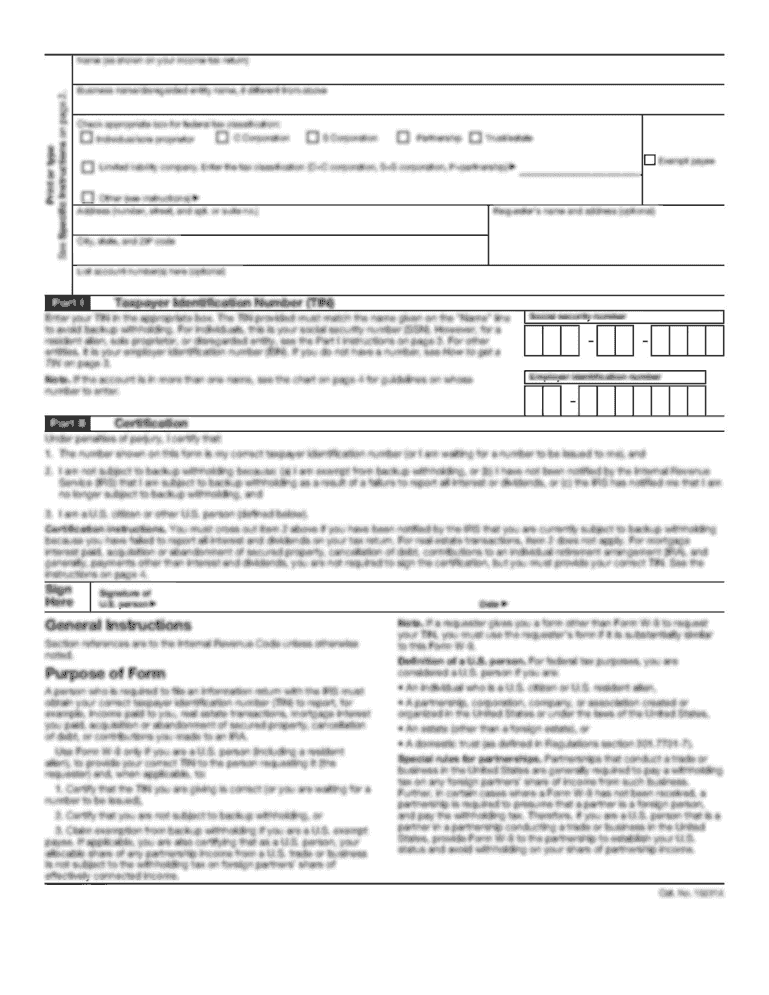

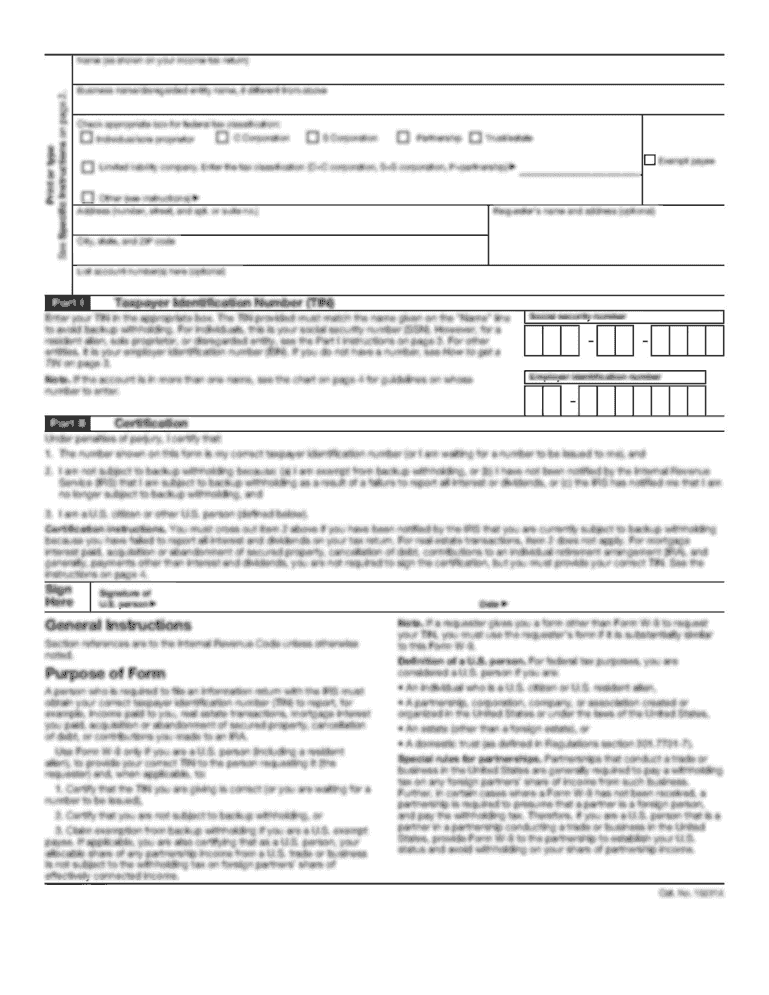

Get the free Loans after LIBOR -- what happens to consumers when the index ...

Show details

Firsthand Bank Limited (Registration Number 1929/001225/06) (Incorporated with limited liability in the Republic of South Africa) Issue of ZAR62,000,000 Senior Unsecured Indexed Rate Notes due 7 December

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loans after libor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loans after libor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loans after libor online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit loans after libor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out loans after libor

How to fill out loans after LIBOR:

01

Understand the transition: Familiarize yourself with the transition away from LIBOR and the new benchmark rates that will be used. Stay updated with the latest news and developments in this area.

02

Review loan agreements: Take a closer look at your existing loan agreements to identify any references to LIBOR. Determine whether there are specific fallback provisions or replacement rates already outlined in the agreement.

03

Contact your lender: Reach out to your lender to discuss the transition from LIBOR. Understand their plans for transitioning and inquire about any steps you need to take as a borrower.

04

Assess your options: Evaluate the various replacement rates available, such as the Secured Overnight Financing Rate (SOFR) or other alternatives that may suit your specific loan terms. Consider seeking professional advice to understand which rate is most suitable for your loan.

05

Evaluate potential impact: Assess the potential impact of the transition on your loan payments and interest rates. Determine whether there will be any adjustments to your loan terms and how it may affect your financial situation.

06

Modify loan agreements: Work with your lender to modify your loan agreements, incorporating the new benchmark rates. Be sure to understand any changes made and their implications on future payments.

07

Understand the transition timeline: Stay informed about the timeline for the transition away from LIBOR. Be aware of important deadlines and milestones to ensure a smooth transition for your loans.

08

Plan for adjustments: Prepare for possible adjustments in interest rates and loan terms as the transition progresses. Evaluate any potential financial implications and adapt your repayment strategy accordingly.

Who needs loans after LIBOR?

01

Individuals: Individuals may require loans after LIBOR if they are seeking funds for purchasing a house, car, or other personal expenses. They would need to understand the transition and how it may affect their loan terms and interest rates.

02

Businesses: Businesses that rely on loans for investment, expansion, or working capital may need loans after LIBOR. They would need to navigate the transition and consider the impact on their financials and loan obligations.

03

Financial Institutions: Financial institutions themselves may require loans after LIBOR as they adjust their own lending practices to align with the new benchmark rates. They would need to modify loan agreements and communicate with their borrowers regarding the transition.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loans after libor?

Loans after libor refer to loans that are adjusted or transitioned away from the LIBOR benchmark to a different reference rate.

Who is required to file loans after libor?

Financial institutions, banks, and any entity that has loans linked to LIBOR are required to file loans after libor.

How to fill out loans after libor?

To fill out loans after libor, one must provide information about the transition to a new reference rate, such as SOFR or SONIA, and any adjustments made to the loan terms.

What is the purpose of loans after libor?

The purpose of loans after libor is to ensure that lending continues smoothly even after the discontinuation of LIBOR and to mitigate any potential risks associated with the transition.

What information must be reported on loans after libor?

Information such as the new reference rate used, the spread adjustment, the calculation methodology, and any fallback provisions must be reported on loans after libor.

When is the deadline to file loans after libor in 2023?

The deadline to file loans after libor in 2023 is set to be announced by the relevant regulatory authorities closer to the time.

What is the penalty for the late filing of loans after libor?

The penalty for the late filing of loans after libor may vary depending on the jurisdiction and the specific circumstances, but it could involve fines, legal repercussions, or reputational damage.

How can I edit loans after libor from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your loans after libor into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get loans after libor?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the loans after libor in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How can I edit loans after libor on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit loans after libor.

Fill out your loans after libor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.