MI D941/501 2012 free printable template

Show details

Employer I. D. Your Federal Employer Identification Number is used by the City of Detroit and is printed on your Form D941/501. DO NOT TAKE CREDIT ON ANY D941/501 a refund will be issued by the City after verification of the facts. Mailing Mail completed DW-3 form with W-2 forms to City of Detroit Finance Department Income Tax 2 Woodward Ave. Final Return If you do not expect to pay wages subject to tax in the future you must file a Final Return and answer the applicable questions on the...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your d941501 2012 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your d941501 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit d941501 2012 form online

Follow the steps down below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit d941501 2012 form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

MI D941/501 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out d941501 2012 form

01

The first step to fill out the d941501 2012 form is to obtain a copy of the form. This can be done by visiting the official website of the organization or government agency that requires the form.

02

Once you have the form, carefully read the instructions that accompany it. These instructions will provide guidance on how to properly fill out the form and ensure that all required information is provided.

03

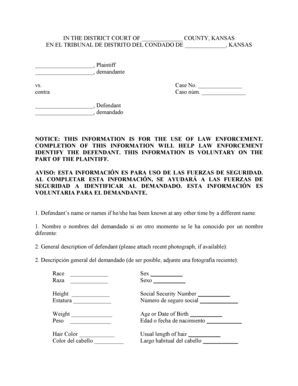

Start by filling out your personal information at the top of the form. This may include your name, address, social security number, and other relevant information. Make sure to double-check the accuracy of the information before proceeding.

04

The form may include sections for different types of information, such as income, deductions, and credits. Fill out each section according to the instructions provided, ensuring that all relevant information is included and any necessary calculations are done correctly.

05

If there are any additional schedules or forms that need to be included with the d941501 2012 form, make sure to attach them in the designated sections. These may include forms for reporting self-employment income, rental income, or other types of income or deductions.

06

Review the completed form carefully to ensure that all information is accurate and complete. Double-check for any errors or missing information before signing and dating the form.

07

Keep a copy of the completed form for your records and submit the original form to the appropriate organization or government agency according to their instructions.

Who needs d941501 2012 form?

01

Individuals who need to report their income, deductions, and credits for the year 2012 may be required to fill out the d941501 2012 form. This form is typically used for tax purposes and is necessary for individuals who are required to file an income tax return.

02

The d941501 2012 form is often required by government tax agencies, such as the Internal Revenue Service (IRS) in the United States, to ensure that individuals accurately report their income and claim any eligible deductions or credits.

03

The form may be required for individuals who have received income from various sources, such as employment, self-employment, rental properties, investments, or other taxable activities. It helps to determine the amount of tax owed or any tax refund that may be due.

04

It is important to check with the specific tax agency or organization to determine if the d941501 2012 form is required in a particular jurisdiction, as requirements may vary. Failure to file the form when required could result in penalties or other consequences.

Instructions and Help about d941501 2012 form

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is d941501 form?

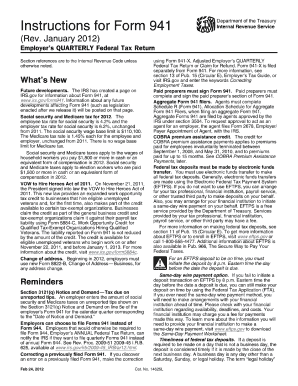

The d941501 form is a tax form used by businesses to report their quarterly Employer's Quarterly Federal Tax Return.

Who is required to file d941501 form?

Any business that has employees and withholds federal income tax, Social Security tax, or Medicare tax from employee wages is required to file the d941501 form.

How to fill out d941501 form?

To fill out the d941501 form, you will need to provide information about your business, including the number of employees, the total wages paid during the quarter, and the amount of taxes withheld.

What is the purpose of d941501 form?

The purpose of the d941501 form is to report and reconcile the amounts withheld from employee wages to the respective federal tax agencies for income tax, Social Security tax, and Medicare tax.

What information must be reported on d941501 form?

The d941501 form requires reporting of the total wages paid to employees, the amounts withheld for federal income tax, Social Security tax, and Medicare tax, and the total tax liability for the quarter.

When is the deadline to file d941501 form in 2023?

The deadline to file the d941501 form in 2023 is April 30th for the first quarter, July 31st for the second quarter, October 31st for the third quarter, and January 31st of the following year for the fourth quarter.

What is the penalty for the late filing of d941501 form?

The penalty for the late filing of the d941501 form can vary depending on the specific circumstances, but it generally includes a percentage of the unpaid taxes for each month of the delay, up to a maximum of 25% of the total tax liability.

How can I get d941501 2012 form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the d941501 2012 form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I make changes in d941501 2012 form?

With pdfFiller, the editing process is straightforward. Open your d941501 2012 form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for signing my d941501 2012 form in Gmail?

Create your eSignature using pdfFiller and then eSign your d941501 2012 form immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your d941501 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.