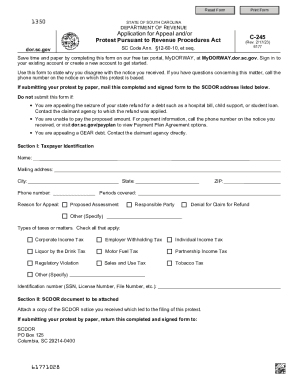

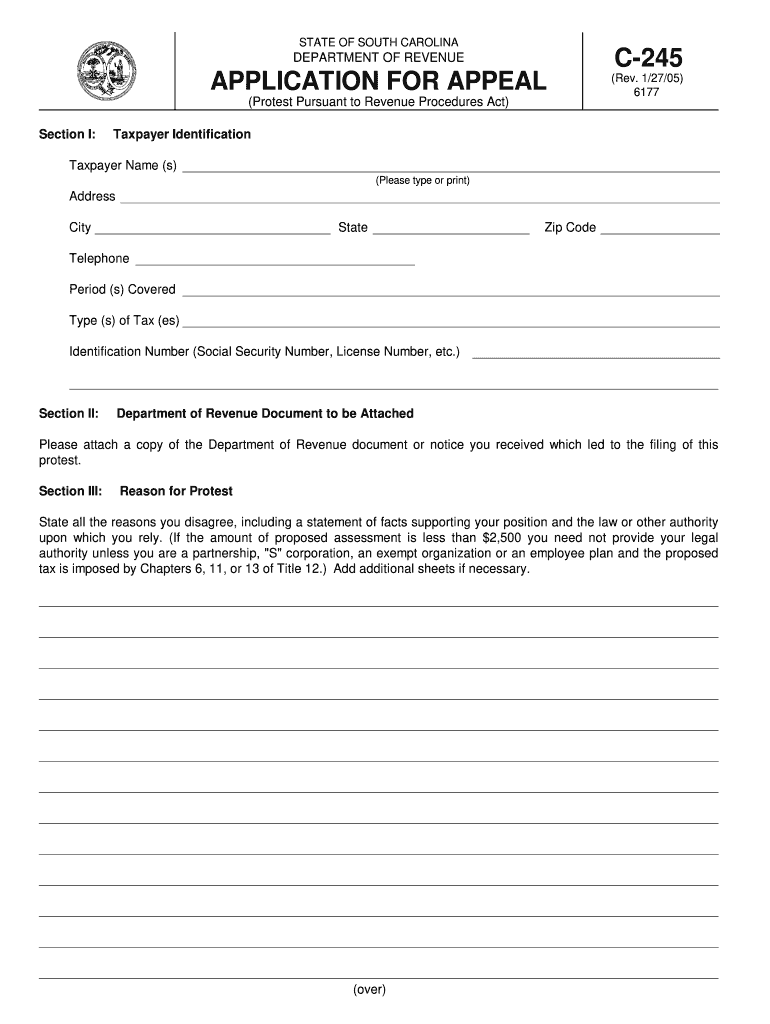

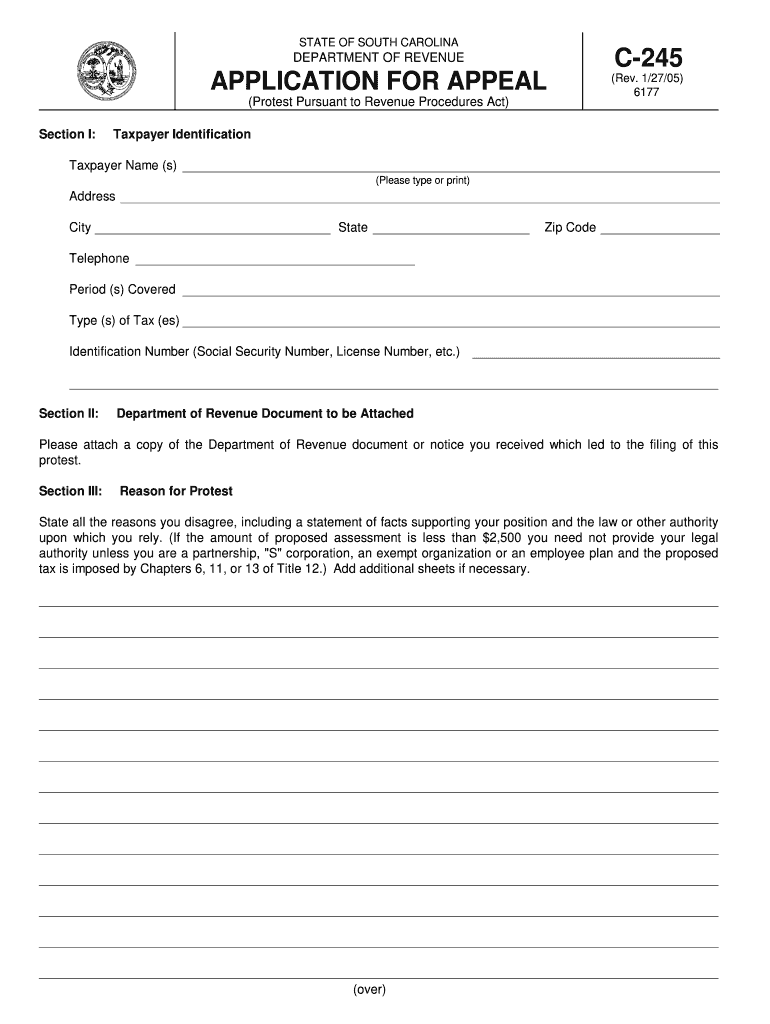

This document must indicate when the filing of this protest occurred and whether it was granted or denied. Documents must include: 1) date 2) number 3) type (protest form, tax return, form 1223, etc.) 4) number of individuals filing 5) number of other organizations filing (if any) A valid copy of the receipt must be attached, along with the supporting documents. The protest will not be approved if all documentation is not attached at this time. Please forward to: Chief Counsel — U.S. Treasury Department.

South Carolina Attorney General

ATTN: Filing Tax Protest

100 Bur dell Street

Spartanburg, SC 29306 Fax: The South Carolina Department of Revenue must receive a timely protest after the expiration of 10 calendar days from the date on which your protest is filed. The Department will review each protest filed within 10 calendar days from that date and, within twenty calendar days, will either accept the protest for filing or notify the taxpayer of the status of the protest. Should the Department decline to accept your protest and notify you via mail that your protest will not be accepted, please file an appeal against that decision to the tax appeal officer at the nearest Department of Revenue Office. The Department of Revenue provides the following instructions regarding appeals: 1) Submit Form TAR/TA-120 (available at all Department of Revenue locations) or a written appeal to the Tax Appeal Officer at the nearest Tax Appeals Office. 2) Prepare the appeal, and if required, attach a copy of Form TAR/TA-120 or a written appeal to the appeal. The appeal must include details concerning: the specific issues which are the basis for the appeal; the issues on which you are requesting an in camera review; and the specific reasons why your protest is denied. 3) Keep copies of documents accompanying your appeal, such as tax returns, schedules, etc. You also want to keep copies of materials which you submitted in an earlier tax return. 4) If you are filing Form 982, attach a separate sheet(s) of paper for each return filed. 5) If it will take you more than one year to complete your return, complete Form 982 as soon as possible after you file your last return. Do not file the completed form on the 12th day of the month, even if you are entitled to a one-year extension for a 1090 Tax Return.

SC DoR C-245 2005 free printable template

Show details

STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE APPLICATION FOR APPEAL (Protest Pursuant to Revenue Procedures Act) Section I: Taxpayer Identification C-245 (Rev. 1/27/05) 6177 Taxpayer Name (s) (Please

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your sc dor form c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sc dor form c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing sc dor form c online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit sc dor form c. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

SC DoR C-245 Form Versions

Version

Form Popularity

Fillable & printabley

Fill form : Try Risk Free

People Also Ask about sc dor form c

Does SC accept federal POA?

What is the $800 tax rebate in SC?

What is a power of attorney for SC Income Tax?

Is South Carolina sending out stimulus checks?

Can taxpayers get up to $800 in Income Tax rebates in South Carolina?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sc dor form c?

SC DOR Form C is a tax form issued by the South Carolina Department of Revenue. It is used to report certain financial and non-financial transactions to the department.

Who is required to file sc dor form c?

The requirement to file SC DOR Form C depends on the specific circumstances of the taxpayer. Generally, individuals and businesses who have engaged in qualifying transactions in South Carolina are required to file this form.

How to fill out sc dor form c?

To fill out SC DOR Form C, you will need to provide the required information such as your personal or business details, the details of the transaction, and any supporting documentation. The form can be filled out manually or electronically through the South Carolina Department of Revenue's online portal.

What is the purpose of sc dor form c?

The purpose of SC DOR Form C is to gather information about specific transactions that may have tax implications in South Carolina. This form helps the Department of Revenue in ensuring compliance with tax laws and regulations.

What information must be reported on sc dor form c?

The information that must be reported on SC DOR Form C includes details about the transaction, such as the parties involved, the date, and the amount or value of the transaction. Additionally, any supporting documents related to the transaction may need to be attached to the form.

When is the deadline to file sc dor form c in 2023?

The deadline to file SC DOR Form C in 2023 may vary depending on the specific tax year and individual circumstances. It is recommended to consult the South Carolina Department of Revenue or review the official guidance for the exact deadline.

What is the penalty for the late filing of sc dor form c?

The penalty for the late filing of SC DOR Form C may vary depending on the specific circumstances and tax laws in South Carolina. It is advisable to consult the official guidelines or contact the South Carolina Department of Revenue for accurate information regarding penalties and consequences of late filing.

How can I modify sc dor form c without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your sc dor form c into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit sc dor form c in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing sc dor form c and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit sc dor form c on an iOS device?

Use the pdfFiller mobile app to create, edit, and share sc dor form c from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your sc dor form c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.