Get the free certification for no information reporting form irs

Show details

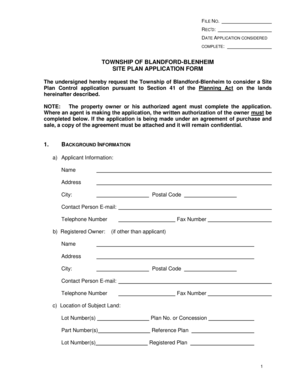

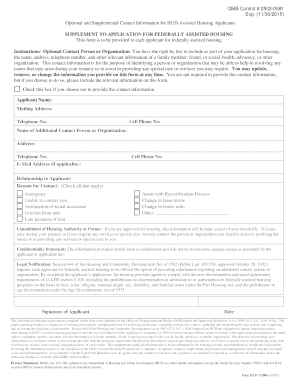

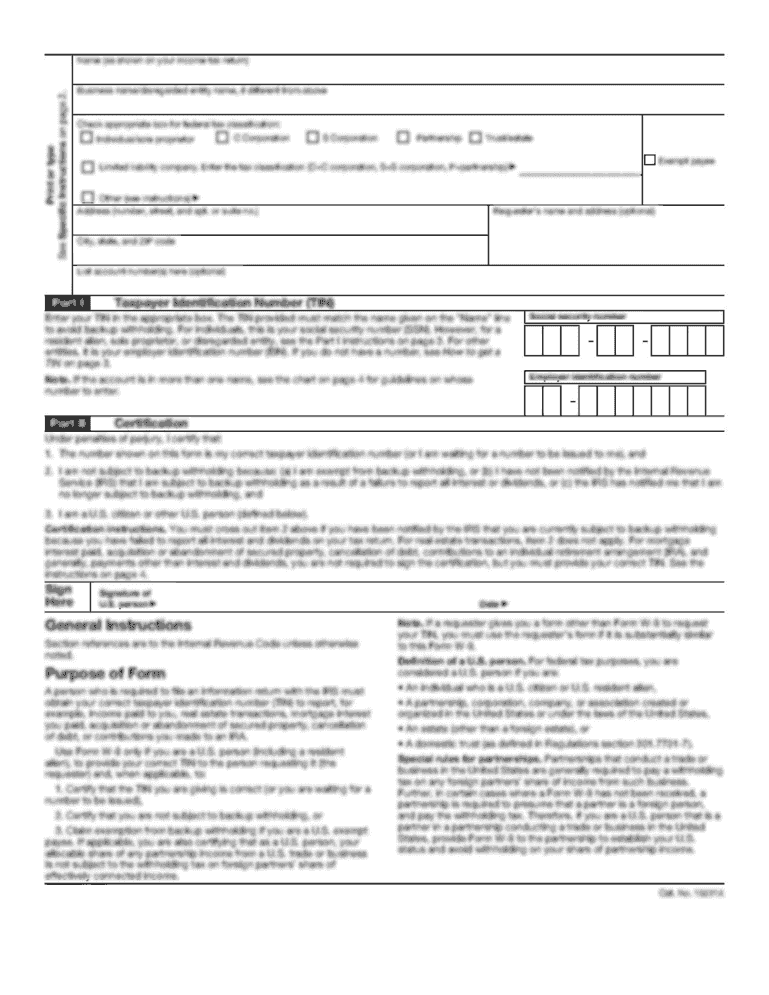

CERTIFICATION FOR NO INFORMATION REPORTING ON THE SALE OR EXCHANGE OF A PRINCIPAL RESIDENCE The information requested here is necessary to determine whether the sale or exchange of this residence

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your certification for no information form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certification for no information form via URL. You can also download, print, or export forms to your preferred cloud storage service.

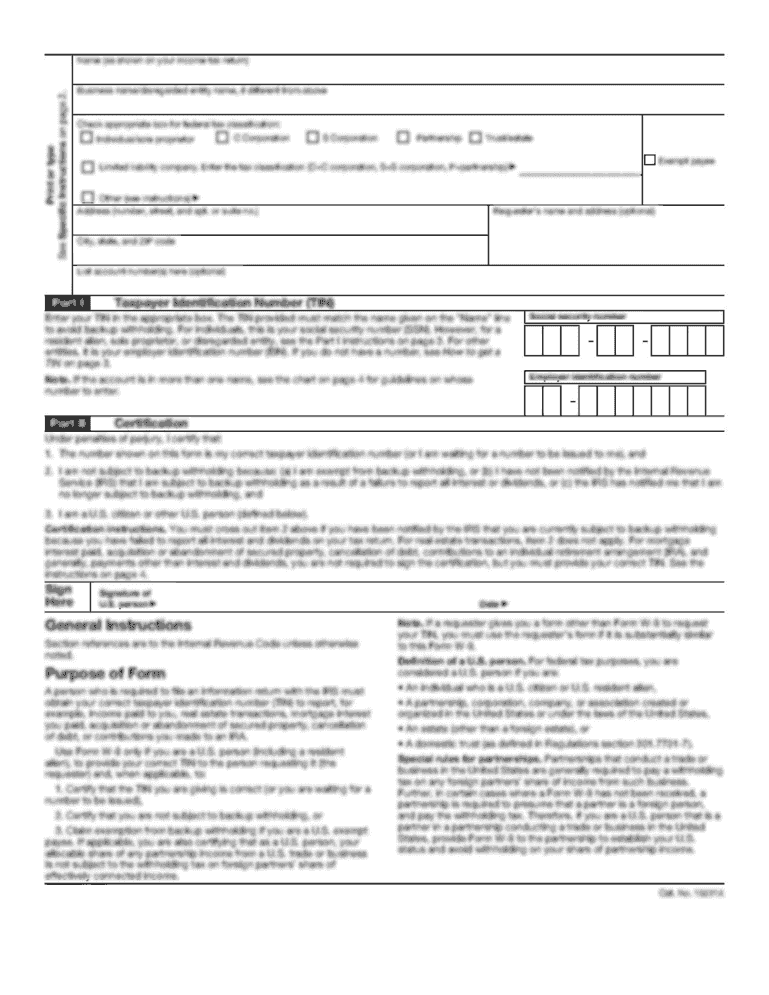

How to edit certification for no information reporting form irs online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit certification for no information reporting form irs. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

How to fill out certification for no information

How to fill out certification for no information?

01

First, gather all the necessary materials for filling out the certification form.

02

On the form, indicate that you have no information by checking the appropriate box or selecting the relevant option.

03

Provide any additional required details or documentation, if applicable.

04

Review the form to ensure all information is accurate and complete.

05

Sign and date the certification form as required.

06

Submit the form according to the instructions provided, whether it is to be mailed, electronically submitted, or hand-delivered.

Who needs certification for no information?

01

Individuals or organizations who are required to provide certification or documentation but have no relevant information to provide.

02

This may be necessary in various scenarios, such as when applying for a certain type of permit, license, or clearance, or when reporting on certain legal or financial matters.

03

Certification for no information is typically an official acknowledgment that no relevant information is available or applicable in a given situation.

Fill form : Try Risk Free

People Also Ask about certification for no information reporting form irs

What to do if you receive a 1099a?

What is a 1099a form of payment?

What types of sellers are eligible to complete the 1099-S certification for no information reporting?

Can I buy a house with a 1099a form?

Is 1099a a loan?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is certification for no information?

Certification for no information is a declaration that an individual or organization has no information to report.

Who is required to file certification for no information?

Any individual or organization that has no information to report must file a certification for no information.

How to fill out certification for no information?

To fill out the certification for no information, you need to provide your name or the name of your organization, contact information, and a statement affirming that you have no information to report.

What is the purpose of certification for no information?

The purpose of certification for no information is to ensure transparency and accountability by requiring individuals or organizations to declare that they have no relevant information to report.

What information must be reported on certification for no information?

On the certification for no information, you only need to provide your name or the name of your organization, contact information, and a statement affirming that you have no information to report.

When is the deadline to file certification for no information in 2023?

The deadline to file certification for no information in 2023 is November 30th.

What is the penalty for the late filing of certification for no information?

The penalty for the late filing of certification for no information is a monetary fine of $1000.

How do I edit certification for no information reporting form irs online?

The editing procedure is simple with pdfFiller. Open your certification for no information reporting form irs in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out certification for no information reporting form irs using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign certification for no information reporting form irs. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out certification for no information reporting form irs on an Android device?

On Android, use the pdfFiller mobile app to finish your certification for no information reporting form irs. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your certification for no information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.