Get the free 1098 t wmu form

Get, Create, Make and Sign

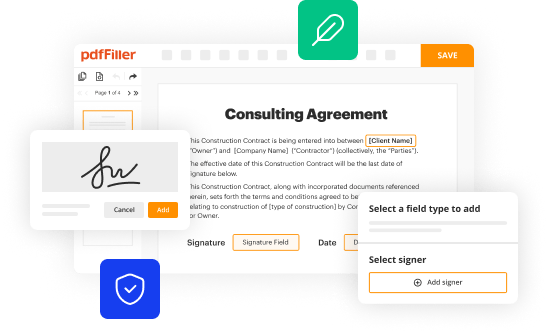

How to edit 1098 t wmu online

How to fill out 1098 t wmu form

How to fill out 1098 t wmu:

Who needs 1098 t wmu:

Video instructions and help with filling out and completing 1098 t wmu

Instructions and Help about 1098 t wmu form

Laws dot-com legal forms guide form 1098-t is a United States Internal Revenue Service tax form used for providing information about a student's tuition payments during a taxable year the form is used to determine if tax paying students or their parents qualify for the American Opportunity Credit the form 1098 — t can be obtained through the IRS s website or by obtaining the documents through a local tax office the tax form is to be filed by the school or college the student is enrolled in during the taxable year first you must supply the tax filers contact information including their name address city state and telephone number in the first box below the contact information provide the filers federal identification number and the student's social security number next put the student's contact information including the student's name street address city state and zip code if you have a service provider account number provide that number in the bottom left box on the form 1098 — T next the school must supply the tuition amount information in boxes 1 and 2 to the right of the filers contact information first provide the dollar amount of payments received for qualified tuition during the tax year below that box put the amount billed during the tax year for qualified tuition in box 3 indicate if your institution has changed the reporting methods for the current tax year if any adjustments apply to the students' tuition state them in box 4 if the student received any scholarships or grants write that amount in box 5 if any provided scholarships or grants have been adjusted during the tax year write in the amount in box 6 if the total tuition amount stated in above boxes include tuition for the following semester in the next tax year indicate so in box 7 indicate if the student is a graduate student in box 8 and finally if any insurance contract reimbursement occurred during the tax year once completed submit the form 1098 — T to the IRS and send a copy to the student while also keeping a copy for the school's records to watch more videos please make sure to visit laws dot-com

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 1098 t wmu form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.