Get the free Credit Approval Form - Spokane Public Schools - spokaneschools

Show details

CREDIT APPROVAL FORMS These forms are no longer needed when turning in clock hours and credits for salary placement. Courses will be approved by HR ONLY IF the content of the course meet one of the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit approval form

Edit your credit approval form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit approval form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit approval form online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit credit approval form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit approval form

How to fill out a credit approval form:

01

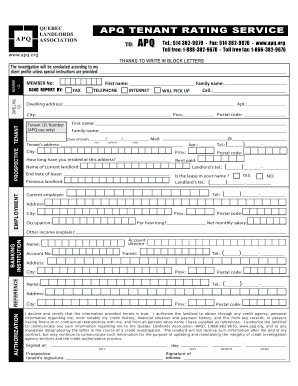

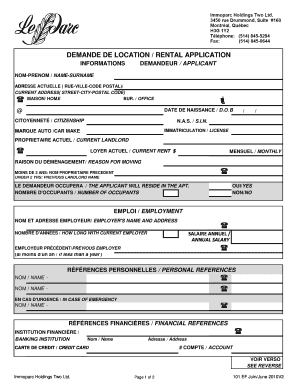

Begin by carefully reading through the credit approval form. This will help you understand the information that needs to be provided and any specific instructions given.

02

Start by filling out your personal information. This may include your full name, contact details (address, phone number, email), date of birth, and social security number. Ensure that you provide accurate and up-to-date information.

03

Next, provide details about your employment. This may include your current job title, employer's name and address, length of employment, and monthly income. Be sure to accurately state your employment details as this information helps assess your ability to repay the credit.

04

The credit approval form may require you to provide information about your current financial situation. This can include details about your monthly expenses, any outstanding debts, assets you own, and sources of income like investments, rental properties, or other sources of income.

05

If you have any existing credit accounts or loans, you may need to disclose them on the form. This helps the lender assess your creditworthiness and evaluate your ability to manage additional credit.

06

The credit approval form may also ask for references or emergency contacts. Provide accurate contact information for individuals who can vouch for your character and reliability.

07

Review the form once you have filled in all the required information. Make sure everything is accurate and complete. Double-check your contact details, employment information, financial details, and any other information mentioned in the form.

08

Finally, sign and date the credit approval form to certify that all the information provided is true and accurate to the best of your knowledge.

Who needs a credit approval form?

01

Individuals applying for credit from a lender, such as a bank, credit union, or financial institution, will need to complete a credit approval form. This form is typically required for various types of credit, including personal loans, mortgage loans, car loans, credit cards, and other credit products.

02

Businesses or companies seeking credit or financing may also need to fill out a credit approval form. This helps the lender assess the creditworthiness of the business and its ability to repay the borrowed funds.

03

Landlords or property management companies may require potential tenants to complete a credit approval form as part of the tenant screening process. This helps assess the tenant's financial stability and their ability to pay rent on time.

In summary, anyone seeking credit, whether it's an individual or a business, may need to fill out a credit approval form. These forms help lenders evaluate the applicant's financial situation and determine their creditworthiness before approving their credit request.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is credit approval form?

Credit approval form is a document used by lenders to assess the creditworthiness of a borrower before approving a loan.

Who is required to file credit approval form?

Borrowers who are applying for a loan are required to file a credit approval form with the lender.

How to fill out credit approval form?

The credit approval form typically requires borrowers to provide personal and financial information such as income, assets, debts, and credit history.

What is the purpose of credit approval form?

The purpose of the credit approval form is for lenders to evaluate the risk of lending money to a borrower and determine whether to approve the loan.

What information must be reported on credit approval form?

The credit approval form generally requires information on the borrower's personal details, employment status, financial assets, debts, and credit history.

How can I manage my credit approval form directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your credit approval form and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Can I create an electronic signature for the credit approval form in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your credit approval form.

How can I fill out credit approval form on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your credit approval form. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

Fill out your credit approval form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Approval Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.