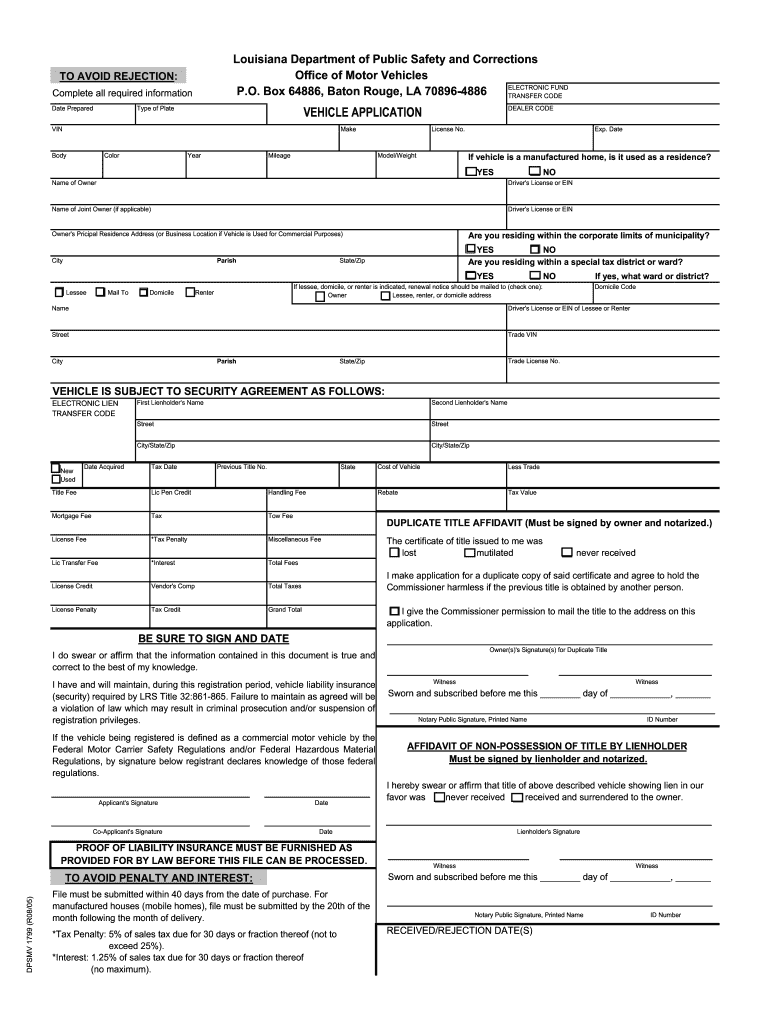

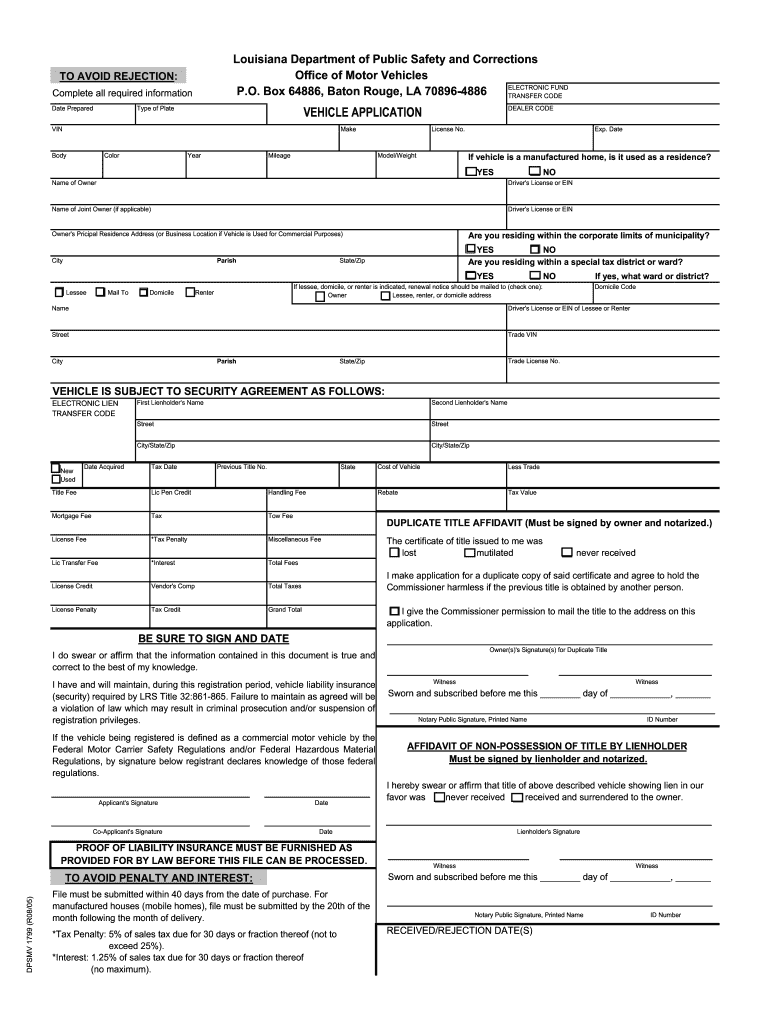

LA DPSMV 1799 2005 free printable template

Get, Create, Make and Sign

How to edit instructions for form 1799 online

LA DPSMV 1799 Form Versions

How to fill out instructions for form 1799

How to fill out instructions for form 1799?

Who needs instructions for form 1799?

Instructions and Help about instructions for form 1799

Hi this is Dave with AH one vehicle registration service also known as car registration City here in the city of Lucia today's lesson we're going to cover how to fill out the application for duplicate title so what are the occasions in which you would need to use the application for duplicate title well one occasion would be is if all you want is just a duplicate title and that said you know in other words you own this vehicle you don't have your title for whatever reason you just want to have it with you, you would just simply mark off duplicate title fill all sections one through three and that's it okay another case would be it say if you're going to transfer the vehicle over, and it could be your vehicle, or it could be the other person's vehicle, and you don't have the title you don't want to wait forward you just want to order to sell the vehicle you can go ahead and do a transfer without duplicate title the first thing you do is mark on the box up here transfer of title with duplicate next you get a first part of the form we're going to start from the top and work our way down your first one up here is going to be the license plate and if you can follow along with my mouse here you'll see it be the license plate information right here the next will be the VIN number in that VIN number is a 17-digit number combines of both numbers and letters and if you're not familiar where that's at if you have a car registration form it's going to be on the right-hand side if it's you don't have that then it'd be on your vehicle near the driver side and lower left-hand dashboard it's usually seen exactly from outside looking down next you're going to have over here your year make and vehicle okay, so you're just going to mark your year slash the make of the vehicle and then two-digit year is fine section one is going to be who the current owner of the vehicle is right now, so you'll put the current owners' information here and with mostly DMS paperwork that information is always going to be inputted with a last name first name and middle as you can see if you forget it's here in parentheses for you if the vehicle's owner's name was in a business name or a lessor of it was at least vehicle then that would go here as well and or actually that would go there if it's a business name that would go in place of whoever it is then the fund how its registered and again if it's an individual then their driver's license would go here if they don't have a driver's license and then the none would be marked on here and the same thing if there's a co-owner of the vehicle in other words two people on the vehicle, so I'm following down along here you got the physical residence or business address and that needs to be filled out the current address of the owner where they live now and or whatever basically technically supposed to be the information what's on file with DMV right now that information not here okay, and then you're going to have the county of residence and...

Fill form : Try Risk Free

People Also Ask about instructions for form 1799

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your instructions for form 1799 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.